Just a few more trading sessions, the Vietnamese stock market officially closes for Tet Nguyen Dan 2024. When it comes to Tet Nguyen Dan, investors often have concerns as the holiday mindset often leads to a decrease in liquidity. Investors tend to withdraw money from their accounts to serve Tet shopping and avoid risks from international markets or epidemics.

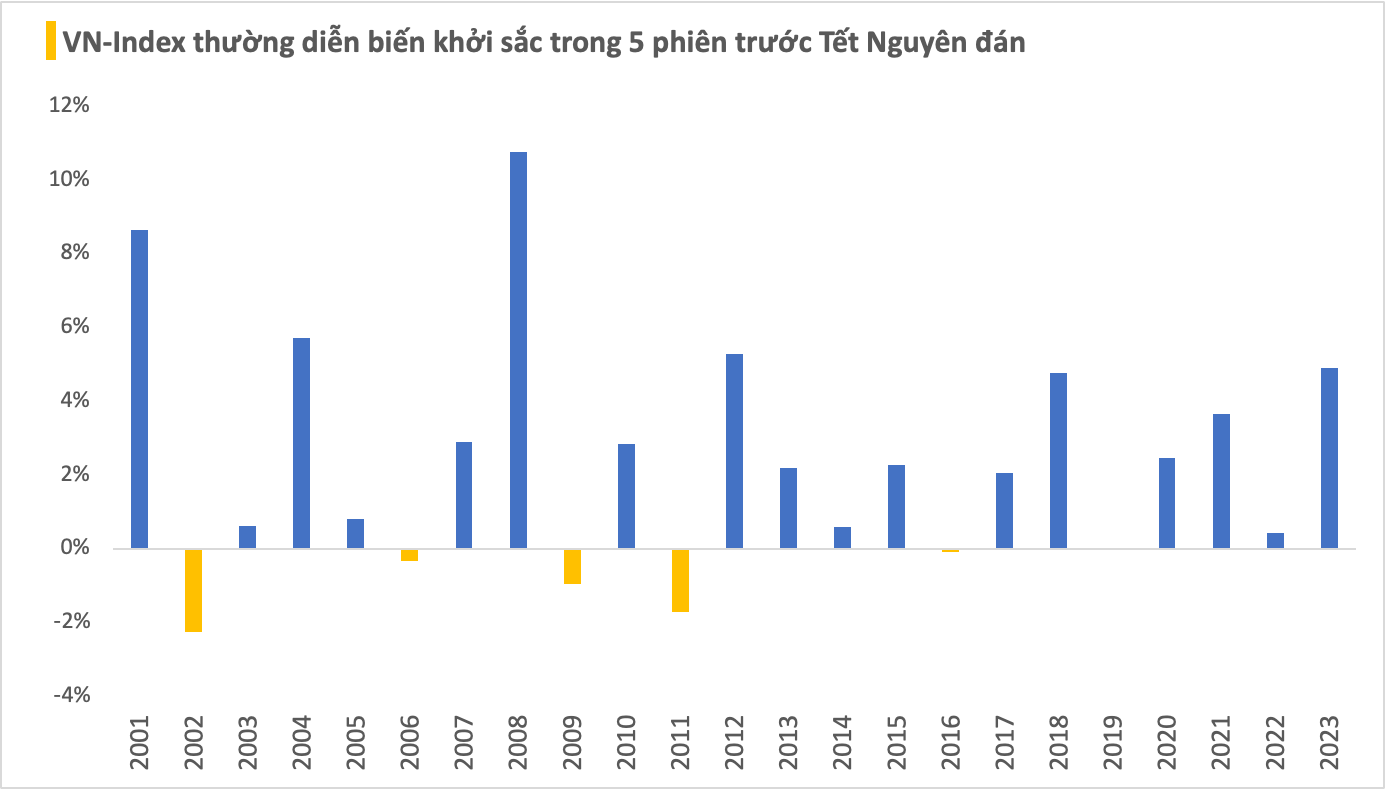

However, according to statistics in the past 23 years, the VN-Index has increased in 17 out of 5 trading sessions before Tet, and the increases are quite positive compared to the few times the index decreased, indicating that the market is usually optimistic before the Lunar New Year.

Most of the increases are recorded above 2%. In 2008, the VN-Index experienced a strong breakthrough with an increase of nearly 11% in just 5 sessions, and in 2001, it recorded an increase of nearly 9%. More recently, in the past 7 years, the main index of the Vietnamese stock market has been performing well during the week near Tet. Most notably in 2023, the index increased by nearly 5% in the week before the long holiday.

Although the statistics are only for reference, the positive past records help Vietnamese stock investors gain more confidence, especially to take advantage of this precious time to maintain strategies, hold stocks with potential for further growth, or even buy into promising stocks.

Moreover, the record low-interest rate environment and lack of alternative investment channels are expected to stimulate domestic capital flows actively participating in the stock market. The low-interest rate environment will also support enterprises in reducing capital costs, improving profitability, increasing credit demand for business and consumption.

According to DSC Securities’s strategic report, from a cyclical perspective, Vietnam is in the early stages of economic recovery. DSC evaluated that the investment story in 2024 will focus on the actual business results of the enterprises rather than just expectations. Considering the slow global economic recovery and low profit levels in 2023, DSC evaluated that Vietnamese enterprises would achieve a low-profit growth rate in 2024 but it would be difficult to achieve a profit explosion.

In theory, with the current loose monetary and fiscal policy, it is expected that the economy will perform better in 2024. A well-known principle is that the stock market often leads ahead of the economy, so in terms of theoretical expectations, 2024 is expected to be the breakthrough year of the stock market after 2023 can be viewed as the transitional year from the slump of 2022 towards lateral movement.

With the expectations of (1) lower market trends, (2) improved business fundamentals, and (3) expectations about the KRX system going into operation, boosting in the upgrading process will be a supportive platform to bring the market to a new level higher than the previous year. DSC expects the VN-Index in 2024 to maintain its position at around 1,100 points and move towards the target of 1,300 points.

More optimistically, Maybank Securities evaluates that the stock market has bottomed out since the State Bank of Vietnam began reducing interest rates in March 2023, and the low-interest-rate environment will continue to support the market throughout 2024.

In addition, profit growth will become the main driver of the market due to a stronger recovery pace from the second half of 2024. At the same time, liquidity is boosted by the possibility of Vietnamese market being upgraded to the emerging market by FTSE, which will be a big boost for the market beyond the prospects of profit growth.

Maybank Securities provides two scenarios for the Vietnamese stock market in 2024, with the market upgrade being the key factor.

In the base scenario, the VN-Index could reach 1,250 points, mainly driven by the expectation of profit recovery. In the more positive scenario, the index could reach 1,420 points, driven by stronger liquidity from the market upgrade potential.

However, investors should also note that the price uptrend in the second and fourth quarters of last year also somewhat reflected the expectations of business results for many industries. Mr. Nguyen Anh Khoa, Head of Analysis and Research Department at Agriseco Securities, estimated that only a few groups of stocks are currently in attractive valuation areas with positive business prospects and are expected to continue to attract money flow in the coming time, including banking, oil and gas, construction infrastructure, and power generation.