In recent years, data centers (DCs) have evolved from technical infrastructure to high-tech assets sought after by international investors. According to CBRE, in the APAC region, this sector has risen to become the second most preferred alternative asset for investment, following only the healthcare industry.

The primary driver is the surge in artificial intelligence, particularly generative AI—a technology capable of creating new content from vast datasets. McKinsey estimates that by 2030, approximately 70% of global computing volume will be AI-related, driving an average annual growth of 19-22% in DC infrastructure demand.

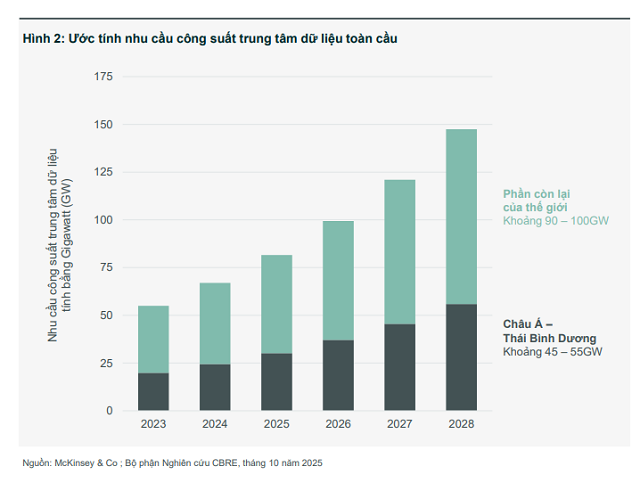

CBRE reports that global DC capacity in 2023 reached around 16,400MW and is projected to double to 32,500MW by 2030. North America leads with nearly 40% of total capacity, followed by APAC and Europe. However, the APAC region is emerging as the fastest-growing market, expected to account for 45-55 gigawatts of global demand by 2028.

Within the region, China, Australia, and Japan are the top three DC markets, with operational capacities ranging from 949 to over 1,000MW each. Shanghai leads with over 1,000MW, followed by the Greater Tokyo Area. Cities like Seoul, Mumbai, and Singapore are also key DC hubs. Secondary markets such as Bangkok, Ho Chi Minh City, Kuala Lumpur, and Jakarta are emerging as new expansion points, offering more favorable investment costs and land availability.

CBRE forecasts an average annual growth of 17% in DC capacity across APAC, among the highest globally. Major tech corporations and global cloud providers are accelerating the construction of new facilities, particularly in Southeast Asia—a strategic buffer zone for the massive computing demands of hubs like Singapore and Hong Kong, which face spatial and power constraints.

Source: CBRE

|

Vietnam’s DC capacity projected to increase 5.6x by 2030

Vietnam is gaining significant attention in this landscape. Despite a total DC capacity of only 104MW—about one-tenth of Shanghai’s—its growth potential is remarkable. CBRE predicts that by 2030, domestic operational capacity could reach nearly 590MW, a more than fivefold increase, driven by numerous new projects from domestic and foreign enterprises.

The expansion is expected to focus primarily on Ho Chi Minh City and Hanoi. The Viettel data center project, which broke ground in April at the Tan Phu Trung Industrial Park (Cu Chi), is a prime example, with a designed capacity of 140MW—the largest in Vietnam to date.

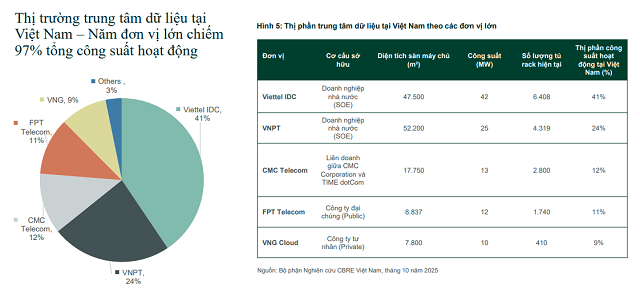

Currently, five major players—Viettel IDC, VNPT, CMC Telecom, FPT Telecom, and VNG Cloud—dominate the market. According to CBRE, the strong presence of local conglomerates provides Vietnam with a robust infrastructure foundation to attract international capital, especially as foreign investors seek new strategic locations beyond traditional markets.

Source: CBRE

|

The investment wave is bolstered by rapid digitalization. Vietnam boasts over 100 million internet users, nearly 80% of its population, one of the highest rates in the region. E-commerce, digital payments, and cloud services are all experiencing robust growth. The cloud computing market is expected to reach $650 million by 2030, more than tripling its current size.

International connectivity infrastructure is also receiving significant investment. Between now and 2030, Vietnam will add at least 10 new submarine cable routes, with the largest, ADC, already operational since April 2025. This expansion not only enhances connection speed and stability but also positions Vietnam as a critical link in regional data flows.

CBRE highlights Vietnam’s standout advantage: low DC construction costs. The average cost is approximately $7 million per MW for Tier 3 DC capacity, nearly half that of Tokyo ($14.3 million) and Singapore ($13.8 million). This cost differential makes Vietnam an attractive choice as energy and land costs rise in more developed markets.

In addition to cost advantages, Vietnam offers a young workforce and open policies. The median population age is 32.5, with a goal of 75% trained labor and 40% certified professionals by 2030. Investment incentives and the national digital transformation program are creating a conducive environment for sustainable data infrastructure development.

However, challenges remain, including localized power shortages, complex permitting processes, and high technical requirements for large-scale projects. Nonetheless, the supply-demand imbalance in APAC DCs is expected to persist for years, presenting significant opportunities for new investors.

– 14:55 13/11/2025

What Did the VFA Chairman Say About the Philippines’ Rice Import Halt Until 2025?

Philippines, the world’s largest rice importer and Vietnam’s top rice export market, has officially extended its rice import suspension until the end of 2025.

Exciting News: Rice Exports, Accounting Services, and 23 Other Industries Proposed by the Government to Operate Without Business Licenses

The government has submitted a draft amendment to the Investment Law to the National Assembly, proposing the elimination of conditional business requirements for 25 sectors, including accounting services and rice exports. This move aims to significantly shift from ex-ante to ex-post inspection, fostering greater business freedom and streamlining regulatory processes.

Elevating Data Recovery and Protection Standards in Vietnam with FSI DDS

In the digital age, data has transcended being merely an asset—it has become the lifeblood of organizations and individuals alike. As digital transformation accelerates, Vietnamese users and businesses are increasingly prioritizing information security, proactively investing in robust solutions for data protection, storage, and recovery.

SGI Capital: High Margins, Currency Pressure, and Premium Valuations Pose Hidden Risks

SGI reports that the recent surge in deposit and lending interest rates is beginning to impact both cash flow and investor sentiment within the domestic market, leading to a noticeable decline in purchasing demand.