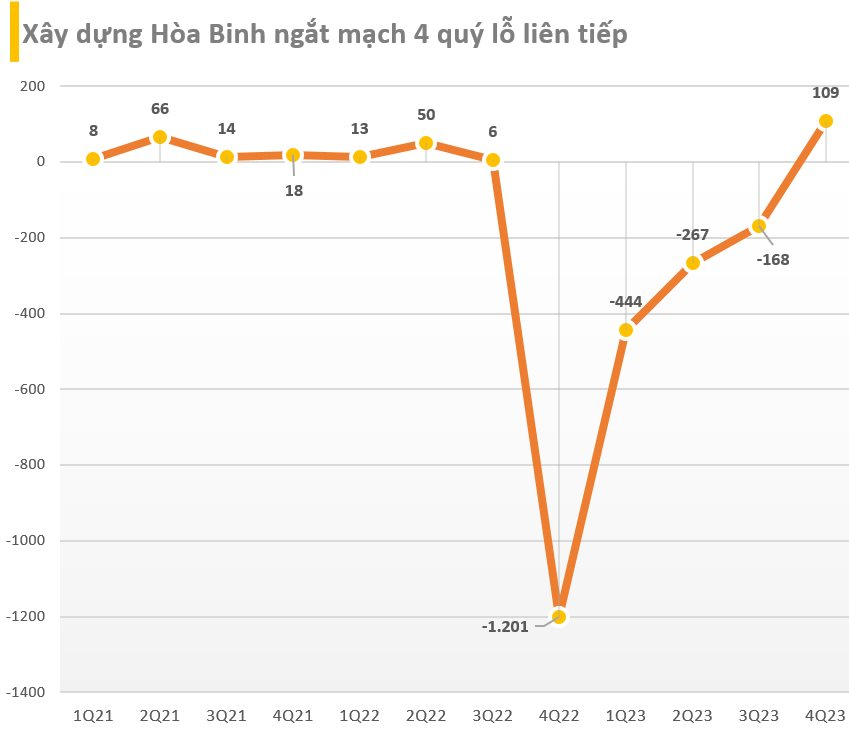

Hoa Binh Construction Corporation (stock code: HBC) has just announced their Q4/2023 financial statements with a revenue of 2,190 billion VND, a decrease of 32% compared to the same period last year. However, thanks to a significant decrease in costs, the company achieved a gross profit of 53 billion VND, while the same period last year saw a loss of 462 billion VND.

The financial revenue for this quarter was over 20 billion VND, while the same period saw a negative figure of nearly 113 billion VND. The financial expenses of Hoa Binh Construction decreased, while the sales expenses increased slightly. In addition, the company recorded a loss of 32 billion VND from its affiliated company.

However, the company received a refund of 223 billion VND for enterprise management fees. According to the financial statements, this is a refund of the provision for uncollectible receivables of 310 billion VND. As a result, Hoa Binh Construction reported a net profit after tax for the company’s shareholders of nearly 103 billion VND, while the same period last year saw a loss of more than 1,200 billion VND.

In 2023, Hoa Binh Construction recorded a revenue of 7,546 billion VND, a decrease of nearly half compared to 2022. However, the company still suffered a loss of 777 billion VND for the whole year, while the same period last year saw a loss of nearly 2,600 billion VND.

As of December 31, 2023, Hoa Binh Construction still accumulated losses of nearly 2,900 billion VND. Therefore, excluding the company’s equity funds, the remaining amount is only 453 billion VND. The financial borrowings of this enterprise amount to more than 4,700 billion VND.

The total assets of Hoa Binh Construction reached 13,054 billion VND, a decrease of more than 2,500 billion VND compared to the beginning of the year. Among them, the short-term and long-term receivables accounted for the majority of the assets, at 8,820 billion VND, a decrease of about 2,000 billion VND compared to the beginning of the year. The company’s cash and deposits amounted to only 390 billion VND.

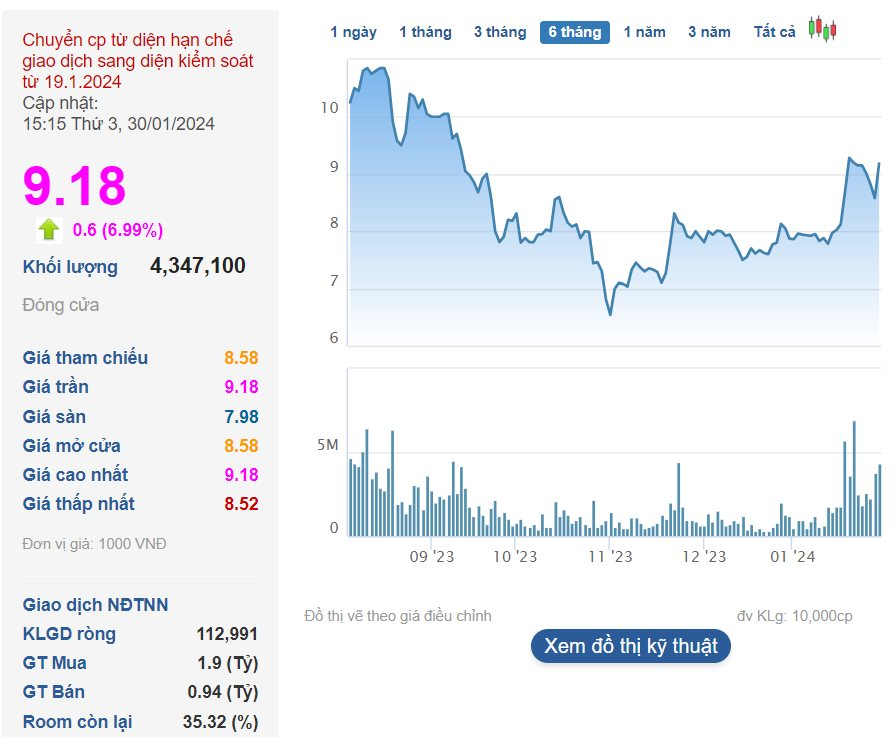

At the end of the trading session on January 30, thanks to the positive business results, HBC shares increased to the ceiling price of 9,180 VND/share, ending a series of 6 consecutive declining sessions.