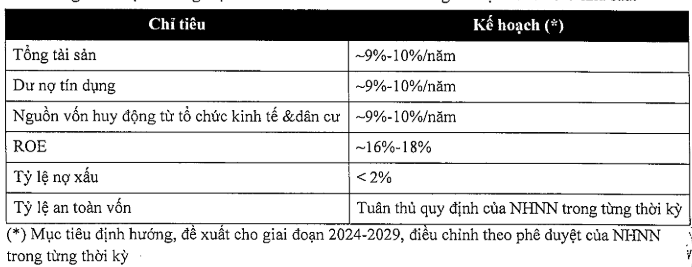

Targets for the 2024-2029 period

In the 2024-2029 period, VietinBank sets a target for total assets to increase by 9-10%/year, outstanding loans and mobilized capital to also increase by 9-10%/year. Return on equity (ROE) of 16-18%. Bad debt ratio controlled below 2%.

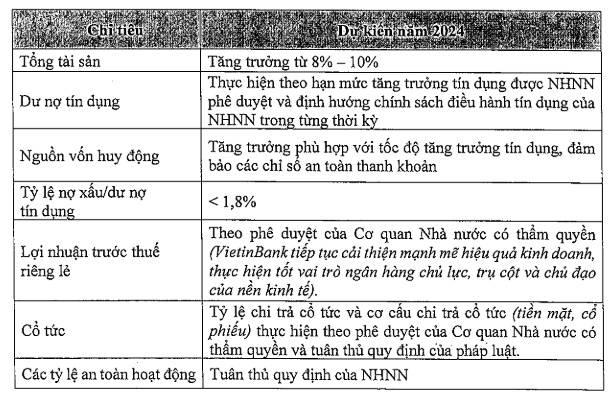

In 2024 alone, the Bank aims for a total asset growth of 8-10%. Outstanding loans to be implemented according to the credit limit approved by the State Bank of Vietnam (SBV). Mobilized capital will grow in line with the credit growth rate. Bad debt ratio controlled below 1.8%.

VietinBank has not set a specific pre-tax profit target for 2024, which will be subject to approval by the competent state authority.

Using nearly VND 14,000 billion to pay dividends in shares

Regarding the profit distribution plan, VietinBank has VND 19,457 billion of after-tax individual profit in 2023. After setting aside for various funds, the Bank has VND 13,927 billion, which is expected to be used to pay dividends in shares, subject to approval by the State agency.

In 2023, VietinBank completed the issuance of over 564 million shares to pay dividends, at a rate of 11.7415% (shareholders owning 1 million shares received 117,415 new shares). The capital for issuance came from after-tax profit, after setting aside for funds and paying dividends in cash in 2020. This was the dividend distribution plan approved by the 2022 Annual General Meeting of Shareholders. VietinBank’s charter capital increased from VND 48,057 billion to nearly VND 53,700 billion.

On the HOSE exchange, the CTG share price closed on April 16 at VND 34,050/share, up nearly 26% since the beginning of the year. Average liquidity of 9.6 million shares/day.

| CTG share price from the beginning of the year to present |