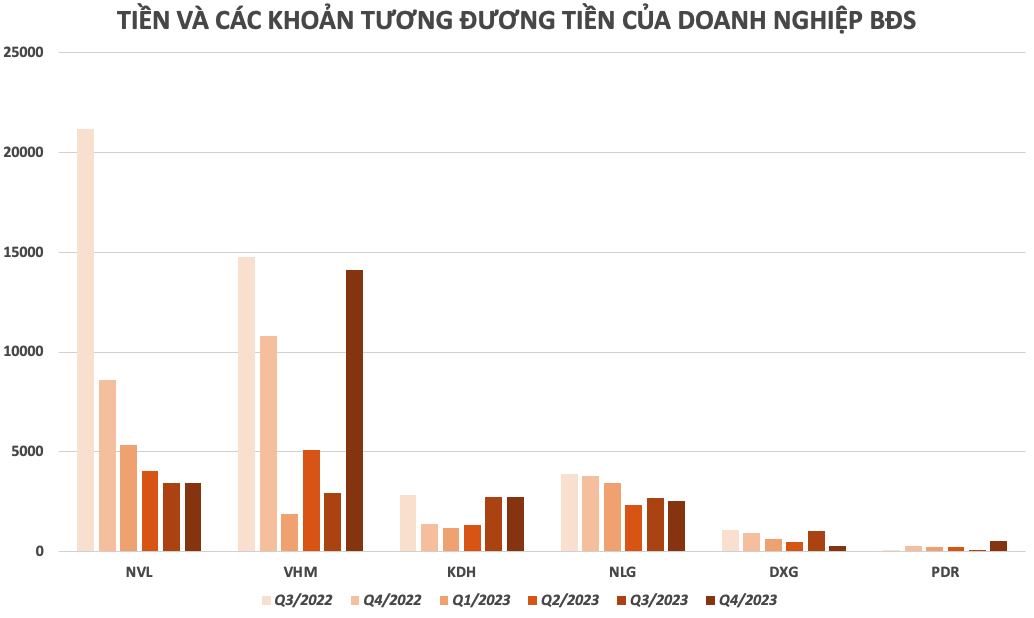

In the context of a sluggish real estate market, most businesses have significantly reduced their cash flow. In fact, some businesses have lost more than half of their “wallet.” On the other hand, a “giant” has increased its cash by 7 times in just 1 year.

Specifically, No Va Real Estate Investment Corporation (Novaland; stock code: NVL), as of December 31, had cash and cash equivalents of VND 3,412 billion, a decrease of 60% compared to the end of the previous year. In which, in the fourth quarter, the company recorded cash of VND 1,713 billion, a decrease of nearly 43% compared to the same period.

Regarding the cash equivalents, NVL recorded VND 1,699 billion at the end of the fourth quarter, a decrease of nearly 70% compared to December 31, 2022. NVL stated that the cash equivalents are bank deposits with maturities from 1 – 3 months and earn interest rates from 1.9 – 6% per year.

However, at the end of December, NVL’s cash and cash equivalents were used as collateral for loans and guarantees totaling VND 63 billion. In addition, the money is being managed by banks for loans for specific projects, amounting to VND 856 billion, compared to VND 5,537 billion at the end of the previous year.

Nam Long Investment Corporation (stock code: NLG) recorded cash and cash equivalents of VND 2,540 billion at the end of the fourth quarter, a decrease of 32.7% compared to the end of the previous year. In which, NLG recorded cash of VND 659 billion, while the cash equivalents were VND 1,881 billion. NLG stated that the cash equivalents reflect bank deposits with maturities of less than 3 months with interest rates ranging from 3 – 4% per year.

Specifically, Dat Xanh Group Corporation (stock code: DXG) recorded VND 276 billion of cash and cash equivalents at the end of the fourth quarter, a decrease of 70% compared to the end of 2022. In which, DXG’s cash was VND 174 billion, a decrease of 38% compared to December 31, 2022. The cash equivalents were VND 102 billion, deposited short term with a maturity of no more than 3 months at banks and earning interest rates ranging from 3 – 6% per year.

While many “wallets” of the big players have declined sharply due to the sluggish real estate market, some businesses have seen their cash and cash equivalents increase.

Specifically, Khang Dien Investment and Trading Joint Stock Company (stock code: KDH) recorded VND 3,730 billion of cash and cash equivalents at the end of 2023, an increase of 35% compared to the end of the previous year. In which, KDH recorded cash and bank deposits of VND 1,452 billion, while the rest was VND 2,277 billion of cash equivalents. Khang Dien stated that the cash equivalents reflect bank deposits with a maturity of no more than 3 months and earn interest rates ranging from 2.7 – 4.3% per year.

At Phat Dat Real Estate Development Corporation (stock code: PDR), cash and cash equivalents at the end of the fourth quarter reached VND 505 billion, nearly twice as much as the same period. In which, the cash equivalents of the company were only VND 200,000.

Of note, as of December 31, 2023, the cash and cash equivalents of Vinhomes Joint Stock Company (stock code: VHM) stood at VND 14,104 billion, an increase of 30% compared to the same period. In which, VHM’s cash reached VND 13,124 billion, a 7.1-fold increase compared to the end of 2022. However, Vinhomes’ cash equivalents decreased by 89% compared to the same period, to VND 980 billion.

Vinhomes stated that the cash equivalents include investments and deposits in commercial banks with maturities from 1-3 months, earning interest rates ranging from 2.1 – 8.5% per year.

According to accounting principles, items such as cash are momentary in nature. To understand more about the company’s operations, it is necessary to look at a longer period of time. However, in reality, in the context of a difficult real estate market, some companies have gradually run out of money.