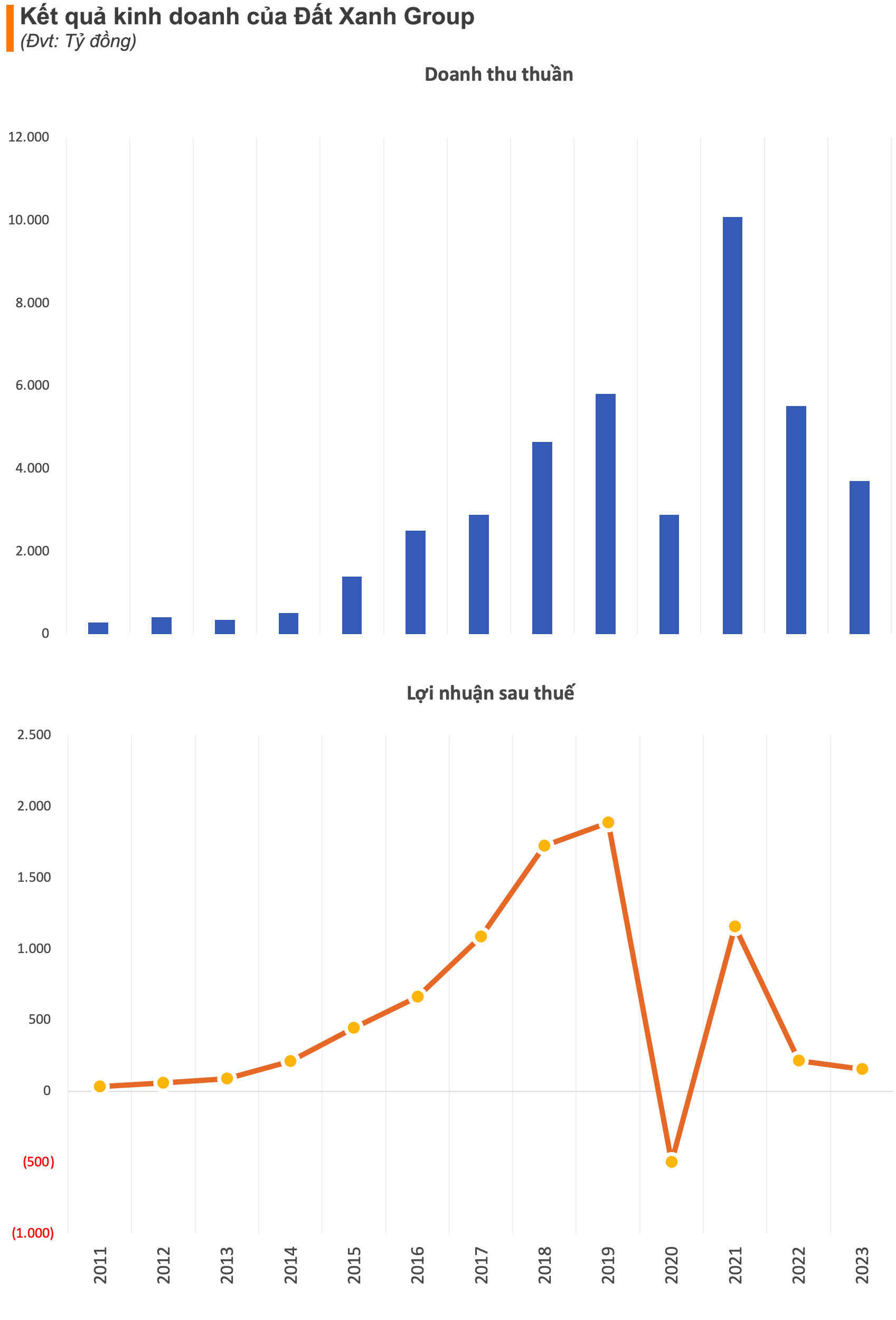

Dat Xanh Group Joint Stock Company (DXG code) has announced its financial report for the fourth quarter of 2023, with revenue of over 1,400 billion VND, a strong increase of 53% compared to the same period last year. However, the gross profit margin narrowed to 46%.

