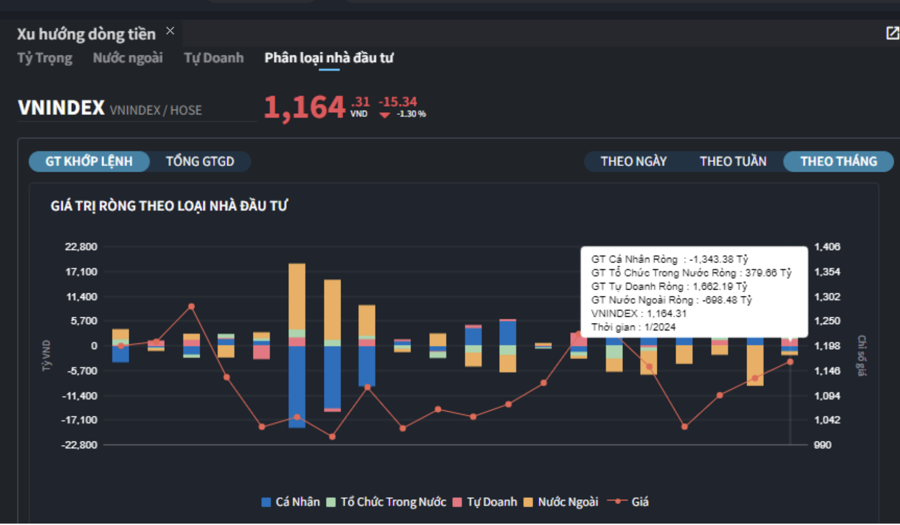

The VN-Index closed January 2024 at 1,164.31 points, up +34.38 points or +3.04% compared to the end of 2023, with slightly improved liquidity. The average trading value per session on the three exchanges reached VND 16,881 billion, up +7.6% compared to the December average.

In terms of sectors, Banking and Construction were notable sectors with increased liquidity and prices. Meanwhile, the average trading value per session decreased in Real Estate, Securities, Agriculture & Seafood, and Electrical Equipment sectors.

Looking at the monthly time frame, the allocation of money flow reached a peak of 10 months in the Banking sector and approached a peak in the Steel sector, while it hit a bottom in the Real Estate, Oil Services, and Building Materials sectors.

Funds increased their allocation to large-cap stocks, with the money flow allocation in the VN30 group increasing in January 2024. Conversely, the money flow allocation decreased in the mid-cap group VNMID and remained almost unchanged in the small-cap group VNSML.

Foreign investors net bought VND 184.77 billion, while in matched orders, they net sold VND 698.48 billion. The main net buying in matched orders by foreign investors was in the Banking and Basic Resources sectors. The top net buyers in matched orders by foreign investors included VCB, HPG, VPB, STB, MWG, VCG, HCM, CTG, VCI, and OCB.

The main net selling in matched orders by foreign investors was in the Food and Beverage sector. The top net sellers in matched orders by foreign investors included VNM, VRE, FUEVFVND, DGC, MSN, HDG, LPB, SAB, and FRT.

Individual investors net sold VND 1,397.6 billion, with net selling in matched orders at VND 1,343.38 billion. In matched orders, they net bought 9 out of 18 sectors, mainly in the Food and Beverage sector. The top net buyers by individual investors included VRE, VNM, ACB, VHM, MSN, DGC, SAB, HDG, VND, and CII.

The main net selling in matched orders by individual investors was in the Banking and Basic Resources sectors. The top net sellers included HPG, STB, VCB, MWG, VCG, VPB, HDB, CTG, and OCB.

Domestic institutional investors net sold VND 356.25 billion, with net buying in matched orders at VND 379.66 billion. In matched orders, they net sold 10 out of 18 sectors, with the highest value in the Financial Services sector. The top net sellers included ACB, FUEVFVND, PC1, CII, BCM, HCM, SBT, VHM, REE, and EVF.

The highest net buying value was in the Banking sector. The top net buyers included CTG, STB, HPG, HDB, VCG, OCB, VNM, NVL, TCB, and KDH.

Proprietary trading net bought VND 1,569.1 billion, with net buying in matched orders at VND 1,662.19 billion. In matched orders, proprietary trading net bought 15 out of 18 sectors. The strongest net buying was in the Financial Services and Basic Resources sectors. The top net buyers in matched orders for proprietary trading today included FUEVFVND, VIX, ASM, HPG, PLX, AAA, HSG, VCG, SSI, and PNJ.

The top net sellers were in the Banking sector. The top net sellers included CTG, MBB, VPB, EIB, ACB, GMD, PC1, FPT, VCB, and FUESSVFL.

Looking at the monthly time frame, the allocation of money flow reached a peak of 10 months in the Banking sector and approached a peak in the Steel sector, while it hit a bottom in the Real Estate, Oil Services, and Building Materials sectors.

In terms of market capitalization, funds increased their allocation to large-cap stocks, with the money flow allocation in the VN30 group increasing to 41.9% in January 2024 from 39.2% in December 2023. Conversely, the money flow allocation decreased in the mid-cap group VNMID to 43.2% from 47% previously.

The money flow allocation in the small-cap group VNSML slightly improved to 9.6% (compared to 9.3% in December 2023).

In January 2024, the VN30 index outperformed the VNMID and VNSML indices with a growth of +3.08%. The other two indices increased by +1.39% and +0.62% respectively.