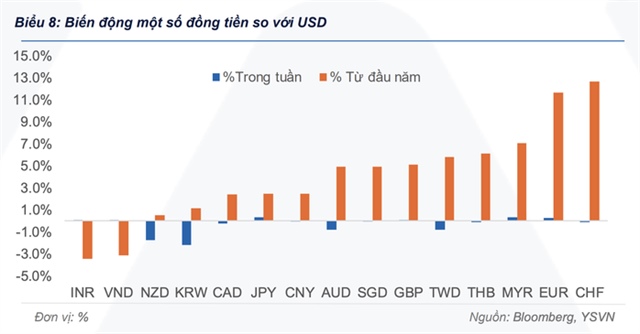

On November 11th, the State Bank of Vietnam set the central exchange rate at 25,118 VND/USD, marking a 12-dong increase from the previous day and a 25-dong rise since the beginning of the month.

Commercial banks have also seen a steady climb in USD rates over recent days. Vietcombank currently lists the USD buying rate at 26,113 VND and the selling rate at 26,373 VND, reflecting a 12-dong increase compared to yesterday.

Eximbank buys USD at 26,120 VND and sells at 26,373 VND.

BIDV and ACB match the selling rates of other banks, while their buying rates hover around 26,130 VND/USD.

Since the start of November, the USD rate across banks has climbed by approximately 26 dong.

The USD remains strong in the unofficial market, nearing the 28,000 VND mark. On November 11th, some currency exchange outlets quoted USD buying rates at 27,820 VND and selling rates at 27,950 VND, a 90-dong increase from the previous day.

Vietnam’s exchange rate remains high as the USD index (DXY) hovers near 100 points, its highest level in months, currently trading at 99.6 points, up 0.08% from the previous session.

Exchange Rates Expected to Stabilize Soon

|

Mr. Nguyen The Minh, Director of Individual Client Analysis at Yuanta Securities Vietnam, notes a slight increase in Vietnam’s exchange rates compared to last week, both officially and in the unofficial market. While the unofficial market’s upward trend has slowed, rates remain high. However, the short-term weakening of the DXY index and rising interbank VND interest rates have led to a positive VND-USD interest rate differential, suggesting exchange rates may stabilize in the coming days.

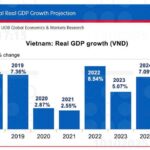

According to experts from UOB Bank’s Global Economics and Market Research Division (Singapore), the foreign exchange market is a key factor influencing the State Bank of Vietnam’s policy decisions. The VND has depreciated by approximately 3.5% against the USD since the beginning of the year, contrasting with regional currencies that have benefited from the USD’s weakness.

Looking ahead, as the US Federal Reserve implements further interest rate cuts, pressure on the USD/VND exchange rate may ease.

In its latest forecast, UOB predicts the USD/VND rate will reach 26,400 VND in Q4 2025 and decrease to 26,300 VND in Q1 2026.

Standard Chartered Bank forecasts the USD/VND rate at 26,300 VND in 2025 and 26,750 VND in 2026.

Experts believe that strong FDI inflows, stable export growth, and increased remittances until year-end will boost foreign currency supply and stabilize exchange rates.

|

Thai Phuong

– 15:50 11/11/2025

Real Estate Credit Surges to New Heights

Over the past 10 months, real estate credit has seen robust growth, emerging as a key driver of economic expansion. However, experts argue that while real estate credit has surged, it has not generated liquidity, as investors primarily engage in short-term speculative trading.

Exciting News for Southern Social Housing Borrowers

The Social Policy Bank of Dong Nai has recently reduced its interest rates on social housing loans for all customers with outstanding balances. The new rate has been adjusted from 6.6% per annum to 5.4% per annum, benefiting those who have borrowed to purchase or lease social housing through the bank.

Dramatic Shifts in Q3/2025 Bank Profit Rankings: VietinBank Loses Top Spot, VPBank Re-enters Top 3, One Bank Surges 26-Fold

The combined after-tax profit of 27 listed banks this quarter reached 70.027 trillion VND, marking a 1.65% decline compared to Q2. Historically, Q3 tends to be a period of reduced profitability for banks, with a notable rebound typically observed in Q4.