On February 6, in Hanoi, the Import-Export Department (Ministry of Industry and Trade) held a meeting to discuss solutions to overcome difficulties for import-export enterprises due to the situation in the Red Sea.

INCREASED TRANSPORTATION TIME, INCREASED COSTS

According to the Import-Export Department’s report, the Red Sea is a sea located between the Northeast Africa region and the Arabian Peninsula. To the north of the Red Sea is the Suez Canal, which connects to the Mediterranean Sea, and to the south is the Bab-al-Mandab Strait, which connects to the Gulf of Aden and the Indian Ocean.

The canal is a shortcut for ships to travel from ports in Europe and North America to ports in southern Asia, eastern Africa, and the Pacific Ocean. This route has been in operation since 1869 and has changed the international maritime transportation industry, allowing ships to bypass the Cape of Good Hope in southern Africa, reducing the distance by about 6,000 km.

This is one of the most important maritime routes in the world, accounting for about 12% of the total global maritime traffic.

However, since late 2023, due to conflicts in the Red Sea area, many shipping companies have had to change their routes, not passing through the Suez Canal but instead going around the Cape of Good Hope, making the journey of ships take 10 to 15 days longer than before.

In addition to the limitations on ships passing through the Panama Canal due to the drought (El Nino), the latest developments in the Red Sea have had a negative impact on the global maritime transportation industry and have directly affected Vietnam’s import-export activities, especially in the European and North American regions, which are two major export markets for Vietnam.

According to the Import-Export Department, in 2023, Vietnam’s import-export turnover of goods with the European region is $71.14 billion and with the North American region is $122.3 billion. The total import-export turnover of these two regions accounts for 28.4% of the country’s total import-export value in 2023.

“Therefore, it can be seen that the impact of the Red Sea conflict on Vietnam is not insignificant,” emphasized Mr. Tran Thanh Hai, Deputy Director of the Import-Export Department.

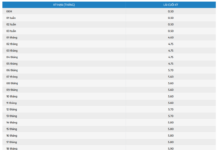

Some immediate negative impacts include the high shipping costs. According to information from the Vietnam Maritime Department, the current shipping rates are still high. From January 2024, shipping costs for container transportation to the US and Canada by sea have increased significantly compared to December 2023. The shipping cost to the West Coast increased from $1,850 per container in December 2023 to $2,873-$2,950 per container in January 2024 (a 55%-60% increase); the shipping cost to the East Coast in December 2023 was $2,600 per container, which increased to $4,100-$4,500 per container in January 2024 (an additional 58%-73% increase).

Similarly, the shipping cost to Europe increased significantly compared to December 2023. Shipping to Hamburg cost $1,200-$1,300 in December 2023, but increased to $4,350-$4,450 in January 2024. European businesses are expected to be most affected as their supply chains depend heavily on this route.

Even more serious is the shortage of empty containers. Due to the longer journey or even some ships choosing to anchor and wait for the situation to stabilize in the region, the cycle of ships is also longer, leading to a shortage of empty containers returning to Asia.

Asian exporting countries, including Vietnam, may experience a shortage of empty containers for loading goods. This will immediately affect the time and cost of loading, prolonging transportation time and causing the price of empty containers to increase significantly, greatly affecting the import-export activities between Asia and Europe.

In addition, the prolonged transportation time also affects the ability to meet import-export orders. As ships have to change the route detouring around the Cape of Good Hope, the transportation time for goods from Asia to Europe is extended by 10-15 days, resulting in significantly increased costs. Furthermore, delayed port arrivals also disrupt the supply of raw materials.

Moreover, the increased transportation costs and oil prices will have a domino effect on other commodity prices and create further economic and geopolitical instability, thereby hindering the global economic recovery.

SOLUTIONS TO COPE AND MINIMIZE THE NEGATIVE IMPACTS

Facing the complex situation with no end in sight, the Import-Export Department proposes coping solutions to minimize the negative impact of the Red Sea situation.

First: It is necessary to stabilize freight rates and transportation fees. Shipping companies need to strictly comply with Vietnamese laws, especially regulations on fare quotation and transparency. They should not impose fees or surcharges without a valid basis and with excessively high fees that affect import-export activities.

Second, smooth cargo flows and choose alternative routes. In addition to the current maritime route, import-export enterprises with Europe can consider alternative routes, such as multimodal railway routes from Vietnam through China, Russia, and Belarus to Europe. Or consider a combination of multimodal transport routes, shipping by sea to ports in the Middle East, then by air, railway, or road to Europe.

Third, diversify sources of goods supply. Build diverse supply options to minimize the impact when the route through the Red Sea encounters incidents as well as cope with similar incidents in the future.

Fourth, during negotiation and signing of purchase contracts, import-export businesses need to pay attention to and focus on contracts (or terms) regarding transportation, delivery, and insurance to protect businesses from risks and losses in case of incidents, especially for goods transported by sea through this route.

Fifth, strengthen coordination, information exchange, evaluate the situation, and respond to similar situations in the future. At the same time, cooperate closely with countries, organizations, and international enterprises to share and coordinate information and find specific solutions to cope with emergencies and unforeseeable situations.

Sixth: Proactively develop prevention plans to minimize risks, losses, and potential incidents in commercial trade, international transportation, and related issues.

For export items such as seafood, they are currently facing difficulties. Mr. Nguyen Hoai Nam, Deputy General Secretary of the Vietnam Association of Seafood Exporters and Producers (VASEP), believes that the impact on costs is one thing, but there are many interdependencies that are unclear how long they will last, especially in the cold storage industry. Shipping costs to the West Coast of the US increased by 70%, while those to Europe increased nearly 4 times based on the total cost paid for one container of goods. Meanwhile, exports are declining, which further complicates matters for the cold storage industry.

Therefore, Mr. Nam emphasizes the need for the collaboration, support, promotion, and participation of shipping companies. Shipping companies are the ones with the optimal solutions in this situation. In 2023, both exports and imports decreased significantly, so shipping companies cut mother ships, and the impact from the Red Sea doubled the delay. “Therefore, the business community hopes for the participation of shipping companies,” Mr. Nam suggested.

Although it has not been heavily affected, Mr. Truong Van Cam, Vice Chairman of the Vietnam Textile and Apparel Association (Vitas), is still concerned that if this situation persists, customers will demand cost sharing. Currently, Vietnam’s textile and apparel export turnover to the Americas and Europe accounts for over 50%, about $60 billion. Textile and apparel businesses currently use the CIF import and FOB export methods, so the immediate impact on the textile and apparel industry is not significant as businesses are only responsible until the goods are on board, and the subsequent process is the customer’s responsibility.

However, when there are risks, there should be sharing between customers and partners. In addition, customers’ demand for fast delivery, if the transportation time is extended, the production time will shrink, putting pressure on the textile and apparel industry.

“The worrisome thing is that the end of the risks cannot be predicted. If this situation persists, customers will demand cost sharing. Therefore, there needs to be information for businesses to proactively and timely handle the situation. Moreover, shipping companies need to provide transparent information about prices so that businesses can plan and respond,” suggested Mr. Cam.