The Business Real Estate Law 2023 is expected to limit weak investors in financial capacity “doing projects without capital,” leading to the risk of unfinished projects. Illustration photo.

Limiting weak investors

Experts from VIS Rating believe that the newly issued Business Real Estate Law 2023 will limit the excessive leverage of investors and protect the rights of homebuyers in the project development phase. When project funds are cautiously mobilized, the mentality of homebuyers will be strengthened to promote transactions and create stable cash flow for investors.

The Business Real Estate Law 2023 stipulates that investors need to be more cautious in raising capital for projects as well as managing their leverage and cash flow. These improvements will support sustainable growth of the real estate market.

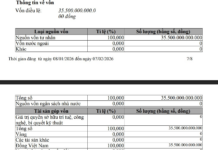

Specifically, the Business Real Estate Law 2023 requires the government to regulate the debt ratio (borrowings and bonds) to total equity. Investors with high leverage in the future will have to adjust according to the new conditions. Referring to China’s policy, investors with a debt-to-equity ratio of over 100% will have their borrowing ability restricted, analyzed by the team of experts from VIS Rating.

Accordingly, investors will now have to finance new project investment costs with at least 15-20% of the total investment amount from equity, significantly higher than the previous minimum requirement of VND 20 billion from equity.

In addition, the new law will also provide conditions for homebuyers to benefit from new legal requirements applied to investors such as fulfilling their financial obligations related to land before commercialization, providing homebuyers with bank guarantees and limiting advance deposits to 5% of the house price.

The new law also introduces many mechanisms to protect the rights of homebuyers and prevent risks in transactions with investors, such as incomplete legal documents, excessive advance deposits, slow construction progress, late receipt of land use rights and ownership of houses.

According to regulations, homebuyers will also benefit from new legal requirements imposed on investors, such as fulfilling their financial obligations related to land before commercialization, providing homebuyers with bank guarantees, and limiting advance deposits to 5% of the total selling price. With these changes, the new law will help reinforce the mentality of homebuyers and restore housing demand in the coming years.

Financial health of real estate businesses

Referring to regulations related to the debt-to-equity ratio, for listed real estate companies, while many companies have a solid capital base (equity adjusted for net debt), there are also many companies with leverage ratios above 100%, such as VHD, TDC, NBB, NVL, VCR, CKG…

Specifically, VHD – Real Estate Development and Investment Corporation has an extremely high debt/equity ratio, with total debt exceeding VND 4.5 trillion and equity of just over VND 210 billion as of Q4/2023.

BD – Business and Development Joint Stock Company – a member of the giant enterprise Becamex, also has a total debt of nearly VND 3 trillion at the end of Q4/2023 and equity of over VND 800 billion…

Or Seven Seven Investment Joint Stock Company has total debt of over VND 5 trillion and equity of over VND 1.8 trillion at the end of Q4/2023. This is also a company controlled by the largest economic interest holder CII – a giant in bridges, infrastructure with special projects with total huge debts of tens of thousands of billion dong, D/E ratio more than 2.3 times…

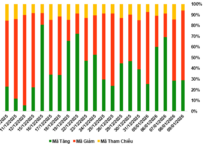

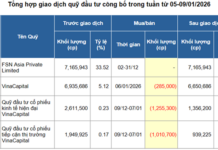

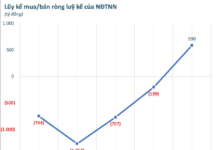

A study based on data provided by WiGroup shows that the financial health of real estate businesses basically has not improved much.

Specifically, for the residential real estate companies, there are signs of a decrease in their ability to repay loans, as the payment ratio is currently low compared to 2022, indicating that real estate companies are under pressure in terms of cash flow.

“This can explain the more cautious trend in the expansion of investment by these companies,” assessed WiGroup and believed that the market will continue to be restricted in terms of real estate supply as well as slowing down the recovery pace, including the pace of promoting timely bond payment to help businesses have more new capital and new investment opportunities.

With residential real estate companies accounting for over 70% of the total number of real estate companies in active groups (including industrial real estate and industrial zone real estate), according to WiGroup, in the short term, slow real estate liquidity will be a barrier to the expected recovery pace of the market.