After deducting expenses, Dat Xanh recorded a meager after-tax profit of nearly 5 billion VND in the fourth quarter, still positive compared to the record loss of 395 billion in the fourth quarter of 2022. However, this is the lowest after-tax profit the company has recorded in over 7 years of operation (excluding loss-making quarters).

For the whole year 2023, DXG’s net revenue reached 3,706 billion VND, a decrease of 32% to the lowest level in 3 years. Deducting expenses, the approximate after-tax profit was 155 billion VND, a decrease of 71% compared to the previous year. This is also the lowest after-tax profit DXG has achieved in the past decade (excluding years of loss).

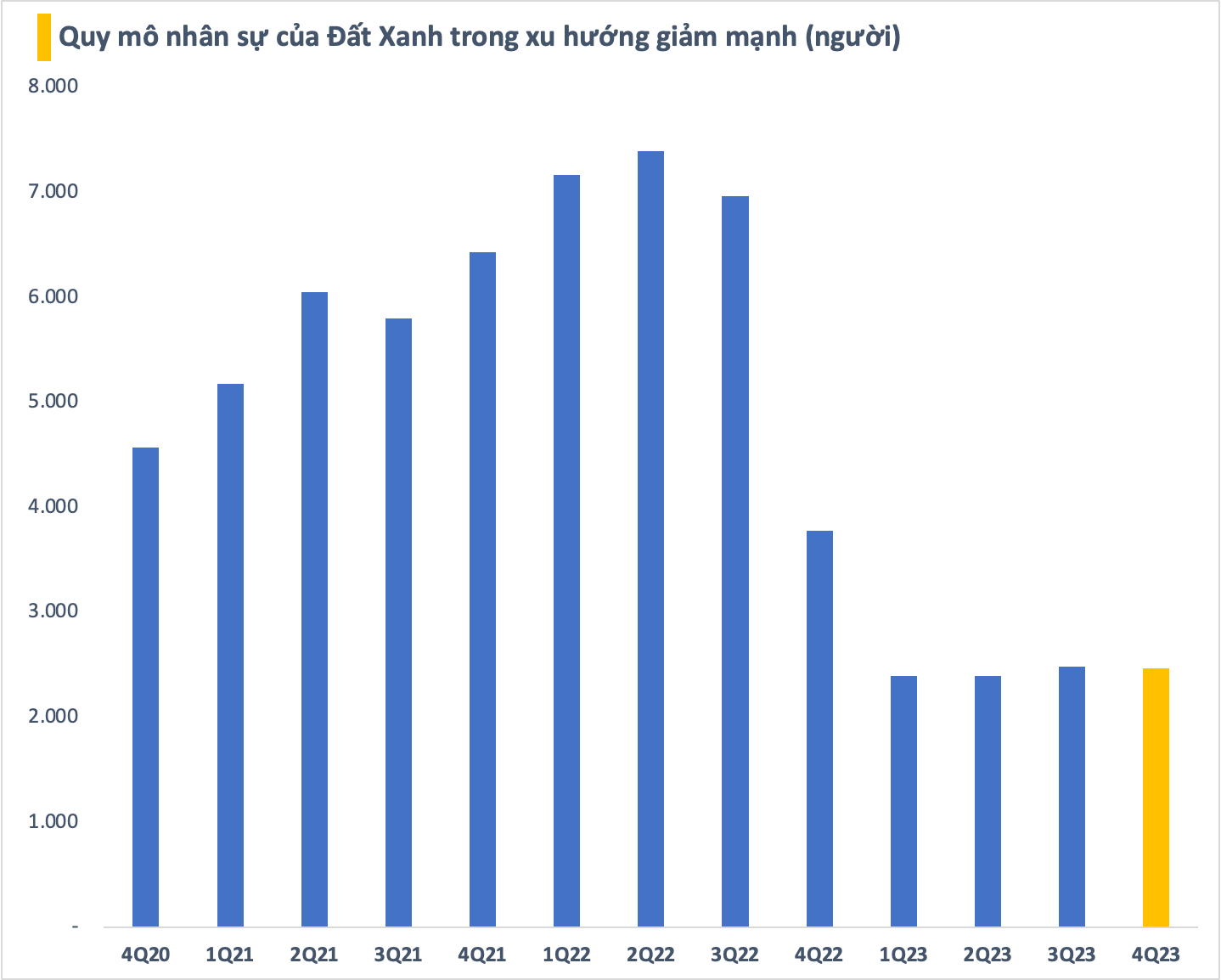

In the context of the business results not really recovering, the scale of Dat Xanh Group’s personnel has significantly diminished in 2023. This real estate company has made significant cuts to its workforce. As of December 31, 2023, the workforce of this real estate brokerage is now only 2,468 people, compared to 3,773 people at the beginning of the year, a decrease of 1,305 people (-35%).

Even compared to the peak period at the end of the second quarter of 2022 (nearly 7,400 people), the number of personnel in the Dat Xanh Group is now only about 1/3.

Will 2024 be “warmer”?

