Specifically, MAC registered to sell 1.5 million shares, equivalent to the entire ownership stake in HAH (1.42%). However, during that period, MAC only managed to sell 620,000 shares, due to the price not meeting expectations. With an average price of nearly 38,450 dong per share during the period, MAC is estimated to have earned about 24 billion dong, reducing its ownership stake to 0.83%, equivalent to 880,000 shares.

In terms of the relationship, Mr. Tran Tien Dung, a member of HAH’s Board of Directors and also the CEO of MAC, is also the Chairman of TM Holding – an organization that currently holds nearly 4.6 million MAC shares, equivalent to over 30% of the capital.

Regarding HAH’s shareholder structure, at the end of January 2023, the company welcomed a major shareholder, Viconship (Container Vietnam Joint Stock Company, HOSE: VSC). Specifically, on January 30, VSC bought over 2.15 million HAH shares, increasing its ownership from nearly 3.13 million shares (a 2.96% stake) to 5.28 million shares (a 5% stake) and officially becoming a major shareholder. It is estimated that VSC spent about 86 billion dong to complete this transaction.

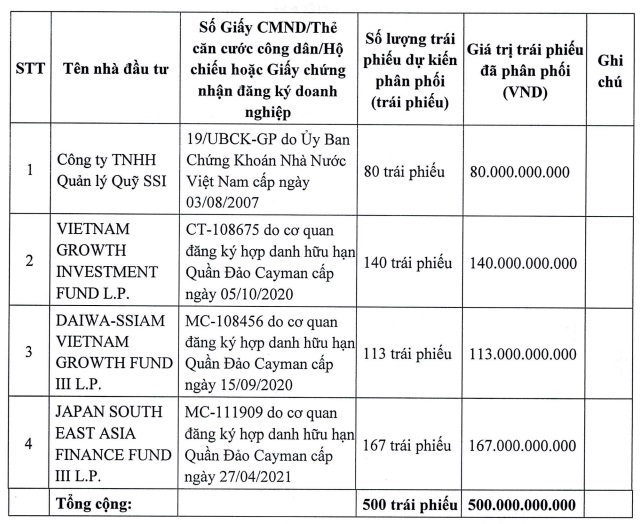

In another development, HAH recently announced the successful issuance of 500 billion dong in private convertible bonds to 4 institutional investors: SSI Asset Management Company purchased 80 bonds, Vietnam Growth Investment Fund L.P (VGIF) purchased 140 bonds, Daiwa-SSIAM Vietnam Growth Fund III L.P (DSVGF) purchased 113 bonds, and Japan South East Asia Finance Fund III L.P (JSEAFF) purchased 167 bonds.

|

List of investors purchasing HAH bonds

Source: HAH

|

This batch consists of 500 bonds with a face value of 1 billion dong, a maturity period of 5 years, a fixed interest rate of 6% per year, with interest payments made every 6 months, and the principal will be paid in one installment on the maturity date or earlier repurchase date. The bonds will be restricted from transfer for one year for institutional buyers.

With the amount received after deducting expenses of nearly 490 billion dong, HAH will use over 476.8 billion dong to pay for the construction of ship HCY-266, which is expected to be disbursed from the fourth quarter of 2023 to the first quarter of 2024. The remaining amount will be used for management and supervision expenses, initial equipment for ship HCY-266, with disbursement expected in the first quarter of 2024.

In another case, HAH will use the funds to build a new ship with the number HCY-268, of which over 495 billion dong will be used to pay for the construction of ship HCY-268, expected to be disbursed from the second quarter of 2024 to the third quarter of 2024; the remaining nearly 5 billion dong will be used for management and supervision expenses, initial equipment for ship HCY-268, with disbursement expected in the third quarter of 2024.

The collateral asset is the HAIAN BELL ship owned by Hai An Container Transportation Co., Ltd, with a value of over 207 billion dong. In addition, the Company will use a newly built ship owned by the Company as collateral.

Chau An