|

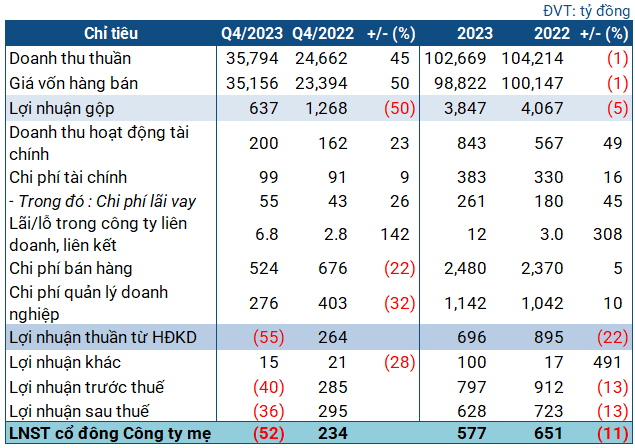

Business performance of OIL in Q4 and full year 2023

Source: VietstockFinance

|

In Q4, OIL reported revenue of nearly 36 trillion VND, an increase of 45% compared to the same period. However, the cost price increased by 50%, reaching over 35 trillion VND. After deduction, gross profit was 637 billion VND, equal to 1/2 of the same period.

Despite the increase in financial revenue while most costs decreased, the large proportion of expenses resulted in a net loss of 52 billion VND for OIL in Q4 (compared to a profit of 234 billion VND in the same period).

At the year-end conference held on December 22, 2023, OIL revealed that the reason for the loss was due to the company being affected by the sharp decrease in oil prices during the period.

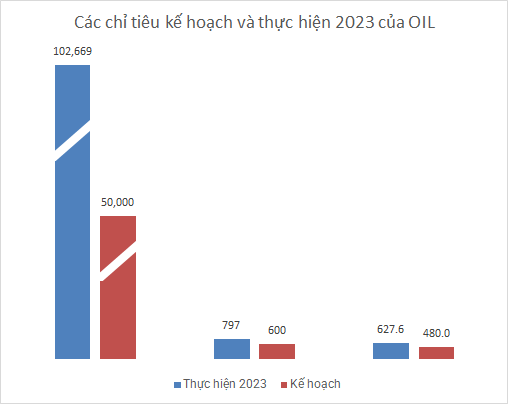

Looking at the full year, OIL reported nearly flat revenue, reaching nearly 103 trillion VND; net profit of 577 billion VND, lower than the same period by 11%. Although the results declined, compared to the targets set through the 2023 Annual General Meeting, OIL achieved double the revenue target, and exceeded the after-tax profit target by nearly 31%.

Source: VietstockFinance

|

By the end of 2023, OIL‘s total assets increased nearly 35% compared to the beginning of the year, reaching nearly 39 trillion VND. Of which, nearly 33 trillion VND is current assets, an increase of 42%. Cash and deposits amounted to nearly 15.3 trillion VND, a 30% increase.

Short-term receivables from customers more than doubled compared to the beginning of the year, reaching nearly 9.2 trillion VND. The value of inventory also increased significantly, reaching nearly 4.2 trillion VND. Basic construction costs during the period increased by nearly 50%, to over 173 billion VND, with the main change in fuel depot costs at Vung Ro.

In terms of capital sources, OIL‘s end-of-period short-term debt increased by 57%, to over 27 trillion VND, corresponding to a current payment rate of about 1.2 times. Short-term borrowings recorded nearly 7 trillion VND, 2.6 times higher than the beginning of the year.