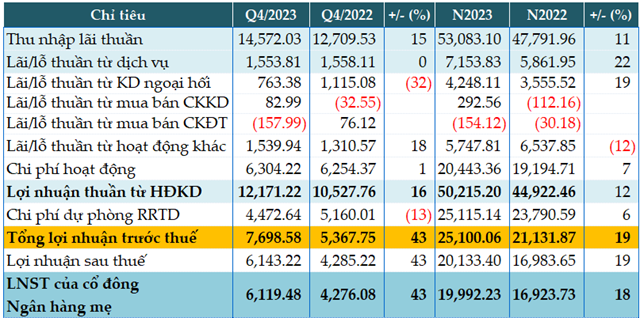

Overall, VietinBank’s business operations in 2023 showed growth compared to the previous year.

The growth of VietinBank in the year came mainly from the contribution of net interest income of VND 53,083 billion, an 11% increase.

Other sources of income also grew, such as service income (+22%), foreign exchange income (+19%). Notably, the securities trading activities generated nearly VND 293 billion in profit, compared to a loss of over VND 100 billion in the previous year.

During the year, the Bank set aside VND 25,115 billion for credit risk provisions, a 6% increase compared to the previous year, yet VietinBank still recorded a pre-tax profit of over VND 25,100 billion, a 19% increase.

In the individual financial statements, VietinBank achieved a pre-tax profit of VND 24,304 billion in 2023. Thus, the Bank exceeded the target of VND 22,500 billion in pre-tax profit set for the whole year by 8%.

|

Business results of CTG in Q4 and full year 2023. Unit: VND billion

Source: VietstockFinance

|

The Bank’s total assets exceeded VND 2 quadrillion at the end of 2023, a 12% increase compared to the beginning of the year. In which, deposits at the State Bank increased by 37% (VND 40,597 billion), customer loans increased by 16% (VND 1.47 quadrillion).

In terms of business capital, customer deposits increased by 13% compared to the beginning of the year, reaching over VND 1.41 quadrillion. Deposits and borrowings from the Government and the State Bank decreased by nearly 80% (remaining VND 21,814 billion), while deposits from other credit institutions increased by 86% (VND 259,892 billion)…

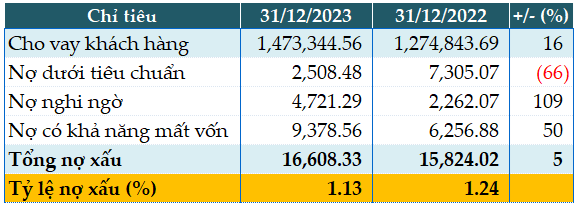

VietinBank can be considered one of the banks with good loan quality control in the system. The total non-performing loans as of December 31, 2023, increased by only 5% compared to the beginning of the year, recording VND 16,608 billion. The NPL ratio on outstanding loans decreased from 1.24% at the beginning of the year to 1.13%.

|

Loan quality of CTG as of December 31, 2023. Unit: VND billion

Source: VietstockFinance

|