At one point, the VN-Index surged nearly 21 points, approaching 1,758 points, yet declining stocks dominated. By the close, selling pressure from banking stocks narrowed the index’s gains, ending the session up 4 points at 1,741 points. Notably, almost the entire VN-Index gain stemmed from VIC, which hit its ceiling and single-handedly contributed over 8 points, reprising the “green shell, red core” scenario.

Many investors still feel “index gains, portfolio losses.”

Liquidity failed to spread, clustering around a few blue-chip stocks. The VN30’s 0.2% decline indicates a lack of consensus among leading stocks. Investor sentiment leans toward profit-taking after a rapid rally and caution over macro factors like exchange rates, interest rates, and ETF rebalancing.

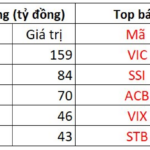

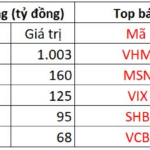

Most major sectors ended in the red. Banking stocks faced the heaviest pressure: SHB dropped over 3%, while MBB, ACB, LPB, and TCB fell 1.5% to 2%. Securities stocks also tumbled, with SSI, VCI, and VIX down over 1.5% as funds exited overheated sectors.

Steel, energy, and consumer staples—typically high-weight sectors—failed to sustain recovery amid market-wide liquidity plunging to 20.1 trillion VND, 5.5 trillion VND below the previous session.

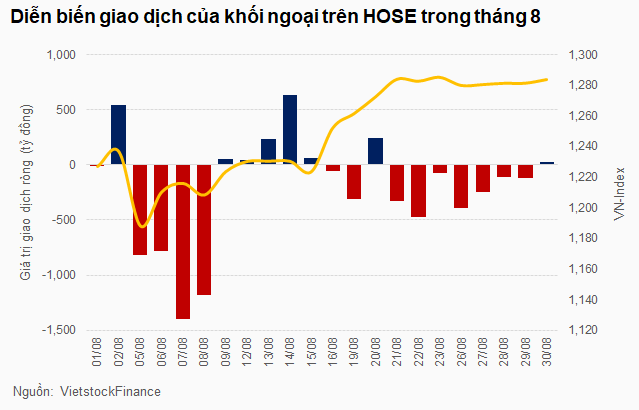

The real estate sector shone, but gains were concentrated in the Vingroup family. VIC surged to its ceiling at 142,800 VND/share post-dividend adjustment; VHM rose 1.71%, while most other real estate stocks remained in the red. Despite heavy foreign sell-offs, VIC extended its rally. Foreign investors net-sold 678 billion VND on HoSE today, focusing on VIC, SSI, and ACB.

Session close: VN-Index +4.08 points (0.23%) at 1,741.32; HNX-Index -1.66 points (0.63%) at 260.65; UPCoM-Index -0.45 points (0.37%) at 120.49. Liquidity shrank, with HoSE trading below 20 trillion VND.

Technical Analysis for the Afternoon Session of December 5th: Uptrend Continues

The VN-Index extended its winning streak to an impressive eight consecutive sessions, despite trading near its October 2025 peak. Meanwhile, the HNX-Index experienced a mild pullback as it retested the middle band of the Bollinger Bands indicator.

Stock Market Update December 4: Capital Flows Shift to Real Estate Stocks

Market volatility has emerged among the “blue-chip” stocks, yet capital flows have shifted towards real estate and equities, propelling the VN-Index to its second consecutive session of gains, with trading volumes reaching billions of dollars.