The reason why TVC has addressed the causes of restricted stock trading and has not violated the minimum market disclosure requirements for 6 consecutive months since the date that the causes of restricted stock trading were fully addressed.

TVC’s stock is still under warning due to negative retained earnings as of December 31, 2022 and the audit firm has an unqualified opinion on the consolidated financial statements for 2022, according to the HNX’s letter on the same day.

Prior to that, TVC also had a disclosure on the measures to address the stock warning status. The company stated that according to the consolidated financial statements for Q4/2023, the company had a post-tax profit of VND 20 billion and a full-year profit of nearly VND 279 billion; and with this result, TVC’s retained earnings at the end of 2023 exceeded VND 16 billion. Thus, the negative retained earnings were fully addressed.

| Business results of TVC |

In addition, the company also added that the plan for 2024 is to continue focusing on the strengths of stock investment and urge debt recovery.

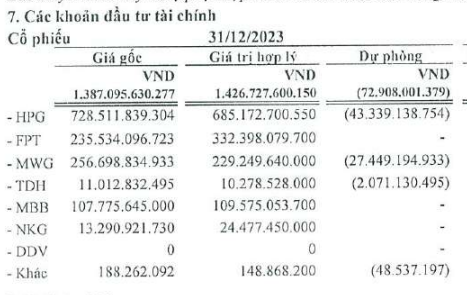

In 2023, TVC’s total assets were VND 1,975 billion, up 14% compared to the previous year. Short-term financial investments, mainly securities trading, recorded VND 1,402 billion (excluding provision of nearly VND 73 billion), up 44%.

The investments mainly focused on stocks, with the largest allocation being on HPG shares and currently incurring a loss of over VND 43 billion compared to the original price. Similarly, the investment in MWG shares also incurred a temporary loss of VND 27 billion.

Source: Company’s Financial Statements

|

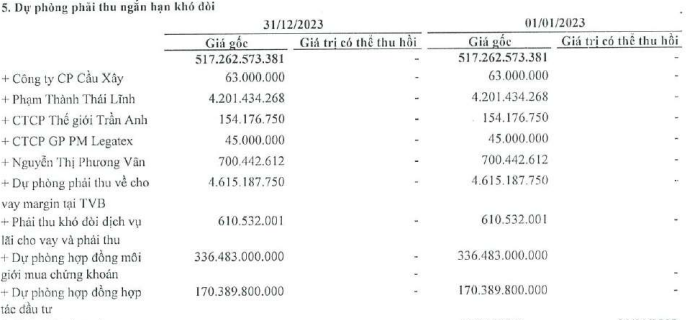

Notably, TVC has a short-term receivable of VND 837 billion, up nearly 2% compared to the beginning of the year and TVC has set aside over VND 517 billion.

Source: Company’s Financial Statements

|

On the balance sheet, the payable debt is VND 178 billion, mainly short-term borrowings and lease liabilities of VND 145 billion, which are margin loans from securities companies. At the beginning of the year, the company recognized nearly VND 162 billion. These are borrowings from bonds, TCORP6 (settled on August 31, 2023) and TCORP8 (settled on December 9, 2023).

Source: Company’s Financial Statements

|

Kha Nguyễn