“Expanding northward has always been a challenging decision for retailers,” said Nguyen Do Quyen, CEO of FPT Retail, the company that owns FPT Shop and FPT Long Chau pharmacy chain, in an interview.

The interview took place around 4pm after a quick lunch for the busy female boss. “Speed” is the keyword she chose for FPT Retail in 2023, turning Long Chau into the only profitable pharmacy chain.

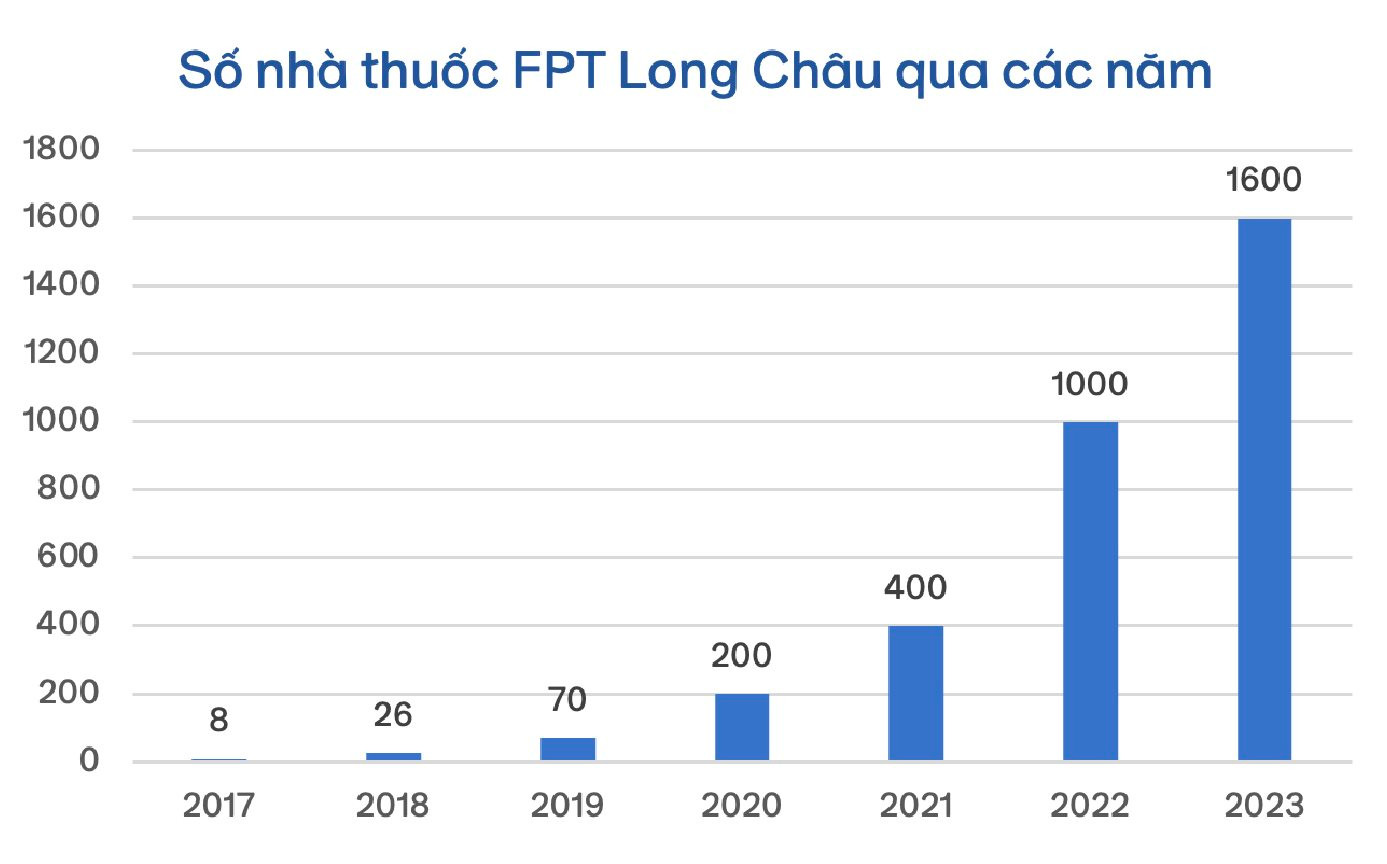

“We worked diligently, opening 1,000 stores last year, bringing the total to 1,600. That’s an average of opening 2 stores every 3 days. Truly amazing!” Quyen exclaimed.

