The Resale Power Rises: Stocks Plummet, VN-Index Retreats to Former Lows

The market lacked the liquidity to sustain prices after yesterday's positive bottom-fishing and reversal. The VN-Index briefly turned green but soon plunged into the red, weakening as the session drew to a close. The breadth saw decliners outpace advancers by a ratio of 2.6 to 1, while turnover remained high, confirming intensified selling pressure.

The Stock Market “Quakes” as Shares Plummet Across the Board

The market took a shocking turn during the final minutes of today's continuous matching session. In a 20-minute window, the VN-Index swung 2.73%, translating to over 34 points. Plunging as much as 25 points, it closed at a loss of 12.52 points, showing a slight recovery. This outcome is still surprising, with decliners outnumbering advancers 3.4 to 1, and a staggering 26 stocks hitting the floor price.

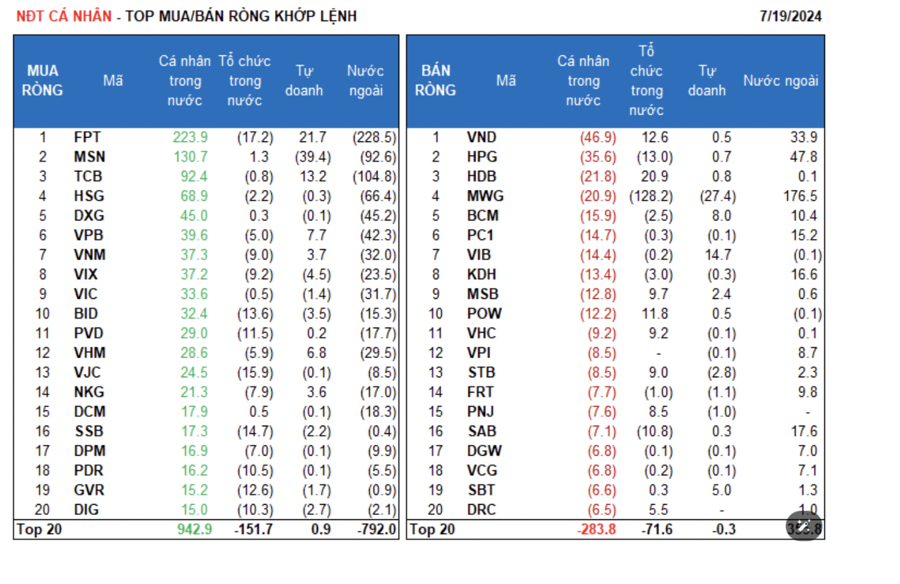

The Billion-Dollar Investor: Unveiling the Massive $3,000 Billion Stock Buying Spree

Individual investors net-bought VND 2,596.6 billion, of which they net-bought VND 3,083.4 billion in stocks.

The Price of Gold Plunges as the Dollar Rallies

Some experts predict that if former US President Donald Trump is re-elected, his economic policies could bode well for the price of gold. With his unique approach to trade and fiscal policy, Trump's potential second term could have a significant impact on the precious metal's value. His policies have often been a topic of discussion among economists and investors, and their effects on the global economy could create an interesting dynamic for gold prices. As we approach the election, all eyes are on how a Trump victory could shape the future of gold and the broader financial markets.

Stock Market Insights: The Case for Low-priced Options

The market weakened again during the weekend session, with a slight increase in trading volume on the two exchanges, up 5.5% from the previous day. Selling pressure was not intense, and buyers remained cautious, refusing to push prices higher and instead waiting for lower levels to enter. It appears that the "test" of supply and demand dynamics is still ongoing.

The Price of Gold Plummets, Nearly Dipping Below $2,400/oz

In just 48 hours, the global gold price plummeted, equivalent to a staggering loss of 1.9 million VND per tael, erasing all the gains made in the previous two days.

The Market Sell-Off: Domestic and Foreign Institutions Offload, While Retail Investors Scoop Up Shares

Individual investors net bought 687 billion VND on the weekend, with a net buy match order of 824.3 billion VND. The top net buys included FPT, MSN, TCB, HSG, DXG, VPB, VNM, VIX, VIC, and BID.

“Deputy Minister Nguyen Duc Chi: We Don’t Need 8 Million Stock Accounts, 6 Million...

"A well-organized and professional trading firm need not aim for 8 million securities accounts; 5 to 6 million would suffice. However, what sets an exceptional firm apart is having half of those accounts held by institutional investors."

“SHS Securities Records 6-Month Pre-Tax Profit, Nearly Quadruple From Last Year, Achieving 85% of...

"Sai Gon - Ha Noi Securities Joint Stock Company (code: SHS) has unveiled its Q2 2024 financial report, boasting an impressive 94% year-over-year surge in operating revenue to VND 599 billion."

The Flow of Funds: Will the Short-Term Bottom Hold Amidst the Ongoing Beat?

The volatile nature of the market has reared its ugly head once again, with a tumultuous trio of sessions to end the week pushing the VN-Index below its 20-day moving average (MA20). This marks the second consecutive week of declines, and technical analysts predict the index will likely test, and perhaps even breach, the lows witnessed in June.