Tien Phong had a discussion with Minister of Finance Ho Duc Phoc about the fiscal policy for 2024 to support businesses and individuals in overcoming difficulties. Along with that, the goal is to ensure budget revenue.

The largest tax reduction and fee reduction package in history

Dear Minister! Since the outbreak of COVID-19, the Ministry of Finance has proposed and implemented many fiscal policies to stimulate production and business recovery. In 2024, what fiscal policies will the Ministry of Finance have to continue supporting individuals and businesses?

Minister Ho Duc Phoc: From 2020 until now, the Ministry of Finance has proposed fiscal policies to support individuals and businesses with a total support scale of about 700 trillion VND. This support amount includes: extension, exemption, reduction of taxes, fees, charges, and land rent; exemption, reduction of corporate income tax, personal income tax, value-added tax (VAT), import tax, environmental protection tax, and many other fees to support businesses, individuals, and the economy.

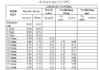

Among them, the scale of support measures in 2020 is about 129 trillion VND, in 2021 is about 145 trillion VND, and in 2022 is about 233 trillion VND. In 2023, the total estimated support value is about 200 trillion VND. These are the largest tax and fee reduction policies in history.

More than 99% of customs procedures are implemented electronically through the Automated Customs Clearance System

In 2024, with the economic forecast still facing difficulties, the Ministry of Finance will effectively implement the issued policies, including: reducing VAT by 2% to quickly enter people’s lives, especially those in need of support. The estimated amount of tax reduction under this measure is about 25 trillion VND. Reducing environmental protection taxes on gasoline, oil, and lubricants, as previously applied in 2023. The estimated value of this policy is about 42.5 trillion VND.

The Ministry of Finance also issued a decree on fees to encourage the use of online public services, which is applicable until the end of 2025. With fee reductions ranging from 10% to 50%, this policy is expected to support individuals and businesses with about 100 billion VND per year. We will closely monitor the actual situation to study and propose further solutions to support individuals and businesses.

Dear Minister! In addition to tax and fee reductions, what reforms will the Ministry of Finance implement in administrative procedures, especially tax, customs-related policies, which closely impact individuals and businesses, in 2024?

Minister Ho Duc Phoc: In 2024, the economy is predicted to continue facing difficulties with low production and business growth, high interest rates, and bad debts. Real estate growth, production and business, and disbursement of public investment have not achieved the expected results. In that context, the Ministry of Finance will continue to carry out reforms in all aspects, including: improving the system, enhancing the effectiveness of the apparatus, comprehensively and effectively reforming administrative procedures, and continuing to promote the modernization of financial sectors.

The Ministry of Finance reforms tax procedures to facilitate individuals and businesses

In particular, taxes and customs are considered as fields that directly impact businesses and individuals. To create convenience and reduce costs for individuals and businesses, the Ministry of Finance focuses on developing and implementing information technology.

We are implementing an automatic customs management system at ports, warehouses, and yards, which contributes to simplifying customs procedures and reducing contact between businesses and customs officials, thereby saving time and costs for businesses. More than 99% of customs procedures are carried out electronically through the Automated Customs Clearance System. The customs industry has coordinated with 13 ministries and sectors to implement 250 administrative procedures related to management and inspection in over 6.67 million records of more than 64.7 thousand businesses through the National One-Stop Mechanism.

The tax sector is implementing the Concentrated Tax Management Application – TMS, replacing 16 decentralized tax management support applications. Promoting the application of artificial intelligence in tracing, determining value-added tax linkages, and creating convenience for businesses. The Ministry of Finance directs the tax authorities to continue expanding e-tax services with the goal of “Taking the taxpayer as the center of service”; supporting taxpayers in quickly and conveniently fulfilling their tax obligations.

“The Ministry of Finance has proactively coordinated with relevant agencies to review export and import tax rates to support domestic production and business. We will closely monitor the actual situation to study and propose further solutions to support individuals and businesses”.

Tax and fee exemptions and reductions also impose significant pressure on the state budget. In 2024, what solutions does the Ministry of Finance have to both have room for tax and fee exemptions and reductions while ensuring state budget revenue?

Minister Ho Duc Phoc: In 2024, the task for the Finance sector is extremely heavy: the state budget revenue estimate is 1.7 million trillion VND; The estimated expenditure is 2.1 million trillion VND; Overspending is 399.4 trillion VND, equivalent to about 3.6% of GDP.

To achieve this task, the Ministry of Finance frequently monitors and accurately forecasts the global and domestic economic situation, avoiding passivity and surprises. It focuses on proactive, reasonable, flexible, and effective fiscal policy management. Close coordination between fiscal policy and other economic policies to maintain the foundation of the macroeconomy, control inflation, ensure major balances, and promote sustainable growth and development in various economic sectors and social aspects.

Along with that, the Ministry of Finance will continue to improve the legal framework and policies regarding budget revenue, strengthen revenue management, and strive to complete revenue estimates. Creating favorable conditions for taxpayers, expanding tax bases, ensuring the consistency of laws and compliance with international practices. Resolutely managing taxation, preventing tax losses, transfer pricing, recovering taxes correctly and sufficiently, responding to the emerging demands in the digital economy, cross-border transactions, etc.

We will tightly manage the state budget spending, enhance cost savings, improve the efficiency of budget management, allocation, and utilization. Strengthening financial discipline; continuing to restructure public investment expenditure. Concentrating resources on important tasks, national key projects. Striving for higher public investment disbursement than the previous year, minimizing resource shifts as much as possible.

Exempt, reduce, extend nearly 700 trillion VND of taxes and fees

From 2020 until now, the Ministry of Finance has proposed fiscal policies to support individuals and businesses with a total support scale of about 700 trillion VND. This support amount includes: extension, exemption, reduction of taxes, fees, charges, and land rent; exemption, reduction of corporate income tax, personal income tax, value-added tax, import tax, environmental protection tax, and many other fees to support businesses, individuals, and the economy.

The Ministry of Finance ensures the stable and secure operation of the financial market and financial services; strictly handling violations, promoting equal competition between economic components. Amending and improving regulations to ensure coherence and consistency; removing difficulties and promoting sustainable development in the banking, credit, securities, corporate bond issuance, insurance sectors, etc.

In the long run, adhering to the Party’s resolutions, the National Assembly’s resolutions, the Ministry of Finance has been and is studying and advising authorized levels to meet the resource requirements for implementing the 10-year Socio-Economic Development Strategy for 2021-2030. The Finance sector aims to have a sustainable, consistent tax system to ensure the rational mobilization of resources for the state budget. At the same time, contributing to creating an investment and business-friendly environment, ensuring fairness, and ensuring the sustainability of the economy.

Thank you, sir!