The corporate bond market in Vietnam has experienced explosive growth during the 2018-2021 period, with an average annual growth rate of about 45% (according to the Ministry of Finance). Among them, the majority of issuances are individual bonds from real estate businesses.

One of the important reasons why real estate businesses are turning to the corporate bond market is because raising credit capital during this period is more difficult due to banks being restricted in their short-term capital lending ratio to medium- and long-term according to legal regulations. In addition, banks require strict legal conditions for projects before disbursing.

“BITTER MEDICINE”

In favorable market conditions, the pressure to pay for corporate issuers is not high because the principal debt is only due at maturity and businesses can continuously issue new bonds to refinance their debts.

In 2022, “storm” erupted in the corporate bond market. A series of businesses that used to “make waves” in the stock market appeared in the media with negative information about their previous bond issuances. The revealed scandals in the corporate bond market have had a significant impact on the overall economy of Vietnam and the investors.

The legal crisis led to a crisis of confidence, causing new corporate bond issuances to almost come to a halt in 2022 and extend into the first half of 2023.

Many businesses are under pressure to repurchase bonds before maturity to avoid legal risks. In reality, individual corporate bonds often have a term of 2-3 years while the implementation time for real estate or renewable energy projects can last for decades.

Thus, the business plans and cash flows of most bond issuers do not align with the term of the corporate bond. Therefore, businesses face significant pressure in bond repayment obligations when they are unable to issue new bonds to refinance their debts.

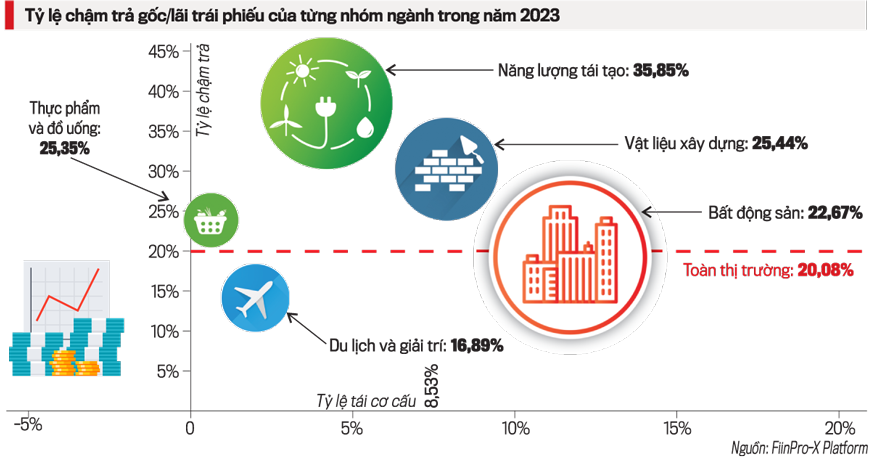

The sudden tightening of capital sources has led to a delay in bond repayment obligations by a number of businesses since the beginning of 2023.

In that context, Decree 08/2023/NĐ-CP was timely issued to partially support the corporate bond market. Some businesses have reached agreements with bondholders to extend/convert their liabilities into other assets, allowing them more time to handle legal procedures, business operations, or project transfers to generate cash flow.

According to Mr. Tran Viet from FiinGroup’s Financial Information Service division, private placements of corporate bonds on the primary market began to surge in the third quarter of 2023. However, this issuance was mainly concentrated in commercial banks.

After a series of incidents in the corporate bond market, the Ministry of Finance has intensified inspection and supervision activities and enhanced transparency in the market through the establishment of a dedicated bond trading platform.

In 2023, the number of cases penalized for violating reporting obligations on principal and interest payment of bonds, as well as reporting the use of funds from bond issuance, increased significantly compared to 2022. The total amount collected from penalties increased from VND 25 billion in 2022 to VND 29 billion in 2023. This indicates that many businesses are still not transparent in fulfilling their obligations in the bond market, affecting the interests of investors.

“Centralizing custody on the Vietnam Securities Depository Center has made information about corporate bonds much more transparent, such as nominal interest rates and interest payment periods. The establishment of a dedicated bond trading platform helps investors have a clearer view of bond transactions on the secondary market, especially data related to the investment yield of each bond. This is the basis for building interest rate curves for issuers or issuer groups,” evaluated a representative of FiinGroup. He also added that the bond trading platform has made transactions on the secondary market more vibrant. Since mid-October 2023, the trading value on this platform has significantly increased, averaging over VND 2,000 billion per session. In some sessions, the trading value reached VND 4,500 billion.

Dr. Can Van Luc, Chief Economist of BIDV, has a positive assessment of the corporate bond market with significant improvements towards healthiness after the restructuring period of 2022-2023. The market has been filtered and segmented to effectively manage high-risk issuer groups, and investors have a more accurate view of credit risks for each sector.

WHEN WILL INVESTORS BE READY TO JOIN?

The macroeconomic outlook reports for 2024 from major financial institutions all forecast continued difficult business environment, slow global and domestic economic recovery, resulting in persistent risks.

Especially, the two sectors that account for a large proportion of corporate bond issuances on the market, renewable energy and real estate, still have gloomy business prospects.

The real estate sector has been “rescued” through various policies in 2023; however, updated market reports forecast that the real estate market is still sluggish due to: (1) high product prices leading to a decline in housing purchases for both living and investment purposes; (2) local authorities enhance legal reviews of projects and handle violations related to sales when projects do not meet business operation requirements to avoid legal risks; (3) the progress of stalled projects due to abrupt capital tightening in the 2022-2023 period.

Data from FiinGroup shows that in 2024, the expected repayment debt of corporate bond issuers is approximately VND 382 trillion. Negotiating the extension of repayment time only delays the payment date, and in many cases, businesses have to bear higher interest rates. Therefore, the cash flow pressure on businesses, although reduced compared to 2023, remains significant.

According to Mr. Nguyen Quang Thuan, Chairman of FiinGroup, in 2024, cases of bond issuers violating the repayment obligations of principal and interest may no longer shock investors, but it is still difficult to expect investors, especially individual investors, to actively participate in the market as in the previous period.

Regarding institutional investors, especially foreign institutions, Mr. Thuan shared that after Vietnam and the US became comprehensive strategic partners in 2023, FiinGroup worked with 5 US institutions that wanted to invest in bonds in Vietnam, but there was no success due to most Vietnamese businesses not being credit-rated.

According to Dr. Can Van Luc, diversifying the investor base, especially institutional investors, is one of the fundamental solutions to revive the corporate bond market sustainably.

To enable investors to confidently enter the market, Dr. Luc emphasized that bond issuers must improve their quality, with business management being elevated to more openness, transparency, and professionalism in the market.

Dr. Luc also suggested that the State Securities Commission continuously consolidate the supervision, inspection, and market monitoring activities. In particular, enhancing capacity and tools for the teams responsible for these tasks…

The full content of the article is published in the Economics Magazine Vietnam No. 7+8-2024 issue released on 12-25/02/2024. Please read it here:

https://postenp.phaha.vn/chi-tiet-toa-soan/tap-chi-kinh-te-viet-nam