| Revenue performance by quarter of TDP from 2017 |

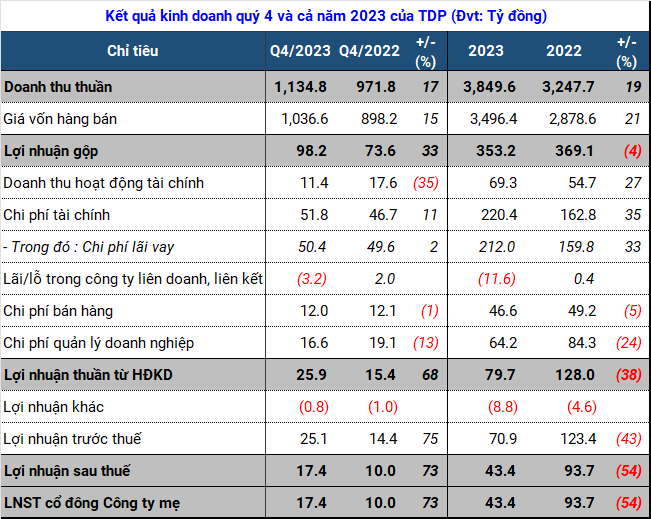

Q4 revenue of Thuan Duc Corporation (HOSE: TDP) increased by 17% compared to the same period last year, while cost of goods sold increased at a lower rate, resulting in a 33% increase in gross profit for TDP.

Despite a 35% decrease in revenue from financial activities, amounting to over 11 billion VND, and a 2% increase in interest expense, TDP achieved a net profit of 17 billion VND, a 75% increase compared to Q4 2022, thanks to a 13% reduction in business management costs.

Source: VietstockFinance

|

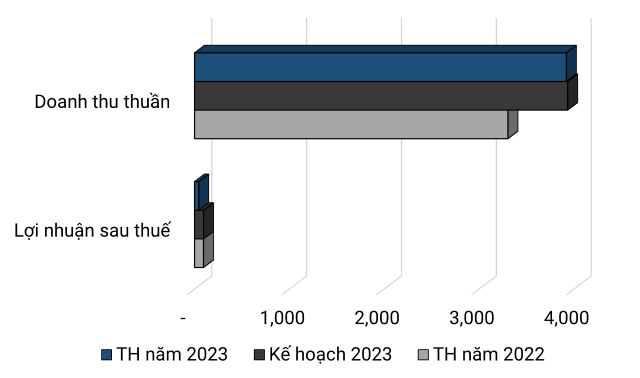

Throughout 2023, TDP generated 3.8 trillion VND in revenue from sales and services, a 19% increase, the highest level ever achieved by the company. According to TDP, although the export market experienced weakened demand at the beginning of 2023 and gradually recovered by the end of Q4, it did not reach the delivery date. Therefore, the domestic market’s stability offset the revenue from exports.

However, TDP stated that the additional growth mainly came from products with low profit margins as well as the company’s overall reduced pricing strategy, which resulted in a higher cost of goods sold at 21%, leading to a slight decrease in gross profit compared to 2022.

Favorable revenue does not necessarily translate into higher net profit. In contrast, TDP’s profit decreased by half to over 43 billion VND. The overall interest rates in the market have been on an upward trend for a long period of time, and the total demand from international markets did not meet expectations. Additionally, the corporate income tax policy specified in Decree 132/2020 increased the tax costs, resulting in a reduction in net profit, as explained by the plastic company.

With these results, TDP achieved its revenue target set at the beginning of the year but only achieved 46% of its after-tax profit target.

|

Actual performance compared to TDP’s 2023 plan (Unit: billion VND)

Source: VietstockFinance

|

At the end of 2023, TDP’s assets experienced notable changes compared to the beginning of the year. High revenue resulted in significant changes in the short-term accounts receivable from customers. For example, the accounts receivable from Viettel Logistics Co., Ltd. increased from 5.4 billion VND to 88.6 billion VND, and from other customers increased from 127 billion VND to 171 billion VND.

TDP increased its investment in Thuan Duc Eco Corporation from 161 billion VND to 298 billion VND, holding a 48.94% ownership ratio according to the equity method of accounting. Thuan Duc Eco currently has a charter capital of 425 billion VND and its main activity is the production of plastic products. In addition, TDP also made a new investment of 6 billion VND in Thuan Duc JB Corporation.

Regarding other accounts receivable, the cooperation investment business decreased nearly half to 143 billion VND as TDP withdrew its investment in the Thuan Duc JB packaging factory project due to non-investment and non-implementation according to the plan, while restructuring the form.

TDP’s inventory at the end of the period reached 1.3 trillion VND, a strong increase of 40%, mainly due to the doubling of raw materials compared to the beginning of the year, reaching 728 billion VND, while finished products decreased by half to 220 billion VND.

| Receivables, payables, and inventory performance of TDP from 2016 |

Similarly, accounts payable to suppliers also increased significantly, for example, payment to Stavian Chemical Corporation doubled compared to the beginning of the year, reaching 93 billion VND; payment to Import-Export Machinery and Spare Parts Corporation increased from 16 billion VND to nearly 41 billion VND; and payment to other customers increased by an additional 50 billion VND. This was also the year with the highest inventory and short-term accounts receivable and accounts payable for the company.

For TDP, achieving favorable revenue in 2023 would not have been possible without the rotation of short-term debts, which was also the period when the company had a record high cash from borrowing and repaying principal. During the period, TDP borrowed 4.3 trillion VND and repaid 4.2 trillion VND, increasing by 38% and 61% respectively compared to the 2022 period, while owner’s equity was only slightly over 800 billion VND.

In 2023, TDP also fully settled a 1-year bond issue totaling 230 billion VND, with a 3-year maturity and a fixed interest rate of 9% per year, using TDP shares as collateral.

| Borrowings and principal repayment performance of TDP from 2016 |

Tu Kinh