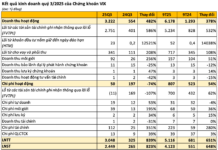

Source: VietstockFinance

|

From Confidence to Arrogance

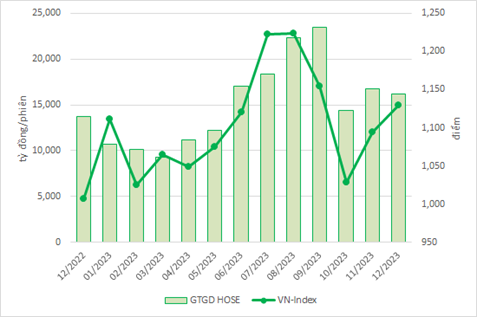

It can be said that the Vietnamese stock market in 2023 went through many unpredictable and complex fluctuations. In the first 4 months of the year, the VN-Index mostly moved sideways and experienced narrow fluctuations. At that time, I was cautious in my investments because I had witnessed unexpected market crashes in 2020, 2021, and 2022. I only dared to observe from the sidelines and cautiously invest in some stocks in the real estate, retail, and steel sectors.

Moving into May and June, when there were signs of money pouring into the market, I took the risk of believing that the VN-Index was entering an Uptrend phase and boldly participated in the market with a significant amount of capital, accounting for 70% of my total assets. At that time, my portfolio consisted of 5 stocks, including 2 real estate stocks – these were all large companies in the restructuring phase after a period of difficulties due to macro instability and the bond market. In addition, my portfolio included 1 retail stock with stable business and cash flow for many years. With the belief that food prices are likely to increase as the El Nino phenomenon is causing record heat worldwide, I added a rice stock to my investment portfolio.

Initially, my investments performed well with an average return of 50-60% in just 2 months, especially the rice stock. At that time, I was very confident and arrogant, thinking that this stock had great long-term potential as there were many forecasts that the food shortage situation would persist and Vietnam would benefit greatly from increased rice exports. However, I forgot that I had to analyze the financial situation, internal factors, and management of the company carefully. Instead, I just focused on the charts and trusted my technical analysis skills. With superficial and subjective analysis, I decided to sell profitable stocks in my portfolio and concentrate my funds on this rice stock.

The Harsh Truth and the Lesson Learned

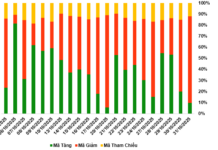

However, “life is not a dream”, the harsh reality gave me a big blow and taught me an unforgettable lesson. After more than 3-4 months of good performance, the stock market experienced significant corrections from a peak of over 1,244 points to below 1,030 points. At this time, the value of my assets also plummeted rapidly.

Instead of applying the principle of cutting losses if the portfolio was in a loss exceeding 7%, I continued to buy more stocks to average down, hoping that the rice stock would stop declining and recover. I even ignored and disregarded negative information related to this stock, such as declining business results, the management secretly selling stocks, as well as lack of transparency in the company’s governance and operations… It was not until I read the news that this rice stock would only be traded on Fridays each week that I truly panicked and didn’t know how to handle the situation. I felt helpless in the face of my own conservatism and stubbornness, which had caused such disastrous consequences. In the end, I painfully decided to cut losses on this stock when the loss ratio exceeded 54%.

As can be seen, the summary of my 1-year investment, although the investment returned to the original capital, was extremely disastrous compared to the performance of the VN-Index. I destroyed the achievements that I had diligently built in previous years. Moreover, I had a great lesson about discipline in investing. And now, I truly understand and am deeply touched by the quote of the great stock investor Jesse Livermore: “The only time I really lose money is when I break my own rules.”