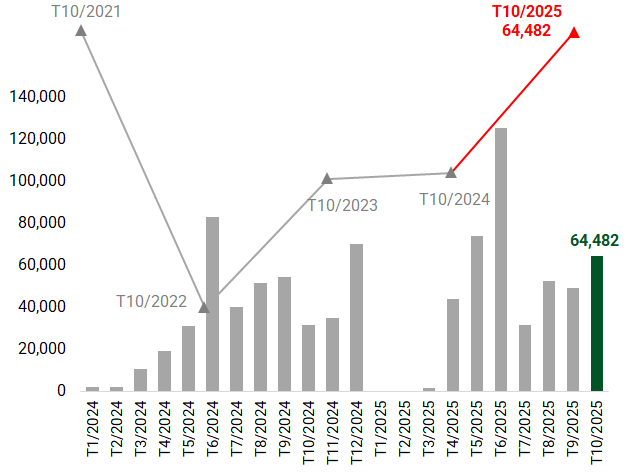

In October 2025, Vietnam’s corporate bond market witnessed a remarkable surge, with real estate firms leading the charge by raising nearly VND 33 trillion, accounting for over half of the total issuance value—the highest since the beginning of the year. This propelled the overall market to surpass VND 64 trillion, doubling the figure from the same period last year and nearing the 2021 peak.

In contrast, commercial banks contributed only 43%, a significant drop from their usual 60-70% share in previous months.

|

October’s private corporate bond issuance hits a 4-month high (Unit: billion VND)

Source: Compiled from HNX data as of November 13, 2025

|

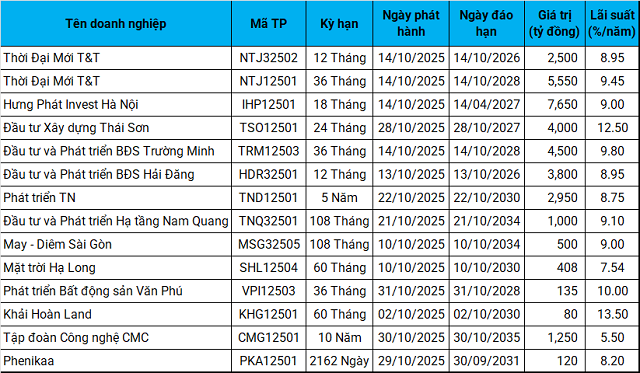

Real Estate’s Spectacular Comeback

October saw a wave of high-value bond issuances from real estate companies. Hưng Phát Invest Hà Nội debuted with a VND 7.6 trillion bond, offering an 18-month term at a fixed 9% annual interest rate. Simultaneously, Thời Đại Mới T&T raised over VND 8 trillion across two issuances (1-3 year terms, ~9% interest) to fund a mega project in Cần Giờ, Ho Chi Minh City.

Trường Minh Real Estate expanded its portfolio with a third VND 4.5 trillion issuance at 9.8%, bringing its 2025 total to VND 10 trillion. Hải Đăng Real Estate returned with a VND 3.8 trillion bond at 8.95%, slightly below last year’s rates. Thái Sơn Construction offered a 12.5% yield on its VND 4 trillion bond, while May – Diêm Sài Gòn prioritized longer-term issuances.

In hospitality, TN Development secured nearly VND 3 trillion (5-year term, 8.75%) for a hotel-entertainment complex in Huế. Nam Quang Infrastructure raised VND 1 trillion (9-year term, 9.1%) for the Gia Lộc industrial zone in Hải Dương.

