Illustrative image

According to the preliminary statistics of the General Department of Customs, Vietnam’s imports of various types of fertilizers in December reached 446,560 tons worth over 151 million USD, a strong increase of 21.5% in volume and 8.8% in value compared to November. In the whole year of 2023, our country imported over 1.4 billion USD for more than 4.1 million tons of fertilizers, a strong increase of 21.3% in volume but a decrease of 12.8% in value compared to 2022.

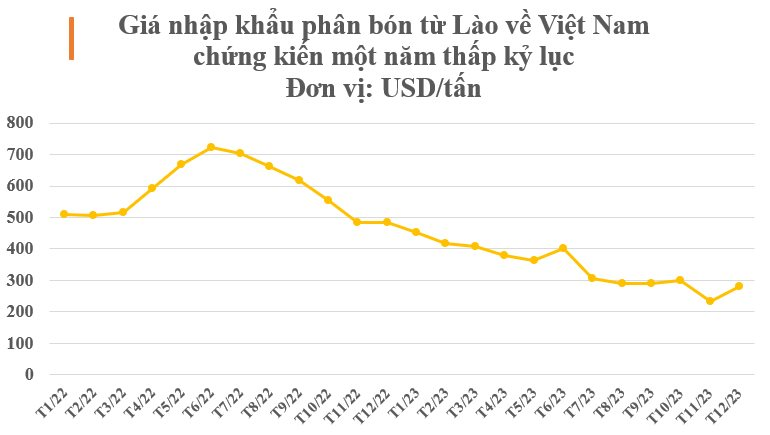

The sharp decline in import value is due to the cooling of fertilizer prices since the beginning of 2023, reaching an average of 342 USD/ton, a decrease of nearly 1/3 compared to 2022.

China still holds the position of Vietnam’s largest supplier with a volume of over 2 million tons, equivalent to over 662 million USD, an increase of 50% in volume and 47% in value compared to the previous year.

Notably among the suppliers, Laos has emerged as Vietnam’s third largest fertilizer supplier, surpassing Israel in 2023. Specifically, by the end of 2023, our country imported 279,752 tons of fertilizer from Laos with a value of over 92 million USD, a strong increase of 73% in volume but only a slight increase of 0.08% in value compared to 2022, accounting for nearly 7% in terms of both output and trade turnover.

It is worth mentioning that the imported fertilizer prices from Laos witnessed a decrease of 42% compared to 2022, reaching an average of 329 USD/ton in 2023.

From the period of 2020 to May 2022, fertilizer prices increased significantly and peaked in May 2022 due to factors such as the Russia-Ukraine conflict impacting the limited supply of fertilizer exports; global fertilizer demand increasing and the prices of inputs (natural gas and coal) rising sharply. From June 2022 to December 2023: fertilizer prices have been under strong downward pressure due to the decrease in input material prices and the return of some exporting countries.

According to Statistics, Vietnam’s total annual demand for various types of fertilizers is about 11-12 million tons, of which there is a shortage of about 4 million tons in production capacity, but there are differences between types.

SA and Kali fertilizers have to be completely imported because the domestic supply cannot meet the demand. For other types such as DAP and MAP, domestic supply only meets 86% of domestic consumption, the rest depends on imports. Regarding Urea fertilizer, the total production capacity from Ninh Binh, Ha Bac, Ca Mau, and Phu My ammonia factories has reached 2.6 million tons, exceeding the average consumption level of 2.2 million tons.

According to the forecast of the commodities market research company CRU (based in the UK), fertilizer consumption in India will increase in January 2024, which will help reverse the slight increase in urea prices. In particular, during the first quarter of 2023, the world urea price will be more clearly determined as importers begin to place orders for fertilizers and have more complete information about world commodity prices.