According to the analysis team, the flow of information about the Annual General Shareholders’ Meeting (AGM) and new business plans for 2024 is likely to make the market more active in the second half of February. The expected trading range of the VN-Index is 1,160 – 1,200 points.

On the contrary, the risk of a deep market decline is considered limited due to the relatively cheap valuation of large-cap sectors, the temporary cessation of foreign net selling, and the waiting capital of investors to re-enter the market.

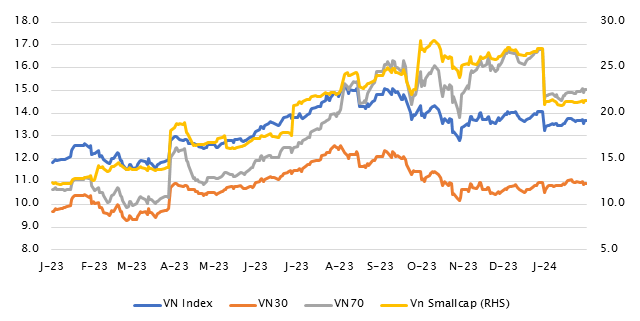

In terms of market valuation, after reflecting the Q4/2023 profit performance, the trailing P/E ratio of the VN-Index has adjusted to 13.6x, which is 10% lower than the peak level of 15x in September 2023.

|

Valuation trend of indexes by market capitalization

Source: Bloomberg, Rong Viet Securities

|

The valuation of some major sectors has also decreased, such as the banking sector, which continues to trade at a P/B ratio of 1.5x (compared to the 3-year low and average levels of 1.3x and 1.9x respectively). The P/B ratio of the real estate sector is maintained at 1.4x (compared to the 3-year low of 1.2x).

Q4 after-tax profit on HOSE increased by 29% compared to the same period last year, led by the banking group’s strong growth, alongside the recovery of profits in sectors such as basic materials and consumer services. Throughout 2023, after-tax profit of listed companies on HOSE decreased by 2%.

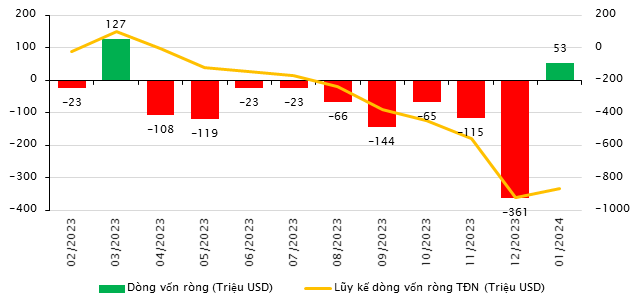

Regarding the activity of foreign investors, the analysis team believes that their continuous net selling activities in large-cap stocks may change in the coming period. Two reasons have been identified, including many parties betting on the possibility of the Fed cutting interest rates this year (although the official timing of the rate cut is still uncertain) and expectations of economic recovery outlook for 2024.

|

Foreign capital flow into the Vietnamese stock market in the past 12 months – Ending the net selling trend

Source: Bloomberg, Rong Viet Securities. YTD: Year-to-date

|

The most important data point evaluation is considered to be the relatively healthy margin lending residual debt limit at the end of 2023. This is evident from the margin loan/equity ratio, which slightly increased compared to the previous quarter (after excluding some abnormal cases in the brokerage group such as TCBS, VPBS, MBS, VCI).

On the other hand, the trend of increasing investments in the stock market continued to be reinforced as the deposits of investors in securities companies at the end of Q4/2023 increased by 5 trillion VND compared to the previous quarter (+6%), reaching an estimated 82 trillion VND. This number has also increased by 30% since the beginning of 2023, significantly surpassing the growth of bank deposits (+13.2%).

The analysis team also emphasized that the increase in deposits and residual debt limit compared to the previous quarter is in contrast to the liquidity trends of the three stock exchanges, which decreased by 25% compared to the previous quarter.

“This indicates that although investors have been more cautious in the late part of 2023, most of them continue to choose to “stay in the market”, especially when savings interest rates are still at bottom levels and confidence in other major investment channels has not yet recovered,” the analysis team noted.

The temporarily “out of market” money flow is expected to return after the Tet holiday, especially with more positive movements from large funds that have a high market-oriented impact on blue-chip stocks in the coming period, along with news flows from the 2024 AGM season.

On the other hand, the sudden sharp decline with more attractive investment opportunities in the market may also reactivate this waiting capital.