|

Real estate firms raise tens of trillions in October

Source: Compiled by the author

|

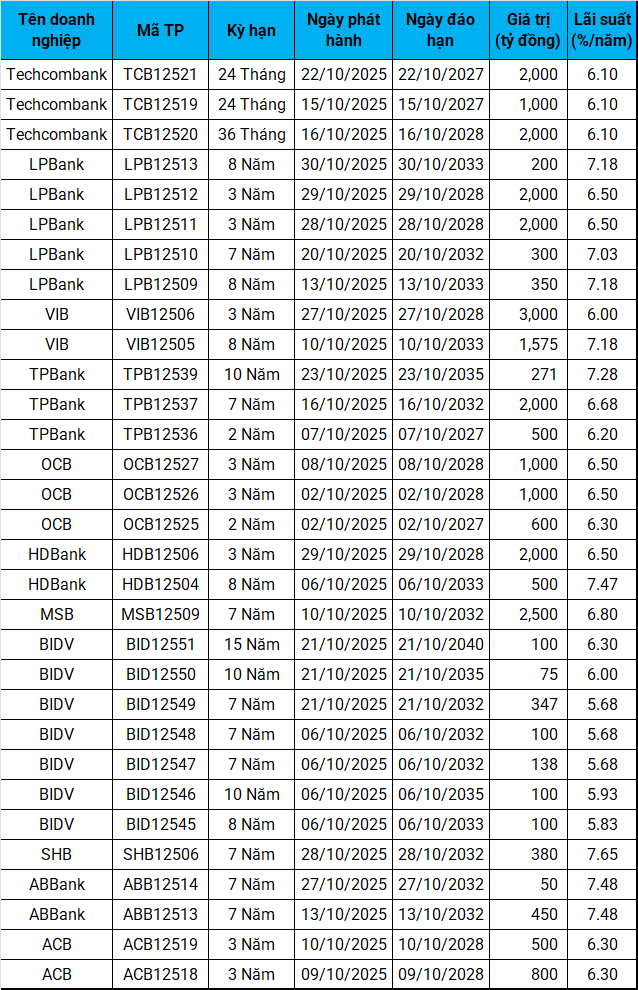

Banks Slow Down

Banks raised only VND 28 trillion in October, a 15% decline from September, capturing just 44% of total issuances. TCB led with VND 5 trillion (2-3 year terms, 6.1% fixed), reaching a YTD total of VND 46 trillion. LPB and VIB followed with VND 5 trillion and VND 3.5 trillion, respectively, at 6-6.5% rates. HDB, TPB, OCB, and MSB secured VND 2.5-2.7 trillion each, primarily in 2-3 year terms at 6.2-6.5%.

|

Bank bond share declines compared to earlier periods

Source: Compiled by the author

|

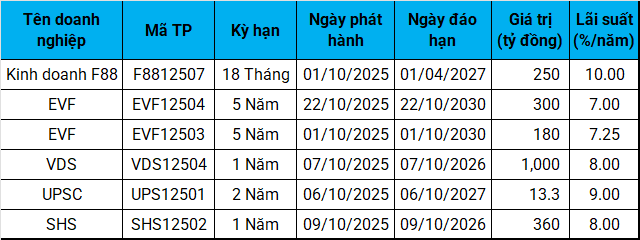

Securities Sector Welcomes New Players

After a quiet September, consumer finance and securities firms resumed activity. EVF issued two VND 480 billion bonds (5-year terms, 7-7.25%). F88’s 7th issuance raised VND 250 billion (18 months, 10%), totaling VND 800 billion YTD. UP Securities (UPSC) debuted with VND 13.3 billion, while SHS added VND 360 billion (8-9% rates). VDS secured VND 1 trillion, its 4th issuance of 2025, totaling nearly VND 3 trillion.

|

F88 maintains steady bond issuance in 2025

Source: Compiled by the author

|

– 13:00 13/11/2025

Capital Inflows Surge into Insurance and Oil & Gas Sectors

Liquidity diverged across two listed exchanges during the week of November 3rd – 7th. Cash flow exhibited polarization across various sectors. Nonetheless, certain sectors demonstrated robust capital inflows.

Top 15 Profit-Soaring Companies in Q3 2025: Minimum 540% Growth, with One Firm Skyrocketing 5,700%—Real Estate Dominates the List

The top-performing businesses in the first nine months of 2025 showcase remarkable growth, with the real estate sector leading the charge and boasting the highest number of representatives. Notably, several companies have turned their fortunes around, transitioning from losses to impressive profits.

Vietnam Bond Market Association (VBMA): Corporate Bond Debt Reaches VND 1,270 Trillion by Q3-End

According to the Vietnam Bond Market Association’s (VBMA) Q3/2025 report, corporate bond outstanding debt reached VND 1,270 trillion by the end of Q3/2025, a 6% increase compared to the end of 2024, accounting for 7.4% of the total credit outstanding in the economy. However, since late 2023, the figure has remained relatively stable, fluctuating around VND 1,200 trillion.

TCBS, VPBankS, VPS IPO Spark Repricing Wave in Securities Sector; VNDirect Highlights Top Beneficiaries

VNDirect anticipates that the IPOs of TCBS, VPBankS, and VPS will serve as a powerful catalyst for the revaluation of securities stocks.