In 2017, before being acquired by FPT Retail, Long Chau had only 4 pharmacies. Since then, FPT Retail has opened an additional 4 pharmacies. As of the end of 2023, the number of pharmacies in the retail chain has reached 1,600.

* Looking back at the 7-year journey since Long Chau merged with FPT Retail, what was the catalyst that propelled Long Chau to its remarkable progress? Was it due to Covid?

Long Chau experienced two catalysts: internal and external.

Indeed, Covid posed a challenge to the whole economy, including Long Chau, but it also became an opportunity for rapid transformation.

During the social distancing period when people were not allowed to leave their homes, we quickly built a platform that enabled our pharmacists to provide 24/7 consultations to customers, whether they were present at the stores or in quarantine. After receiving an order, we delivered the products to the customers or prepared them for pick-up.

We also noticed that Long Chau’s brand recognition significantly increased after two years of dealing with Covid. According to a report, Long Chau’s Brand Share of Voice increased to 93%, which means that 93 out of 100 people knew about Long Chau and 70% of them had made purchases there.

The second catalyst was the commitment of our leadership team to providing excellent customer experiences. “Excellent customer experience” has become a trending term, but taking it seriously requires substantial investment. Amid pressure from shareholders and unfavorable market conditions, whether to persevere with offering outstanding customer experiences was a major question for our management.

* When did Long Chau decide to focus on customer experience?

I remember it was around 2019-2020.

Long Chau started in Ho Chi Minh City and then expanded to the Western and Eastern regions. At that time, our product portfolio was well-suited for the Eastern and Western regions. However, when we decided to expand to the North, we encountered immediate challenges.

For example, in Hanoi, people tend to wash mosquito bites or soothe itchy skin with water. When a customer asked for “a bottle of water,” our pharmacists would reply, “Sorry, what is water? We don’t have it.” This left a bad impression of Long Chau. People would say, “Why doesn’t a pharmacy have water?” Or, for instance, the B1 ointment is commonly used in the North but not in the South. Therefore, our product portfolio was not adequately prepared.

The initial impression of Long Chau was not up to the customers’ expectations, especially the demanding customers in Hanoi and the North. We faced difficulties during that time and had contemplated returning to our original market, which we were more familiar with, and temporarily suspend expansion in the North.

However, some of us saw it as a challenge that we needed to overcome; otherwise, we would lose our enthusiasm even more. We decided to approach customers differently.

We conducted extensive and intense surveys. We stood on the street, where there were many traditional pharmacies that were crowded and trusted by the locals. Whenever customers passed by, we invited them in, asked for their opinions, and shamelessly persuaded them.

After many days of observation, we identified 3 factors to approach people in the North:

1. Sufficient stock of medicines is crucial. Most customers expressed their desire to visit pharmacies with a comprehensive stock of medicines rather than stores that only offered 1-2 out of the 5-6 items they intended to buy. In response, every pharmacist carried a notebook to jot down the medications customers asked for that Long Chau didn’t have. After receiving the orders, our supply chain department immediately contacted suppliers, restocked the stores, and monitored the demand.

