Concerns over the supply of sugar have eased due to the influence of El Nino, which has caused heavy rainfall in Brazil. As a result, the global sugar price in December 2023 decreased by 24% to $20.58/lbs, the lowest level in the entire year.

However, in January 2024, the Indian Sugar Mills Association (ISMA) reported that India’s annual sugar production for the 2023/2024 season from October 15, 2023 to January 15, 2024 decreased by 5.3% to 14.95 million tons, raising concerns about the shortage of sugar supply.

In addition, on January 18, 2024, the Indian Government decided to impose a 50% export tax on molasses, indicating that the restrictions on sugar exports from India are unlikely to be lifted in the near future. This further strengthens concerns about the sugar supply in the country.

Furthermore, the increase in crude oil prices since January 2024 has made the production of biofuel Ethanol more attractive, indirectly putting pressure on the global sugar supply. As a result, the world sugar price rose by 16% to $23.91/lbs in January 2024.

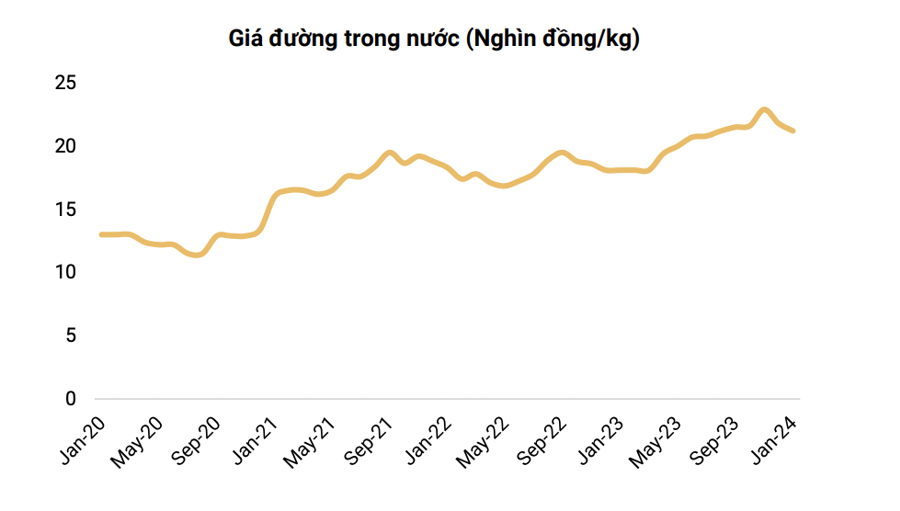

The domestic sugar price has adjusted downward after a period of following the global sugar price but the decline was lower compared to the world sugar price and remained at 21,200 – 21,800 VND/kg from December 2023 to January 2024.

According to Phu Hung Securities, the production outlook for 2024 is still positive, with sugarcane production expected to increase by 9% to reach 10.6 million tons and refined sugar expected to increase by 10% to over 1 million tons, the highest level since the 2019/20 season. Therefore, the domestic sugar supply is expected to be abundant in 2024, making it difficult for the domestic sugar price to increase significantly and may slightly decrease in line with the fluctuations of the world sugar price.

Phu Hung Securities believes that the world sugar price in 2024 will continue to decline as El Nino is expected to last until mid-2024. The weather is forecasted to shift to a neutral phase, which will be more favorable for sugarcane cultivation, somewhat brightening the sugar supply outlook in India and Thailand.

However, in the short term, the sugar price is expected to remain high as concerns about the sugar supply shortage in India will continue until the end of Q1/2024. In addition, according to Unica, as of December 2023, Brazil’s annual sugar output for the 2023/24 season has increased by 25.4% YoY to over 42 million tons.

The International Sugar Organization (ISO) has also raised its estimate for global sugar output for the 2023/24 season to 179.9 million tons, compared to the previous estimate of 174.8 million tons, reducing the global sugar deficit for the 2023/24 season to 0.3 million tons from the previous forecast of 2.2 million tons. These factors will support the stability of the sugar supply and prevent a surge in the world sugar price in 2024.

Therefore, Phu Hung Securities believes that the domestic sugar price in 2024 will adjust downward according to the fluctuations of the world sugar price.

At the end of 2023, thanks to the benefits from the sugar supply shortage and price increase in the past period, QNS recorded strong growth in net revenue and profit, reaching 10,023 billion VND, an increase of 21% compared to the same period, and 2,189 billion VND, an increase of 70%. The gross profit margin in 2023 increased by 370 percentage points to 33% thanks to the positive support from the sugar segment, with the gross profit margin of the sugar segment in 2023 reaching 30%, up from 19% in 2022.

In 2024, QNS will continue to achieve positive business results, with growth momentum mainly coming from the sugar segment. Despite the risk of lower domestic sugar prices this year, the expectation for the annual sugar price for the 2023/24 season is still higher than that of the 2018/19 and 2019/20 seasons. QNS’ sugarcane production in 2024 is also expected to increase as QNS expands its sugarcane raw material area in Gia Lai province, increasing the total sugarcane area to 30,000 – 40,000 ha in the 2023/2024 season (+54% compared to the previous season).

In addition, QNS has recorded a high dividend yield (about 8%), which is worth noting for investors.