According to Savills’ report, despite challenges, the office market in Asia-Pacific is undergoing a strong transformation.

The most prominent in the Southeast Asian market is Ho Chi Minh City, which demonstrates its attractiveness with high occupancy rates and an increasing supply of green-grade A apartments.

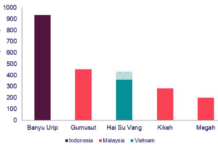

The company believes that the widespread return to work alongside the strong development of emerging economies has supported office activities in the Asia-Pacific region in the second quarter of 2023. Asian cities such as Chennai, Ho Chi Minh City, Kuala Lumpur, and Metro Manila, adherence to ESG and green certifications are among the factors influencing leasing decisions and tenant relocation trends in Metro Manila and Ho Chi Minh City.

In Ho Chi Minh City, the city has seen the highest GDP growth rate in the country at 4.6%, along with expanding business activities in the service sector, which has offset the decline in FDI capital and made Ho Chi Minh City a preferred office destination in the region.

Tenants in Ho Chi Minh City come from Australia, South Korea, Taiwan, Malaysia, and many other countries). Grade A rental capacity reached a high of 96% in the third quarter of 2023, with an average rent of $63/m2/month.

Photo: Ha Vy

In the Indian market, the service and IT sectors are growing strongly along with the strategic geographical location, coupled with strong manufacturing and well-managed Grade A supply, have propelled Chennai into the country’s third largest office market in the second half of 2023. Supported by future industrial development policies, Chennai’s office market grew by 23% compared to the same period in 2023.

Meanwhile, the Metro Manila area continues to recover slowly but remains stable in the office sector, despite a 10% decrease in leasing activity in the third quarter of 2023 compared to the previous quarter; and the current vacancy rate is 21%. That was largely driven by the shift to high-quality properties and achieving green certifications. Strong supply from other key smaller markets in Makati (over 40,000 m2 from 2023 to 2025), BGC (182,000 m2), and Ortigas (88,000 m2) also put downward pressure on rental prices.

In Kuala Lumpur (KL), new buildings are beginning to reshape the office market significantly in 2023 when ESG and investment trends put pressure on developers and investors in the office space. This creates a “new generation of buildings” with modern real estate assets accompanied by green certifications.

Savills highlights other important new findings from research in the office sector. Specifically, in the third quarter of 2023, the financial, insurance, real estate, and banking sectors accounted for 66% of leasing activity in Ho Chi Minh City, with IT services and distribution at 9%.. The total transaction volume in Chennai reached about 836,000 m2 of office space in 2023, making it the third largest leasing market in India after Bengaluru and Hyderabad;

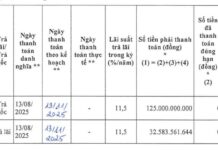

The suburban area of Kuala Lumpur has the highest rental price in Greater KL, currently at 5.70 MYR per square foot (about $1.25), up 9.6% from the same period last year;