In Q4/2023, Dam Phu My brand recorded a net revenue of nearly 3,400 billion VND and a net profit of 108 billion VND, a decrease compared to the same period last year.

The bright spot lies in financial activities, along with a reduction in expenses. During this period, the company recorded a financial revenue of 175 billion VND, while financial expenses decreased significantly to 13 billion VND.

Meanwhile, selling expenses and business management expenses both decreased significantly to 228 billion VND and 150 billion VND, respectively.

For the whole year 2023, DPM recorded a net revenue of nearly 13,600 billion VND and a net profit of over 530 billion VND, both decreasing compared to the same period last year. The setback in business results is mainly due to a high base in the same period – the period of escalating commodity fever and sharply rising fertilizer prices.

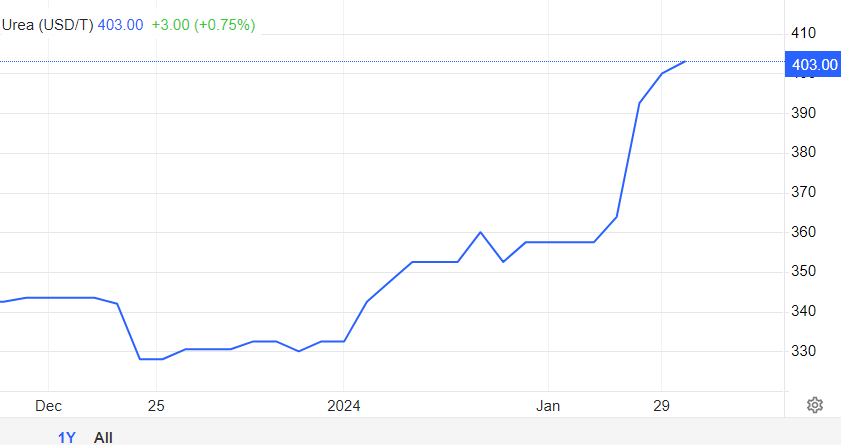

However, the business situation of the fertilizer industry giants may improve in the near future, as urea prices show signs of strong recovery. According to TradingEconomics, the urea contract price has increased from 325 USD/ton to 403 USD/ton in the past month.

Cash over 6,800 billion VND, no short-term debt

In addition, DPM also possesses a healthy financial picture, with the majority of short-term assets being cash.

At the end of 2023, DPM held nearly 9,600 billion VND in short-term assets, of which 70% was cash and bank deposits. Inventory decreased to 1,900 billion VND at the end of the year.

On the liability side, short-term debt amounted to nearly 1,500 billion VND, but there was no short-term financial borrowing.