VN-Index could rise after the Lunar New Year holiday

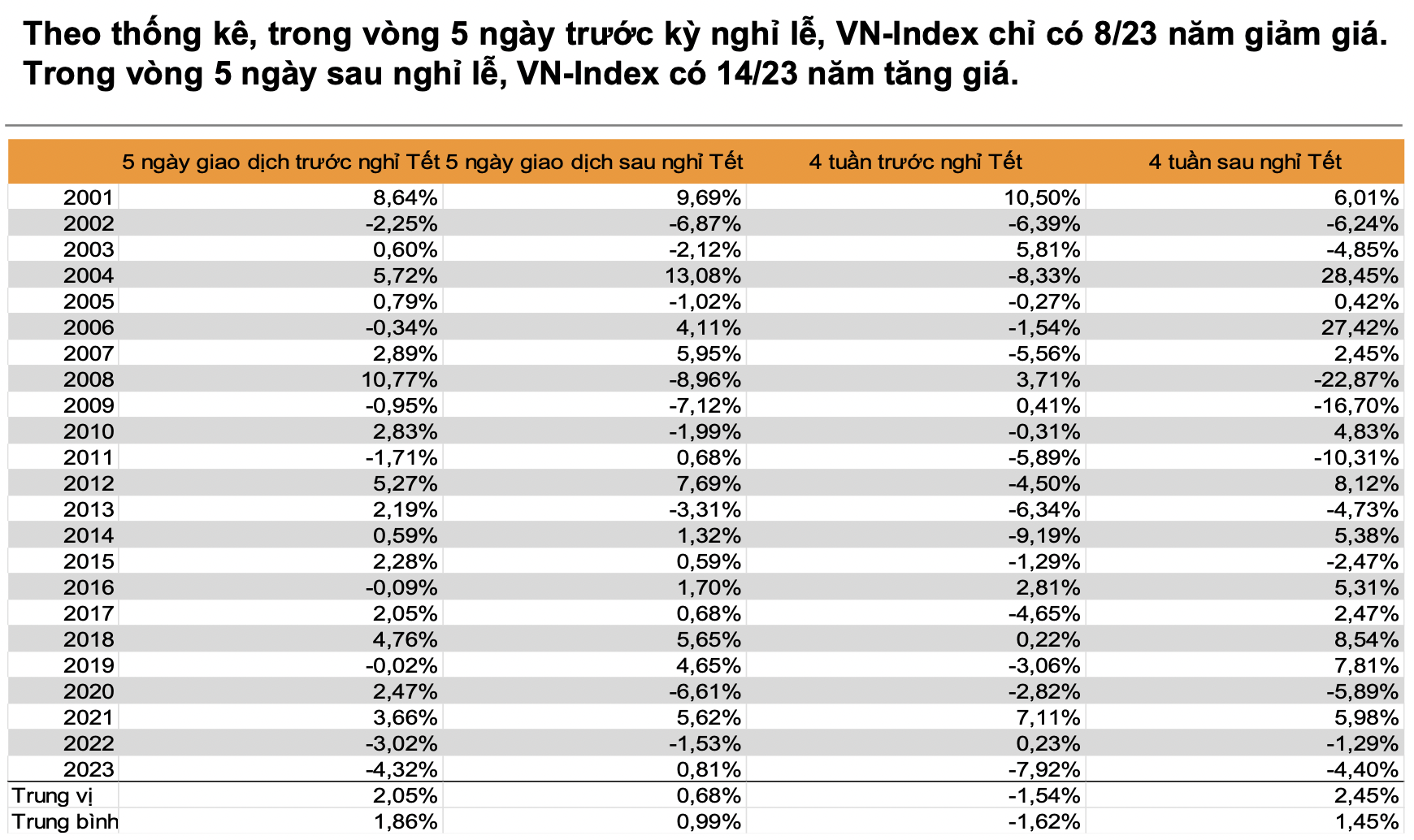

Based on VNDirect’s statistics, the stock market usually tends to increase within +/- 5 days before and after the holiday (15 out of 23 years VN-Index increased before the Lunar New Year and 14 out of 23 years increased after the Lunar New Year). However, the profit rate of the market before the holiday is usually higher than that of the 5 days after the holiday.

The market tends to decline within a month before the holiday, but in the month after the holiday, the trend is usually positive, with 13 out of 23 years gaining points. The average/median increase rate within a month after the holiday is 2.45%/1.45%.

