On November 12th, the Hanoi People’s Committee officially approved the investment policy and investor for the Duc Giang Public Works, School, and Residential Complex (Duc Giang Residence). Located at 18, Alley 44, Duc Giang Street, Viet Hung Ward, Hanoi, the project is spearheaded by Duc Giang Real Estate Co., Ltd., a subsidiary of DGC.

Spanning over 47,000 square meters, the project boasts a total investment of 4.5 trillion VND, entirely funded by the company. Key components include 60 low-rise townhouses (1 basement + 5 floors), two 25-story luxury apartment towers (880 units), public facilities, commercial spaces, and a school (1.1 hectares).

Construction is slated from Q4 2025 to Q4 2030, divided into three phases. Phase 1 (Q4 2025 – Q4 2027) focuses on infrastructure and low-rise housing. Phase 2 (Q4 2025 – Q4 2028) addresses social infrastructure. Phase 3 involves high-rise residential construction. The entire project is expected to be completed and operational between Q1 2026 and Q4 2030.

DGC Chairman Dao Huu Huyen previously mentioned the project at the 2025 Annual General Meeting. While expressing a preference for focusing on chemical production, Huyen acknowledged the project’s viability due to existing land holdings. “DGC waited five years for the necessary permits and 1/500 planning approval,” he stated. “The project is projected to generate over 5 trillion VND in revenue and approximately 1 trillion VND in profit.”

The approval news immediately impacted DGC’s stock performance. On November 13th, DGC shares surged to 100,000 VND per share, reaching the daily limit with no sell orders.

| DGC stock price skyrockets after Duc Giang Residence approval |

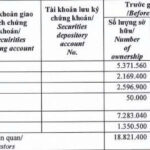

DGC reported a slight profit increase in Q3, reaching 752 billion VND (+6%) due to cost-cutting measures. For the first nine months of 2025, the company achieved over 8.5 trillion VND in revenue (+14% YoY) and 2.4 trillion VND in net profit (+7%), fulfilling 82% of its revenue target and 84% of its post-tax profit goal set by the AGM.

Chau An

– 14:27 13/11/2025

Why Sun Group Cau Giay Apartments Are a Magnet for Expatriates?

Sun Feliza Suites Cau Giay stands as a harmonious blend of Vietnamese identity and international sophistication, where investment value, lifestyle excellence, and personal prestige converge. Tailored for foreign professionals seeking long-term rentals or ownership, it epitomizes a refined living experience.

Capital Flow Shifts: Northern Investors’ Quest for Profitable Territories

In the context of the Northern market entering a phase of diminishing profit margins, investment capital is now significantly shifting towards the South, an area recognized for its substantial growth potential and long-term profitability. Savvy investors are increasingly focusing on regions with ample room for yield expansion.