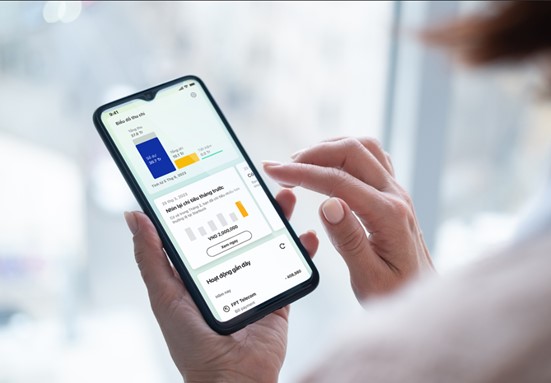

Leading the race in technology and enhancing the user experience, with over 200 new features continuously upgraded and added to the application, equivalent to more than 90 individual customer transactions carried out on the digital platform, with an app stickiness rate of 88%, Techcombank Mobile has won the hearts of customers with its high level of personalization.

Expanding beyond the scope of a financial management tool, Techcombank Mobile has now become a daily habit for customers: from paying daily expenses to tracking budgets, saving investments, and even consulting proposed solutions to optimize cash flows. All of this is easy thanks to the convenience and flexibility of this application.

Accompanying consumers in the journey of improving financial health, Techcombank has created unique and distinctive digital experiences that are highly personalized to make customers always feel comfortable and familiar every time they use any feature in the Techcombank Mobile app.

Where your personal colors are highlighted

With the ability to “transform” the interface according to the personality and preferences of each customer, Techcombank Mobile has not only created a unique and distinctive way, but also designed it in a sophisticated way for users to easily access and enjoy the number one digital banking experience in the most comprehensive and comfortable way possible.

Moreover, customers can now arrange their favorite features in the “My Features” group. If you’ve ever had difficulty finding a feature in the app, now everything is easier when you can personally drag and drop commonly used features for quick access.

In Techcombank Mobile, users can customize the background color of their accounts based on feng shui elements and even add the 12-zodiac symbols. No longer feeling bored with monotonous designs, the app interface can now be easily customized, providing a meaningful space that reflects the spirit and connection with the distinctive cultural characteristics of Vietnam.

Techcombank has proven that mobile banking apps are not as dry and difficult to use as people often think. Every time you enter the app, you will feel a familiar and comfortable space.

Affirming style with a “gu” standard account number

Not stopping there, Techcombank Mobile allows users to personalize their account numbers according to their personal preferences. Users are no longer limited by random and hard-to-remember account numbers, but instead, they can choose account numbers based on meaningful milestones in life such as birth dates, anniversaries, phone numbers, or even numbers that they believe will bring luck.

Techcombank Mobile understands that each number has its own meaning and wants to help you connect more deeply with your bank account.

Give your account a unique “flavor” with your own nickname

In addition to choosing account numbers according to preferences, customers can also freely create nicknames for their bank accounts through Techcombank Mobile. For young, dynamic customers who love creativity, they can choose nicknames such as “LINHSOCIU” or “TIENDAYTUI” to express their personality and enthusiasm.

Meanwhile, for shop owners, coffee shops, restaurants… choosing nicknames is also a clever way to promote their business brand. Thanks to that, the brand becomes more intimate with customers. Buyers can also easily make payments without worrying about inputting incorrect information.

Secure transactions thanks to the security features of Techcombank Mobile

In the face of the rampant problem of malicious apps on the internet that harm customers using bank accounts, since August 2023, Techcombank has introduced 2 additional security features for the Android version of the app.

The “Blocking Untrusted App” feature automatically detects and alerts customers that there is an unsafe app on their phone. At the same time, customers cannot log into Techcombank Mobile until the untrusted app is removed from their device.

The “Blocking Untrusted Screen Reader” feature on Techcombank Mobile on remote devices. Thanks to this feature, fraudsters cannot monitor transactions on Techcombank Mobile, preventing them from taking control to steal money from customers’ bank accounts.

With continuous efforts to enhance the user experience, Techcombank has been honored by Global Finance with 2 major awards: “Best Digital Bank App in the Asia-Pacific region” for Techcombank Mobile and “Best Corporate Banking Platform in the world” for Techcombank Business. These awards acknowledge the relentless efforts of Techcombank in its digital transformation journey, innovative and creative efforts, and customer-centric strategy to deliver simple, effective, and superior financial solutions for customers.

In the coming time, Techcombank Mobile will continue to update new features, bringing separate financial management solutions for users.

Enjoy a series of valuable experiences with zero management fees. Open Techcombank Mobile here