Illustrative image

Vietnam owns a newly emerging commodity with a production volume of tens of millions of tons per year, which is animal feed and raw materials. Specifically, in 2022, the country’s output reached 26.72 million tons, ranking 8th in the world.

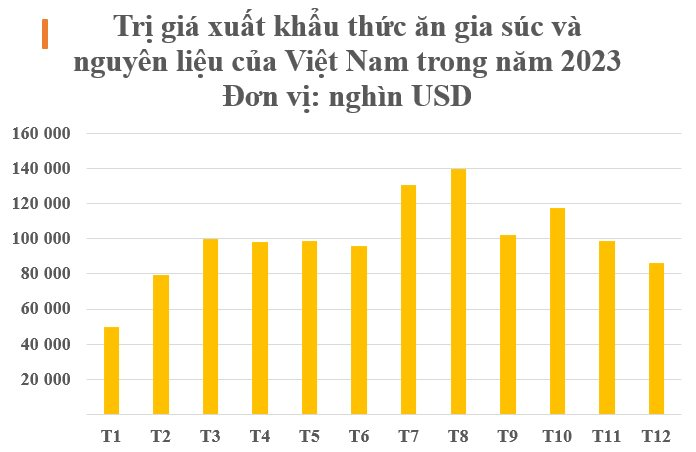

According to preliminary statistics from the General Department of Customs, Vietnam’s animal feed and raw material exports in December reached over $86 million, down 12.7% from the previous month. Accumulated throughout 2023, the country earned over $1.19 billion from the export of this item, an increase of 6% compared to 2022.

Source: General Department of Customs

In terms of markets, China, Cambodia, and Malaysia are the three largest markets for animal feed and raw materials. Specifically, for China, this country spent over $577 million on imports, a sharp increase of 30% compared to 2022, accounting for 48%, and also the largest customer. Meanwhile, China is the world leader in this field, with a capacity of nearly 261 million tons per year.

Source: General Department of Customs

Cambodia ranks second with over $166 million, a slight increase of 1.2% compared to the previous year, accounting for 14%. Malaysia ranks third with over $117 million, a strong increase of 28% compared to the previous year.

According to the Plan for the Development of the Livestock Feed Processing Industry, the target for industrial livestock feed production is 24-25 million tons by 2025 and 30-32 million tons by 2030; meeting at least 70% of the total feed demand.

According to an assessment by the Livestock Department, in general, the biggest challenge currently facing the animal feed industry is the limited production capacity of domestic animal feed ingredients, which is heavily dependent on imported materials.

The total demand for feed raw materials (maize, soybean meal, bran, fish meal, etc.) of the entire livestock industry in Vietnam is about 33 million tons per year, mainly used for pig and poultry farming. To meet this demand, the country needs a large quantity of feed raw materials, while domestic supply only accounts for about 35% of total demand, equivalent to 13 million tons per year, and the rest comes from imports.

Vietnam’s share of maize and soybeans is very small (equivalent to 0.4% and 0.02%, respectively), not to mention the low quality and low productivity that make domestic maize prices difficult to compete with international prices. However, Vietnam has an advantage in rice production (accounting for 8.4% of the world’s output).

The market assessment report of the Vietnam Market Research Company (VIRAC) has also pointed out that with the strong development potential in recent years, the Vietnam animal feed market is attracting many businesses to participate, including many foreign-invested enterprises expanding their production and business activities. Such names include: Cargill Group (USA), Haid (China), CP Group (Charoen Pokphand Group – Thailand), De Heus (Netherlands), BRF (Brazil), Mavin (France), Japfa (Singapore), CJ (South Korea), etc.