Non-Performing Loans Remain Steady in Q3

Data from VietstockFinance reveals that as of September 30, 2025, the total outstanding loans across 28 banks that have published their financial statements exceeded VND 13.6 trillion, marking a 15% increase compared to the beginning of the year.

Saigonbank (SGB) stands as the sole bank experiencing a 6% decline in credit growth, while the remaining banks witnessed credit expansion. Notably, NCB (NVB) led with a remarkable 33.4% surge, followed by VPBank (VPB, +28.5%), MB (MBB, +19.9%), Techcombank (TCB, +19.7%), and TPBank (TPB, +18.3%).

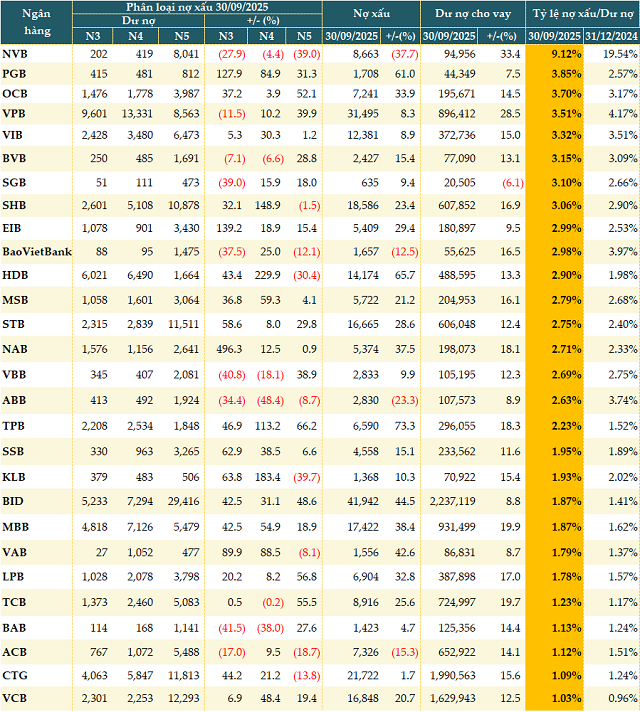

The total non-performing loans (NPLs) of these 28 banks reached VND 274.377 billion by the end of Q3, reflecting a 19% increase year-to-date. However, this figure only rose by 2% compared to the end of Q2.

Four banks reported a decrease in NPLs at the end of Q3 (similar to Q2), with an average reduction of 22%. The banks demonstrating improved loan quality include: NVB (-38%), ABB (-23%), ACB (-15.3%), and BaoVietBank (-12.5%).

The structure of NPLs across various categories has increased uniformly compared to the beginning of the year. Substandard loans (Group 3) rose by nearly 23%, doubtful loans (Group 4) by over 35%, and loss-making loans (Group 5) by more than 11%. When compared to the end of Q2, the NPL structure remains relatively stable.

Several banks have shown significant improvements in loan quality, reducing NPLs across all categories, such as ABB and NVB, or improving in most categories, including ACB, BaoVietBank, Bac A Bank (BAB), Vietbank (VBB), and BVBank (BVB).

|

Loan Quality of Banks as of September 30, 2025 (Unit: Billion VND)

