The VN-Index had its steepest drop in 7 weeks as it lost 9.09 points or -0.77% this morning. Banking stocks were the “culprits” that caused the index to decrease the most, with 8 out of 10 stocks contributing to the drop. Out of a total of 27 banking stocks, only 3 stocks remained in the green, particularly many blue-chips experienced a significant decline. The securities group unexpectedly attracted money flow and foreign investors also made positive net purchases.

SHB was the biggest loser in the group, dropping by 3.66%. However, due to its limited market capitalization, it was not the stock that caused the most significant loss. VCB decreased by 1.54%, causing the VN-Index to lose 1.94 points. VPB decreased by 2.28%, ranking second with -0.9 points. Other notable stocks included BID dropping by 1.24%, CTG falling by 1.86%, TCB declining by 1.28%, MBB decreasing by 1.13%, and STB dropping by 1.79%. The total 8 aforementioned banking stocks caused the index to lose approximately 6 points.

Only 3 stocks remained in the banking group that recorded positive growth, including VAB with a 1.37% increase, PGB with a 0.74% increase, and HDB with a 0.46% increase. The overall liquidity in the banking group on the HoSE exchange this morning tripled compared to yesterday morning, reaching approximately 3,006 billion VND. This is a clear sign as the banking group traded only over 2,500 billion VND all day yesterday, while the prices of these stocks simultaneously dropped.

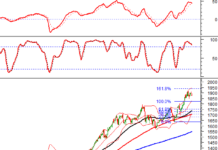

The decline of banking stocks has long been expected after liquidity began to drop sharply and prices showed no clear recovery. However, currently, there is no other group of stocks to replace the banking stocks, so this downturn means a significant decrease in the index. In the morning session, the VN-Index only had about 30 minutes in the green with the highest increase being 0.24%, then it continuously plunged. The breadth also confirmed the simultaneous decline as at 9:30 am, there were still 202 rising stocks/138 declining stocks. By 10:30 am, there were only 127 rising stocks/299 declining stocks. At the end of the morning session, the VN-Index recorded 106 rising stocks/346 declining stocks.

The market has not been able to maintain good differentiation as it did yesterday, as the strong decline of the index always impacts the overall sentiment. The Smallcap group also decreased by 0.54%, Midcap decreased by 0.66%, and VN30 decreased by 0.78%. Banking stocks declined while other blue-chips also weakened – the VN30 basket had only 4 rising stocks/24 declining stocks – so there was no stock that could “soften” the point decline.

The only bright spot this morning was the unexpected good performance of securities stocks. Of course, they could not all increase at the same time, but looking at the industry group, securities stocks were least affected in terms of quantity (6 red stocks/21 rising stocks), 17 of which increased by more than 1%.

SSIs outstanding liquidity reached nearly 32.3 million shares with a value of 1,127.6 billion VND, a 1.61% increase. VIX also ranked among the top 4 with the highest liquidity in the market with 461.7 billion VND and a 1.15% increase. VND followed with 440.5 billion VND and a 0.69% increase. VCI had 305.8 billion VND and a 2.38% increase. These are the stocks in the Top 10 market capitalization and accounted for 20.3% of the total trading value on the HoSE exchange.

Unfortunately, securities stocks have never been considered key stocks due to their limited market capitalization. SSI, with the largest market capitalization, pulled down the VN-Index by 0.2 points, which is significant, while other stocks had less impact. However, a lot of money has poured into this group, and many stocks have increased significantly, indicating short-term expectations despite the market facing risks due to the complete loss of leading stocks.

Thanks to the large trading volume of securities and banking stocks, the total trading value on both exchanges this morning increased dramatically by 119% compared to yesterday morning, reaching nearly 12,552 billion VND, the highest level in 8 weeks. Among the top 10 liquidity stocks, only DIG and HPG do not belong to these two groups.

The downside is that this sharp increase in liquidity mainly caused stocks to decline (securities stocks accounted for about 20% of the HoSE exchange). Out of the 346 red stocks on the HoSE exchange, there were 117 stocks with a loss of more than 1% of their value, with concentrated trading accounting for 41.4% of the total trading value. Apart from banking stocks, the stocks that were heavily sold and experienced drops of over 2% include ST8, DLG, HNG, VPG, CSV, HAG, GMD, VRE, PC1, and NKG. Many of these stocks had just experienced a sharp increase the day before.

There are currently approximately 40 stocks that are rising by more than 1%, mainly securities stocks. Few remaining stocks have increased in price with guaranteed liquidity. Some examples are CSC, DHC, GIL, ITA, LCG, DPG, NVL, SIP, with these stocks increasing by over 1% with a minimum trading value of 10 billion VND.

Foreign investors also made significant purchases of securities stocks, mainly SSI with a net purchase of 196.4 billion VND, VIX with 88.8 billion VND, VCI with 50.4 billion VND, and FTS with 30.3 billion VND. The total net purchase value on the HoSE exchange was only 97.1 billion VND due to significant selling pressure. Notably, VRE with -66.7 billion VND, VNM with -61.8 billion VND, VND with -45.6 billion VND, STB with -30.3 billion VND, VPB with -27.2 billion VND, HAG with -21 billion VND.