Specifically, during the above period, nearly 18.8 million PSH shares of Mr. Huy were sold in bulk orders on the exchange due to liquidation of margin loans by the brokerage company. With an average price during the period of approximately VND 4,600 per share, the transaction value is estimated at VND 86 billion.

Since the beginning of April, Mr. Huy has been subject to forced sales on two occasions, totaling nearly 3.6 million shares. Thus, the Chairman of PSH has had over 22 million shares forcibly sold since the beginning of the month.

| The decline of PSH since the beginning of April has resulted in forced sales of shares of Chairman Mai Van Huy |

The forced sale of Mr. Huy’s shares occurred during the same period that PSH share prices plummeted from the beginning of April, with 9 consecutive trading sessions in the red, including a series of 5 days hitting the floor price, causing the PSH price to decline by 44% as of the closing session on 04/16 (VND 4,400 per share). The stock then unexpectedly hit the ceiling in the two trading sessions on 04/17 and 04/19 before hitting the floor again in the trading session on 04/22. On 04/23, the PSH price continued to hit the floor, dropping to VND 4,300 per share.

It is noteworthy that trading volume on 04/17 was over 20 million shares, so it is highly likely that Mr. Huy’s margin sale transaction occurred on this day.

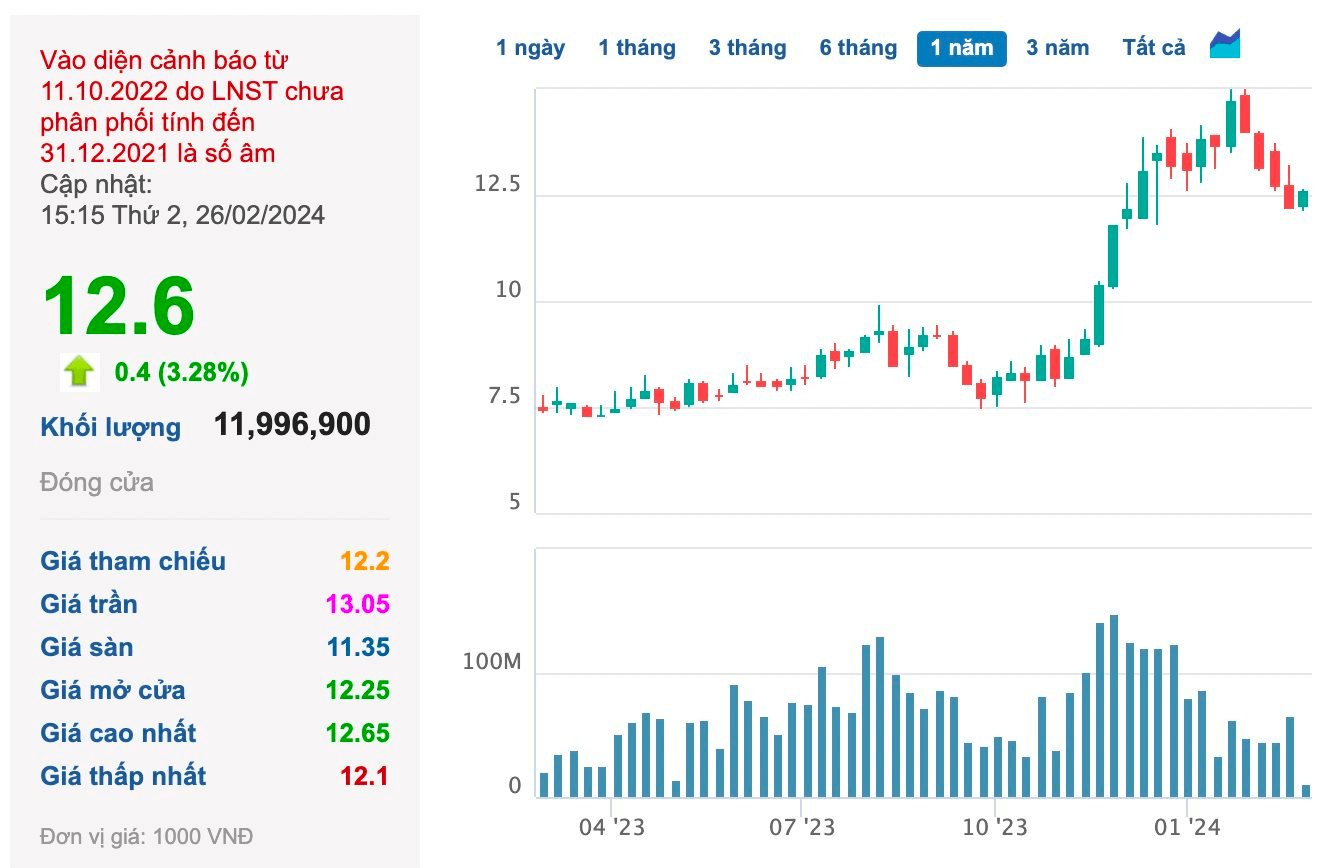

In fact, PSH has been experiencing a difficult period following the tax enforcement incident at the end of 2023. The audited financial statements for 2023 recorded an except auditor’s opinion, partly due to this tax enforcement action. Consequently, the share has been placed on the warning list since 04/03.

Loss in the first quarter

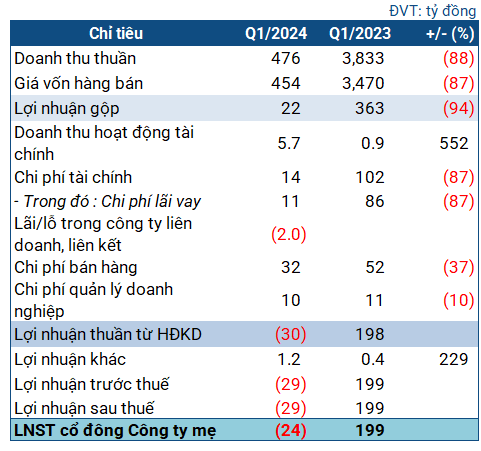

Recently, PSH announced its financial statements for the first quarter of 2024, revealing a lack of improvement in the situation.

|

Business indicators of PSH in the first quarter of 2024

Source: VietstockFinance

|

Specifically, net revenue fell sharply by 88%, reaching VND 476 billion. The cost of goods sold also dropped significantly, but the Company only recorded a gross profit of VND 22 billion, nearly 17 times lower than the same period last year.