In contrast, the market tends to decline a month before the holiday, with 15 out of 23 years experiencing a decrease. The average/median decline rate within a month before the holiday is -1.54%/-1.62%.

In terms of market valuation, VNDirect believes that the valuation is still attractive and the Q4/2023 business result data released is expected to significantly improve market sentiment. The average earnings yield (E/P) of VN-INDEX in January 2024 is about 7.0%, decreased compared to December 2023, primarily due to the increase of VN-Index in January 2024.

The average 12-month deposit interest rate of commercial banks continued to decrease in January 2024. In general, the difference between the market’s E/P and deposit interest rates remains at a high level. In the context of the high difference between E/P and deposit interest rates and the optimistic outlook for the profit growth of listed enterprises in 2024, VNDirect expects the domestic capital flow to continue to pour into the stock market in the coming time.

Cash flow will soon return to the market

Market liquidity could improve in the second half of February 2024 when individual investors gradually return to the stock market after the Lunar New Year holiday. The domestic capital flow could boost the increase of VN-Index towards the psychological resistance zone of 1200-1220 points in this month. The investment themes in February will include: (1) banks, (2) ports & maritime, and (3) consumer-retail. The Evergrande event poses potential risks to the international financial market and should be closely monitored in February.

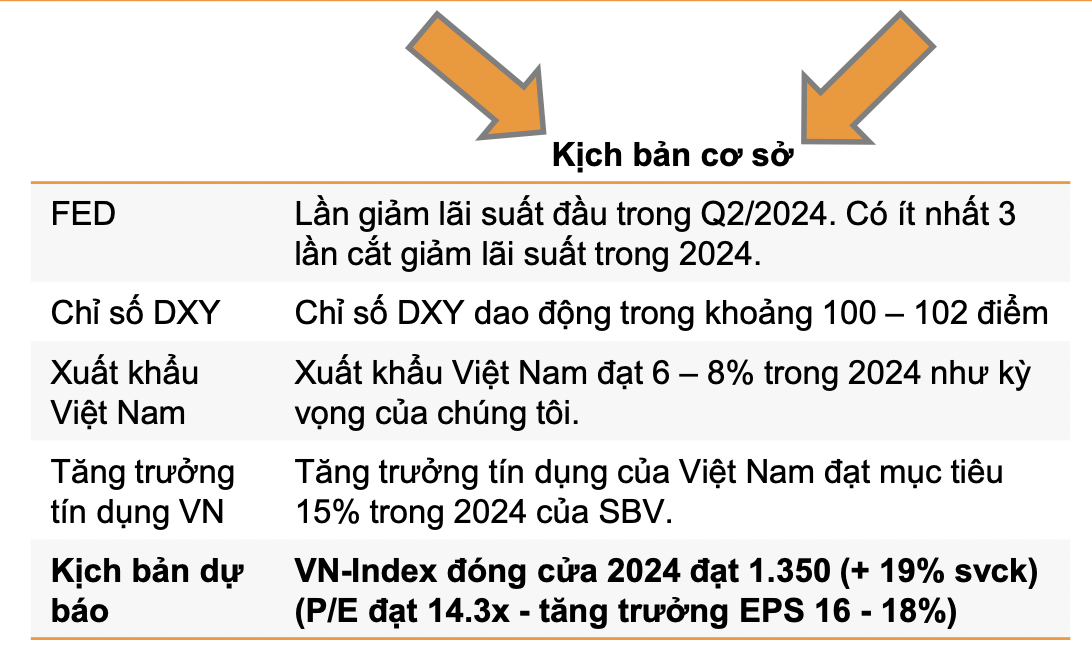

In the long run, the latest policy meeting, the Federal Reserve (Fed) has lowered expectations for interest rate cuts in March. The scenario where the Fed starts cutting policy interest rates from May is currently dominant with more than 90% market confidence in this scenario (according to CME Group’s survey). This leads to a more neutral scenario, in which the Fed starts cutting policy interest rates from May and implements at least three interest rate cuts in 2024.

Meanwhile, positive data on PMI growth, FDI, and exports of Vietnam reinforces the positive growth scenario for the profits of listed enterprises on the stock market in 2024.

With the combination of these two impacts, we believe that the market is heading towards VNDirect’s baseline scenario, in which VN-Index reaches 1350 points by the end of 2024 (based on P/E of 14.3x – EPS growth of 16-18%).