The wind and solar power project in Loi Hai and Bac Phong communes (Thuan Bac) is being implemented quickly thanks to the great support from Ninh Thuan province. Illustration photo: Minh Hung/TTXVN

Increasing green capital

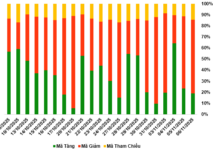

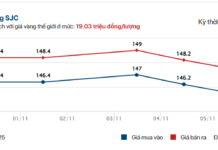

According to the latest data from the Credit for Economic Sectors Department, State Bank of Vietnam, by September 30, 2023, the green credit outstanding balance across the whole system reached nearly VND 564 trillion, accounting for about 4.4% of the total outstanding balance of the economy. Among the 12 green sectors, the outstanding balance is mainly concentrated in renewable energy, clean energy (accounting for nearly 45%) and green agriculture (over 30%).

According to Associate Professor Tran Thi Thanh Tu, Head of the Science and Technology Department, Vietnam National University, Hanoi, the growth rate of green credit outstanding balance has also developed significantly in the past 2-3 years, while 6-7 years ago, it was very low compared to the overall growth rate.

At the Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV), many green credit packages for both corporate and individual customers are being implemented, such as a VND 10,000 billion package for individual customers serving green production and business fields; a VND 3,500 billion package to finance the purchase of electric cars; a VND 4,200 billion package to support textile and garment enterprises in the green transition process…

According to BIDV Deputy General Director Tran Phuong, BIDV has provided funding for more than 1,500 customers with 1,900 projects, green credit plans with a total outstanding balance of over VND 73,000 billion, accounting for nearly 5% of the total outstanding balance of the bank. Among them, more than 80% is invested in the fields of clean energy, renewable energy, followed by environmental protection, ecological restoration, and natural disaster prevention…

Similarly, the green credit outstanding balance of Vietnam Joint Stock Commercial Bank for Foreign Trade (Vietcombank) has also increased significantly in the period of 2018-2021, from more than VND 7,890 billion in 2018 to nearly VND 18,400 billion by the end of 2021.

Mr. Nguyen Van Hao, Deputy General Director of Ho Chi Minh City Development Joint Stock Commercial Bank (HDBank), says that businesses have become more aware of environmental issues in their production and business activities, especially import-export enterprises. As a result, the amount of green credit at HDBank has been increasing. Up to now, HDBank has disbursed more than VND 11,000 billion for projects in the green sectors with the best preferential mechanisms, green credit outstanding balance accounting for 20% of HDBank’s total outstanding balance.

At Shinhan Vietnam Bank Limited (Shinhan Vietnam), the long-term sustainable development strategy through the promotion of green credit has also been focused.

Mr. Vo Vy Tung, Director of Corporate Banking Division, Shinhan Vietnam Bank, said that the bank is allocating its own capital to green projects with an interest rate lower than 2% compared to normal projects and will consider further adjusting the preferential loan policy in the future. The proportion of green credit accounts for about 5% of the total outstanding balance at Shinhan Vietnam; of which, 81% of investment capital for projects in the fields of renewable energy, clean energy, and the remaining is projects in sustainable urban and rural water management and green agriculture.

To expand the scale of capital flow

Recent estimates by the International Finance Corporation (IFC – a part of the World Bank Group) suggest that investment in climate-related activities in Vietnam could reach USD 757 billion by 2030. The need to expand the scale of green credit funding in Vietnam is clear. However, to promote green credit, additional policy mechanisms are still needed to create favorable conditions for banks to provide capital for green economic projects.

According to Mr. Le Ngoc Lam, CEO of BIDV, one of the current difficulties in implementing green funding is the legal framework. So far, regulations on green classification, confirmation of creditworthy projects, issuance of green bonds have not been issued. Therefore, there is no basis for issuing corresponding guidelines of the State Bank, affecting the implementation at commercial banks. At the same time, the identification and collection of data on emissions continue to be difficult in many countries and Vietnam, resulting in difficulties in credit appraisal, evaluation, monitoring, as well as measuring and quantifying the overall emissions of the banks…

On the other hand, Mr. Vo Vy Tung said that the characteristic of green projects is large investment costs, long payback period, and high market risks. Therefore, he expressed his desire for the Government and the State Bank to have specific mechanisms to support credit institutions in effectively promoting green credit with more preferential mechanisms such as time, cost of borrowing, providing preferential loans, applying low-interest rates, and compensating for the interest rate difference; not counting green credit in the approved credit growth targets for credit institutions…