The sharp decline in revenue had a major impact on PSH‘s final results, despite a steep decline in expenses (financial expenses were VND 14 billion, down by 87%; sales expenses were VND 32 billion, down by 32%). By the end of the first quarter, the western petroleum giant recorded a net loss of VND 24 billion (compared to a profit of VND 199 billion in the same period last year). This was also the Company’s second consecutive quarter of losses, although not as severe as the previous quarter (a net loss of over VND 220 billion in the fourth quarter of 2023).

PSH‘s balance sheet as of the end of the first quarter shows a bleak financial picture. The Company had total assets of over VND 11,000 billion, unchanged compared to the beginning of the year, with short-term asset value increasing slightly to VND 6,200 billion. The amount of cash on hand was nearly VND 16 billion, a decrease of 35%.

Short-term receivables increased by 6%, to over VND 1,500 billion. The value of inventories increased slightly, recording nearly VND 4,700 billion.

Long-term construction in progress amounted to nearly VND 2,000 billion, a slight increase compared to the beginning of the year, including funds allocated for projects such as Vam Lang, Phong Dien Eco-Tourist Area, land compensation for the Soi Rap project, and the Agricultural Production Complex in An Giang. Notably, there was over VND 938 billion recorded under “Other,” and the Company did not provide a detailed explanation for this amount.

On the other side of the balance sheet, the majority of the liabilities are short-term debts, over VND 7,200 billion, a 7% increase compared to the beginning of the year. The current and quick ratios are 0.86 times and 0.21 times, respectively, indicating the Company’s risk of default.

The Company’s debt structure includes nearly VND 1,270 billion in amounts payable to the State, likely related to the tax enforcement incident that occurred at the end of 2023. In addition, short-term debt at the end of the period increased by 14% to over VND 5,300 billion, the largest of which was the loan from BIDV (over VND 3,600 billion). The Company also had a long-term loan of over VND 654 billion from BIDV and bonds payable of around VND 757 billion.

PSH previously shared that the outstanding debts (including tax debts, loans, and bonds) will be resolved through a loan agreement from Acuity Funding, a financial institution that provides capital for projects in and outside Hau Giang Province. The Company stated that it has completed the procedures for valuing the collateral for the loan and that Acuity Funding will disburse USD 290 million in the second quarter of 2024.

PSH continues to extend bond interest payment deadline