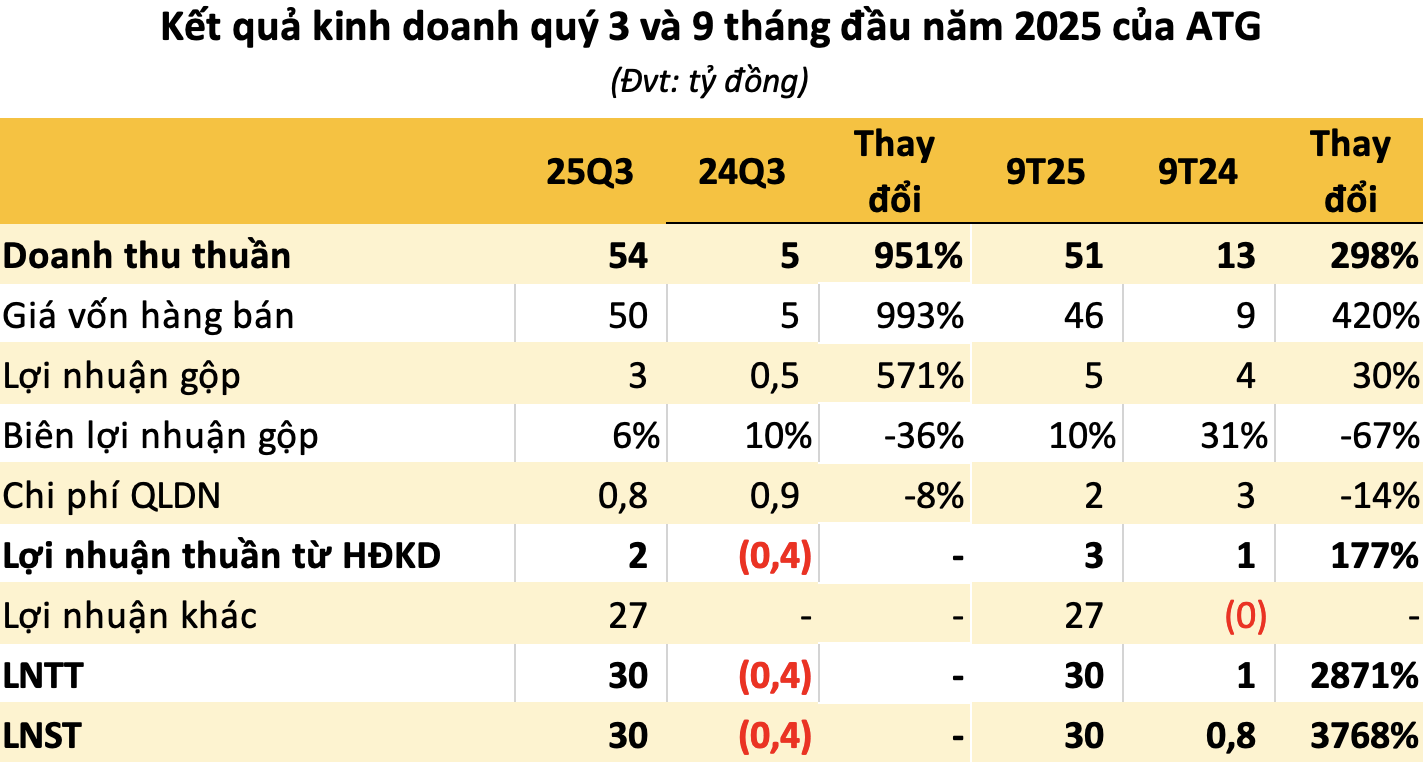

An Truong An Joint Stock Company (UPCoM: ATG) has released its Q3/2025 financial report, revealing a remarkable 951% surge in net revenue to VND 54 billion compared to the same period last year. However, the cost of goods sold also spiked by 993% to VND 50 billion, narrowing the gross profit margin to 6%, down from 10% in Q3/2024.

Gross profit reached VND 3 billion, a fivefold increase year-over-year. Administrative expenses were trimmed by 8% to VND 800 million.

The standout highlight of the quarter was a VND 27 billion gain from other income, propelling both pre-tax and post-tax profits to VND 30 billion, a significant turnaround from the VND 400 million loss in Q3/2024. ATG attributed this gain to debt resolution.

For the first nine months of 2025, ATG recorded VND 51 billion in revenue, a 298% increase year-over-year. Gross profit rose by 30% to VND 5 billion, with a gross margin of 10%, significantly lower than the 31% margin in the same period last year.

Total net profit for the nine months soared to VND 30 billion, a staggering 3,700% increase year-over-year. This remarkable growth was primarily driven by the VND 27 billion gain in other income during Q3, while the core business operations maintained slim profit margins.

As of Q3/2025, total assets reached nearly VND 94 billion, an 11-fold increase from the beginning of the year. Accumulated losses stood at VND 128 billion as of September 30, 2025, with shareholders’ equity rising significantly to VND 31 billion from VND 165 million at the start of the year. ATG employed two staff members at the end of Q3.

Recently, ATG unveiled plans to raise capital through a private placement, rename the company, expand its business sectors, and outline its strategy until 2030. This includes establishing a Blockchain and AI technology company and addressing other key issues.

Specifically, ATG aims to privately issue 10 million shares at VND 20,000 per share, raising VND 200 billion. The offering targets professional securities investors, including both domestic and international organizations and individuals such as IDG, Korean shareholders, and APG Securities. Upon completion, ATG’s chartered capital will increase to VND 252.2 billion.

With the VND 200 billion raised, ATG plans to secure an additional VND 100 billion in loans and establish ATG Planet Stone LLC in Thanh Hoa.

By 2026, ATG expects to eliminate its negative equity and invest in ABI PLANET in Da Nang’s Technology Zone, focusing on Blockchain and AI. The company aims to attract foreign investors experienced in Blockchain and digital assets (BTC, ETH, etc.) as strategic partners and continue capital increases through legal means to invest in digital asset portfolios when permitted by law.

Looking ahead to 2030, ATG aims to invest heavily in research, development, and application of Blockchain and AI technologies across manufacturing, finance, and governance. The company targets annual revenue of VND 1,000 billion and profits of VND 150 billion.

VCI Approves Private Placement of Up to 127.5 Million Shares, Anticipating 10-20% Profit Surge in Annual Plan

On the afternoon of November 7thOn the afternoon of November 7th, Vietcap Securities Corporation (HOSE:On the afternoon of November 7th, Vietcap Securities Corporation (HOSE: VCI) held an extraordinary shareholders’ meeting to discuss and vote on a private placement plan, the establishment of an overseas subsidiary, and amendments to the company’s charter. During the meeting, shareholders expressed keen interest in theOn the afternoon of November 7th, Vietcap Securities Corporation (HOSE: VCI) held an extraordinary shareholders’ meeting to discuss and vote on a private placement plan, the establishment of an overseas subsidiary, and amendments to the company’s charter. During the meeting, shareholders expressed keen interest in the company’s business prospects and changes in executive leadership.