HDBank’s Leadership at the Q3/2025 Investor Conference

|

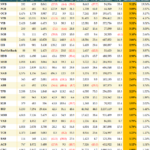

During the conference, HDBank’s leadership reported robust business performance in the first nine months of the year, with several key metrics surpassing targets: credit growth at 22.6%, pre-tax profit of VND 14,803 billion (+17%), non-interest income of VND 5,366 billion (+178.6%), ROE at 25.2%, ROA at 2.1%, and CIR at 25.7%—among the lowest in the industry. HDBank now serves over 20 million customers, achieving sustainable growth backed by a strong financial foundation and the highest Moody’s credit rating in the sector.

Subsidiary companies also delivered strong results in the first nine months: HD SAISON posted a profit of VND 1,100 billion (ROE 24.4%); HD Securities earned VND 614 billion (+30%, leading the industry in ROE); and Vikki Bank turned profitable after seven months of transformation, attracting over 1.3 million new customers.

Shareholders approved HDBank’s plan to relocate its headquarters to Saigon Marina IFC—a new symbol of Ho Chi Minh City’s international financial hub. They also endorsed a 30% dividend and bonus share plan (25% dividend, 5% bonus), maintaining a consistent and high payout policy over the years.

Addressing investors, HDBank’s leadership expressed confidence in accelerating growth in Q4 to meet the full-year 2025 profit target, driven by two key factors: seasonal credit demand and improved asset quality amid a favorable macroeconomic environment. Strong credit growth is expected to offset margin pressures.

However, credit costs and non-performing loans (NPLs) require more time to improve. Q3/2025 developments suggest a slight downward adjustment in profit forecasts, but the 2025 outlook remains positive and is expected to exceed targets.

During the Q&A session, HDBank’s leadership provided further insights into credit growth prospects. In the first nine months, the bank sold over VND 37 trillion in debt to another bank under the State Bank’s restructuring program. Leadership aims for 35% credit growth in 2025.

Growth is fueled by capital demand from FDI, exports, housing programs, and construction during the peak season, along with a significant rebound in retail lending for mortgages and consumer loans. HDBank has secured a credit limit from the State Bank, aligned with its financial capacity and growth strategy, enabling robust credit expansion in Q4.

For net interest margin (NIM), HDBank targets 4.8-5% in 2025, slightly below the 5.09% achieved in the first nine months, reflecting higher deposit costs. Liquidity remains strong, with a loan-to-deposit ratio (LDR) of 71.3% (well below the 85% cap) and short-term funding for medium-long-term loans at 22.3%. The bank has successfully raised over USD 500 million in foreign capital at competitive rates, and potential Fed rate cuts could further reduce USD funding costs.

Non-interest income continues to grow, driven by payment fees, bancassurance, and debt recovery. Since mid-October 2025, new regulations on collateral seizure have enabled faster debt resolution and improved cash flow.

HDBank’s leadership anticipates NPLs to improve significantly from late 2025 to early 2026, supported by a stable macro environment, recovering real estate liquidity, and favorable collateral regulations. The bank aims to reduce the NPL ratio to around 2% by year-end.

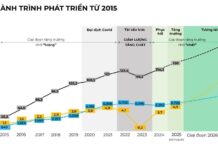

Following the nine-month results, HDBank targets 2025 profits exceeding VND 21 trillion, with a 25-30% CAGR in profit from 2025 to 2030. Subsidiaries also have ambitious plans: HD SAISON aims for 15-16% loan growth and VND 1,500 billion in profit; HD Securities targets VND 1,000 billion in profit, maintaining industry-leading ROE.

HDBank’s leadership emphasized that with a solid financial base, strong funding capacity, and improving asset quality, the bank is well-positioned to accelerate growth in Q4/2025. The focus on efficient growth, risk management, digitalization, and retail expansion remains central to its 2025-2030 strategy.

– 11:12 12/11/2025

Brewery Firm Locks In 20% Cash Dividend Payout Date

Sabeco, the parent company of WSB, holds a significant stake of nearly 12.52 million shares, representing an 86.32% ownership. As WSB prepares to distribute dividends, Sabeco is set to receive over 25 billion VND from this payout.

Will Bank Bad Debt Return to Safe Levels by Year-End?

Despite lingering risks, particularly in real estate and consumer sectors, the overall outlook remains positive as the year draws to a close. With credit growth sustaining its steady pace and legal frameworks for debt resolution improving, bad debt levels are likely to ease slightly by year-end, staying within manageable limits.

Retail Banking Sector Leads Credit Growth Surge in First Nine Months of 2025

Credit growth is projected to reach a robust 20% this year, signaling a positive outlook for the entire banking sector. However, Q3 financial reports reveal a more nuanced narrative: it’s not just about the pace of growth, but the shifting dynamics of credit flows and emerging challenges that will shape the future trajectory of individual banks in the coming period.