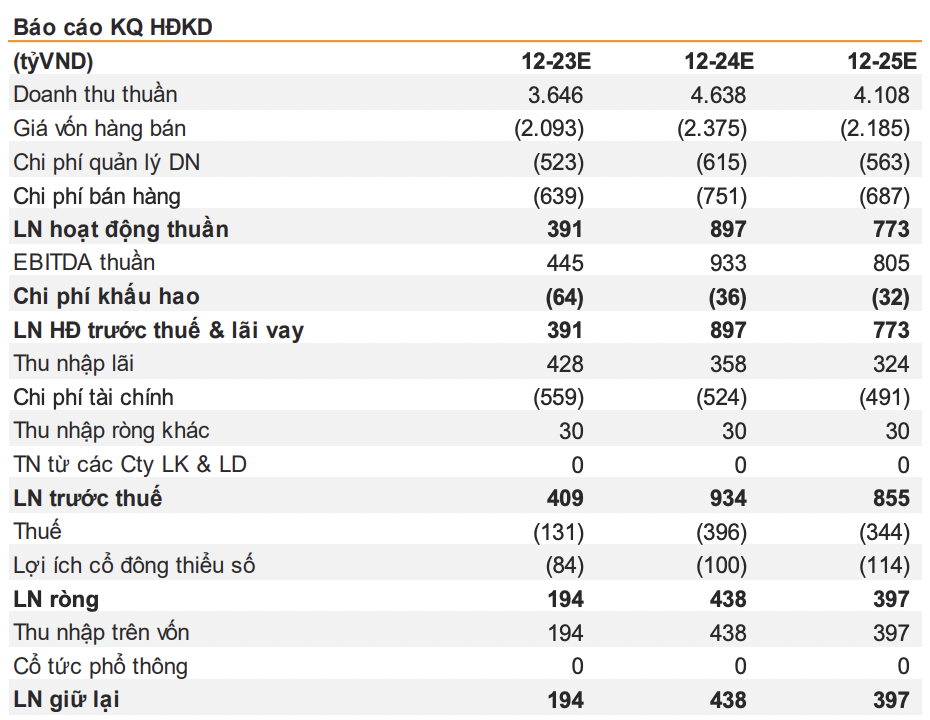

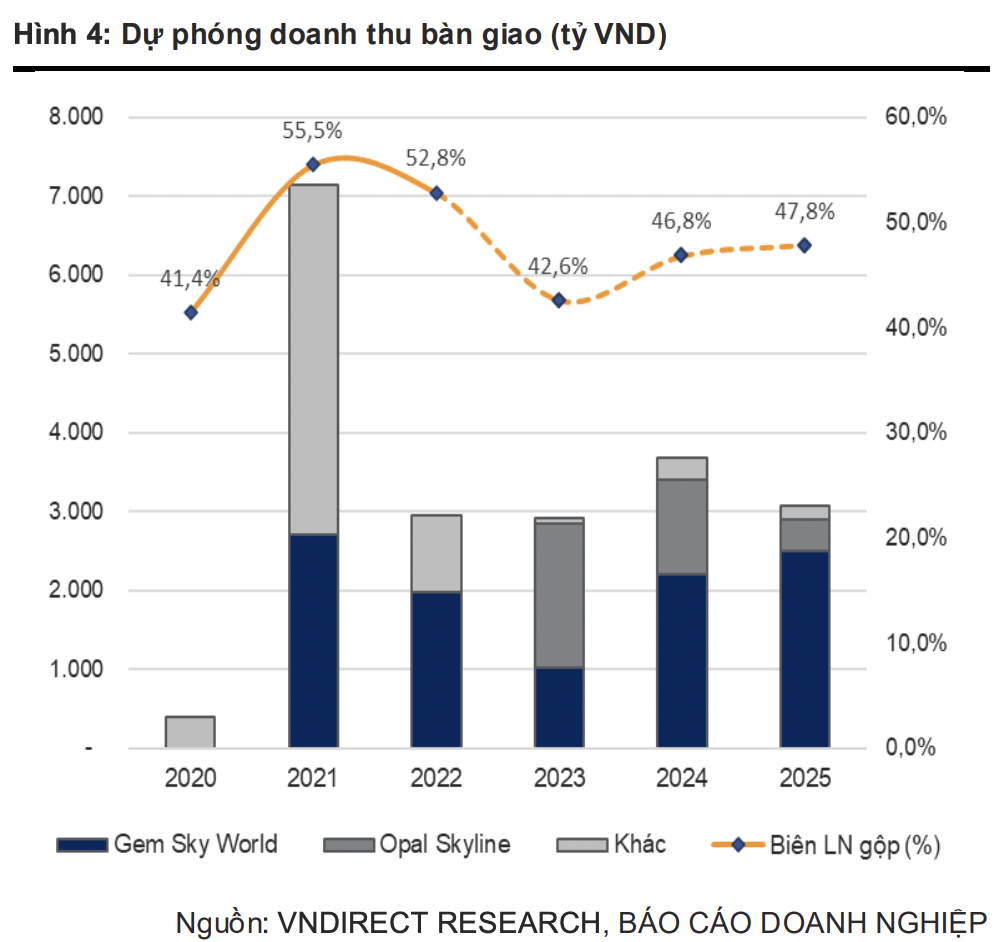

In the latest updated report, VNDirect Securities Corporation (VNDirect) believes that the Gem Sky World (GSW) and Datxanh Homes (DXH) Riverside projects will be the drivers of DXG’s growth in the period of 2024-2026.

Specifically, the GSW project is expected to develop a total of 4,022 units on a land fund with a total area of 92.2 hectares, first launched in July 2020. As of the end of 2023, about 1,600 units of the project have been sold, including land plots, townhouses, shophouses in Pearl Town and Garnet Town with an average selling price of 18 million VND/m2 and an average area of 100m2 per unit. The Topaz Town area, which includes 355 land plots, will be relaunched in 2024 and other areas including Emerald Park, Aquamarine Park, Opal Park will be launched in 2025-2027.

In addition, DXH Riverside is a strategic project that contributes to the sales revenue in the period of 2024-2026. The project completed the necessary legal procedures in the first quarter of 2023 and is expected to receive a construction permit along with additional land use payment and relaunch in the second half of 2024.

Furthermore, Dat Xanh Group also has DXH Park City and DXH Park City which are considered “reserved” for growth targets. VNDirect believes that the gradually cooling interest rate landscape and the systematic removal of legal barriers, through the amendment of the Real Estate Business Law, will facilitate the upcoming launches of DXG.

Although the overall market pressure has eased, VNDirect believes that the risk for DXG still exists as cash flow from business operations has not shown signs of improvement. Operating cash flow (OCF) has been consistently negative. In addition, future projects of DXG are often delayed due to lengthy legal procedures, which have affected the payment cash flow from customers, thereby impacting the operating cash flow. Moreover, the Business of Real Estate Law (amended) stipulates that the maximum deposit amount of customers is only 5% of the value of future houses, thereby increasing the burden on capital and cash flow for DXG.

The debt of DXG is tending to increase, and the short-term debt ratio to total debt is also increasing, reducing the soundness of the financial structure. Currently, the pressure of bond maturity is not too large, but it is still always a challenge for DXG in a market with many unstable factors.