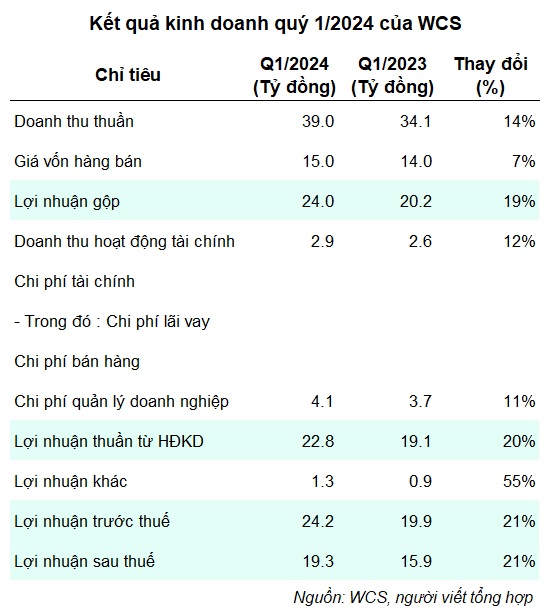

According to Q1 2024 financial statements, WCS recorded net revenue of VND39 billion and post-tax profit of over VND19 billion, with respective increases of 14% and 21% compared to the same period last year. The company stated that the first quarter was when Lunar New Year services occurred, resulting in a surge in the number of vehicles and passengers. Hence, there was an increase in toll revenue and the company also adjusted the charges for parking and shuttle services.

A negative aspect was an uptick in operating expenses like meal allowances for employees, as well as expenses for equipment, electricity, water, minor repairs, and others. However, this did not significantly impact the profit.

For 2024, WCS has set a target of net revenue of over VND160.5 billion and a post-tax profit of nearly VND69 billion, representing increases of 2% and 4% respectively compared to the previous year. These figures are the highest in the company’s history, surpassing the records set in 2023. Therefore, after the first quarter, the company has achieved 24% of its revenue target and almost 28% of its profit plan for the year.

With the record results from the previous year, the Board of Directors of WCS plans to allocate VND40 billion for dividend payment to shareholders at a rate of 160% (VND16,000 per share). Of this, the company has paid an interim dividend of 90% in March 2024 (VND14,400 per share), and the remaining 10% will be paid on June 21, 2024 (VND1,600 per share).

Annually, WCS has consistently distributed cash dividends at a high rate, with a fixed rate of 20% during 2020-2022, and reaching 400% in 2018 and a peak of 516% in 2019. In 2024, the company plans to pay dividends in cash of not less than 20%.

A significant portion of WCS dividends will go to three major shareholders: Saigon Mechanical Engineering and Transport Joint Stock Company – SAMCO, which holds 51% of the company; followed by America LLC, which owns 23.8%; and Thai Binh Investment Joint Stock Company, with 10% ownership.

Apart from regular dividend payments, WCS shareholders have experienced an additional benefit, as the stock has remained among the most expensive in the market, trading in the “three-digit” range for nearly four years. On April 19th, WCS price slightly dropped to VND188,000 per share, resulting in a market capitalization of approximately VND470 billion.

As per the balance sheet, WCS‘s total assets exceeded VND256 billion at the end of Q1 2024, a decrease of VND28 billion from the beginning of the year. Cash and cash equivalents approximated VND214 billion, accounting for almost 84% of the total assets.

On the liabilities side of the balance sheet, accounts payable have reduced from VND81 billion at the beginning of the year to VND34 billion, primarily due to a decrease in other short-term liabilities, while the company remains debt-free.