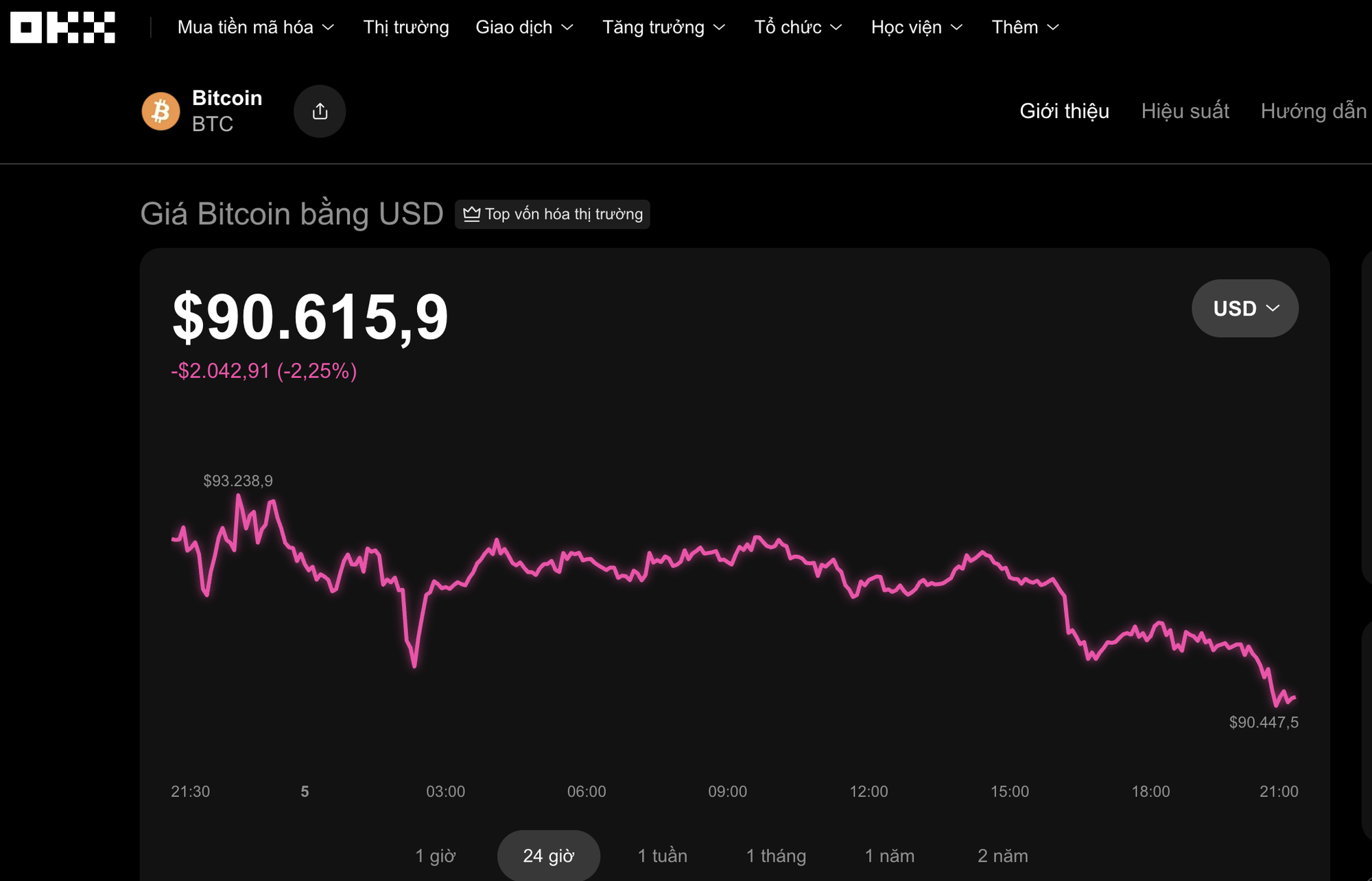

On the evening of December 5th, the cryptocurrency market experienced a widespread decline. Data from the OKX exchange revealed that Bitcoin dropped over 2% in the past 24 hours, trading at $90,615.

Other major cryptocurrencies, including Ethereum and BNB, also saw declines of more than 2%, falling to $3,110 and $887, respectively. XRP decreased by over 3%, reaching $2, while Solana suffered the most significant drop, nearly 5%, down to $136.

According to CNBC, after plummeting from its recent record high, Bitcoin has erased all its year-to-date gains.

This raises a critical question about its role in investment portfolios: When can Bitcoin truly be considered a stable store of value?

Bitcoin is currently trading at $90,615. Source: OKX

“Bitcoin still needs to prove its long-term viability as ‘digital gold,'” stated Nate Geraci, President of NovaDius Wealth Management.

He emphasized that while Bitcoin is only 15–16 years old and remains highly volatile, gold has been a stable asset for thousands of years.

Historically, Bitcoin has surged during stock market volatility, but recently, as tech stocks declined, most cryptocurrencies, including Bitcoin, have plummeted, often outpacing the stock market’s losses.

Despite this, Bitcoin has doubled in value since the beginning of 2024, fueled by inflows from new Bitcoin ETFs.

Geraci attributed the recent downturn to leveraged crypto investors triggering a wave of sell-offs.

Beyond Bitcoin, crypto index funds—which invest in a basket of cryptocurrencies—are expected to help investors diversify their portfolios.

However, he cautioned that most other cryptocurrencies still behave like high-risk tech stocks, vulnerable to market downturns.

Trump Family’s Crypto Ventures Plunge 40% to 70% in Value

American Bitcoin, the cryptocurrency mining company backed by the Trump family, saw its stock plummet nearly 40% on December 2nd. The dramatic drop came as previously restricted shares were released for trading, triggering a wave of profit-taking by investors.

Today’s Crypto Market, November 30: Unexpected Bitcoin Twist Alert

Industry experts predict that if historical patterns repeat, Bitcoin may experience a significant recovery as early as Q1 2026.