Source: VietstockFinance

|

Significant Reduction in NPL Ratio

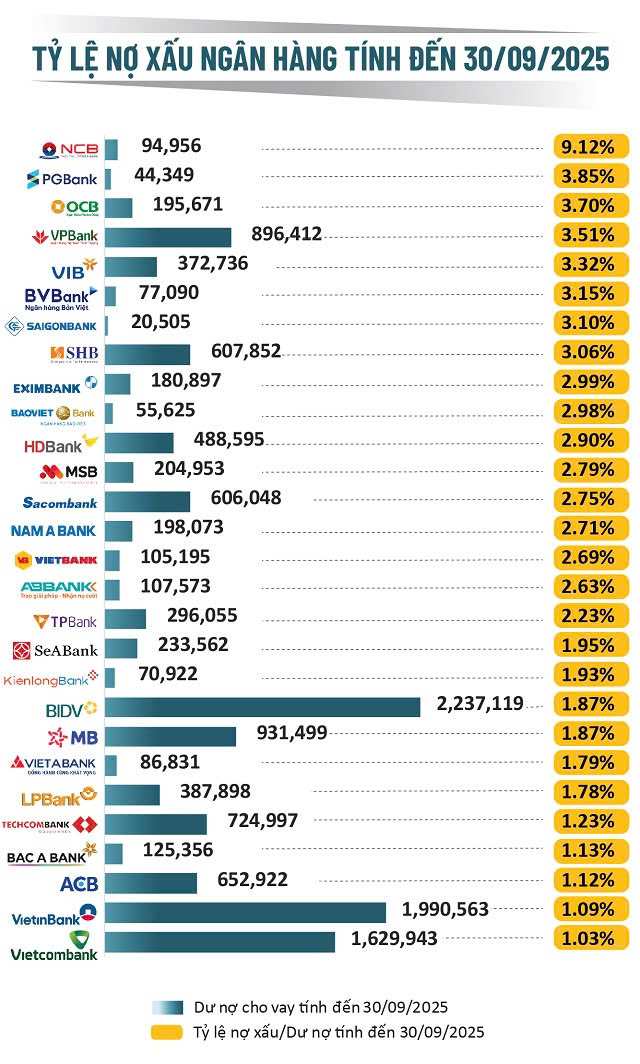

As of September 30, 2025, 10 out of 28 banks have reduced their NPL ratio compared to the beginning of the year. However, when compared to the end of Q2, 15 out of 28 banks continued to lower their NPL ratio.

The number of banks with an NPL ratio exceeding 3% remains unchanged at 8, similar to the end of Q2. Nevertheless, there has been a notable improvement in the ratio. One bank, which had an NPL ratio surpassing 19% at the end of Q2, has now reduced it to just over 9%.

Source: VietstockFinance

|

NPL Reduction Trend Expected to Continue Until Year-End

Assoc. Prof. Dr. Nguyen Huu Huan – Senior Lecturer, University of Economics Ho Chi Minh City believes that the improvement in NPLs from Q2 to Q3 will persist until the end of the year.

Currently, the overall macroeconomic situation is stabilizing, with no significant shocks anticipated in the near future. Consequently, NPLs are likely to enter a stable phase and exhibit a downward trend.

Another crucial supporting factor is the new regulation under the amended Law on Credit Institutions, effective from October 15, 2025. Article 198a of the 2025 Law on Credit Institutions empowers banks and debt handling organizations (including debt trading companies) to seize collateral assets (such as real estate and vehicles) if a loan becomes non-performing and the bank has adhered to legal procedures. This regulation significantly accelerates the asset liquidation process, directly contributing to a faster reduction in NPLs for banks.

Mr. Nguyen Quang Huy – CEO of Finance and Banking Department, Nguyen Trai University attributes the improvement in NPLs to economic recovery and banks’ proactive risk management.

Compared to Q2, Q3 system-wide NPLs have shown signs of improvement, driven by multiple factors. Economic recovery has enhanced businesses’ cash flow, enabling better debt repayment. Flexible debt restructuring policies have supported customers’ recovery without generating new NPLs.

Banks have also increased early provisioning, actively addressing legacy NPLs, and liquidating collateral assets.

In the first nine months of the year, banks have strengthened credit risk provisioning while maintaining profit growth.

According to VietstockFinance data, the total credit risk provisioning expenses of 28 banks in the first half of the year amounted to VND 103.767 billion, a 3% increase compared to the same period last year. While 11 out of 28 banks increased provisioning, only 2 banks reported a decline in pre-tax profits.

|

Pre-Tax Profits of Banks in the First 9 Months of 2025 (Unit: Billion VND)

Source: VietstockFinance

|

Although potential NPLs remain, particularly in real estate and consumer sectors, the overall trend is positive. If credit growth remains stable and the legal environment for debt handling improves, year-end NPLs are likely to decrease slightly and stay within safe limits. This will bolster confidence in the financial system’s health and the management capabilities of commercial banks.

– 12:00 10/11/2025

Retail Banking Sector Leads Credit Growth Surge in First Nine Months of 2025

Credit growth is projected to reach a robust 20% this year, signaling a positive outlook for the entire banking sector. However, Q3 financial reports reveal a more nuanced narrative: it’s not just about the pace of growth, but the shifting dynamics of credit flows and emerging challenges that will shape the future trajectory of individual banks in the coming period.

Dramatic Shifts in Q3/2025 Bank Profit Rankings: VietinBank Loses Top Spot, VPBank Re-enters Top 3, One Bank Surges 26-Fold

The combined after-tax profit of 27 listed banks this quarter reached 70.027 trillion VND, marking a 1.65% decline compared to Q2. Historically, Q3 tends to be a period of reduced profitability for banks, with a notable rebound typically observed in Q4.

Interest Rates Show Signs of Rising Despite State Bank’s Net Capital Injection

After a prolonged period of remaining at a low level, deposit interest rates are showing signs of a slight increase in the final months of the year. Despite the system’s ample liquidity, interest rates in both the primary and secondary markets are trending upward, reflecting notable shifts in the balance of capital supply and demand within the system.