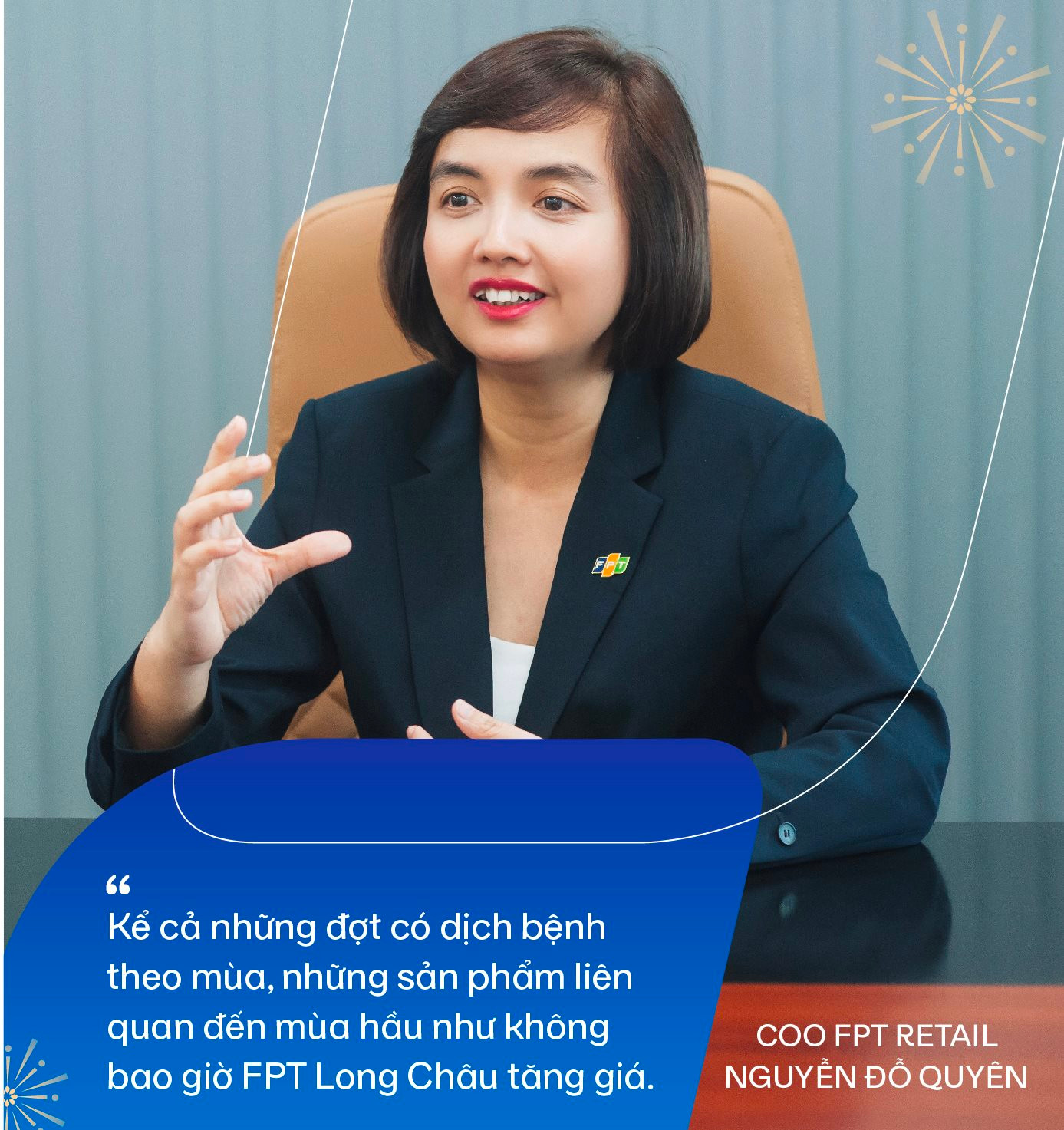

2. Price. For older customers with chronic illnesses, who rely on medicines for life, price is crucial. Although the price difference may be as small as 50-100 VND ($0.002-$0.004) per pill, the cost can add up to 200,000-300,000 VND ($8.6-$12.9) for a monthly supply, especially for low-income individuals. Therefore, even in times of seasonal epidemics or when prices for related products typically increase, Long Chau avoids raising prices.

3. People in the North enjoy collecting loyalty points and redeeming rewards.

Although there is much more work to be done and customers are becoming increasingly demanding, we are proud that Long Chau is the only pharmacy chain with a presence in all 63 provinces and cities in Vietnam.

.jpg)

* What about vaccination services?

We aim to raise awareness of the importance of vaccination among Vietnamese people. We hope that with the participation of Long Chau and other companies, Vietnam’s vaccination coverage will be on par with other Southeast Asian countries within 5 years, and then catch up with developed countries. By then, the burden on the healthcare system, especially in terms of disease treatment, will be reduced. At that time, Long Chau’s expertise in rapid expansion will truly contribute to public health by helping people prevent diseases.

During the Covid outbreak, vaccination became the top priority. At the time, the question was whether any chain with thousands of locations across all provinces could quickly vaccinate the population. No such chain existed in Vietnam. In contrast, countries like the US and Australia commonly adopt the pharmacy-based vaccination model, where people can easily get vaccinated at supermarkets like Walmart. Only with that kind of coverage can vaccination progress rapidly.

We hope that when scientists and pharmaceutical companies develop life-saving vaccines and prevent serious diseases, Long Chau will be present in all provinces. Remote and rural areas are the most vulnerable in such situations.

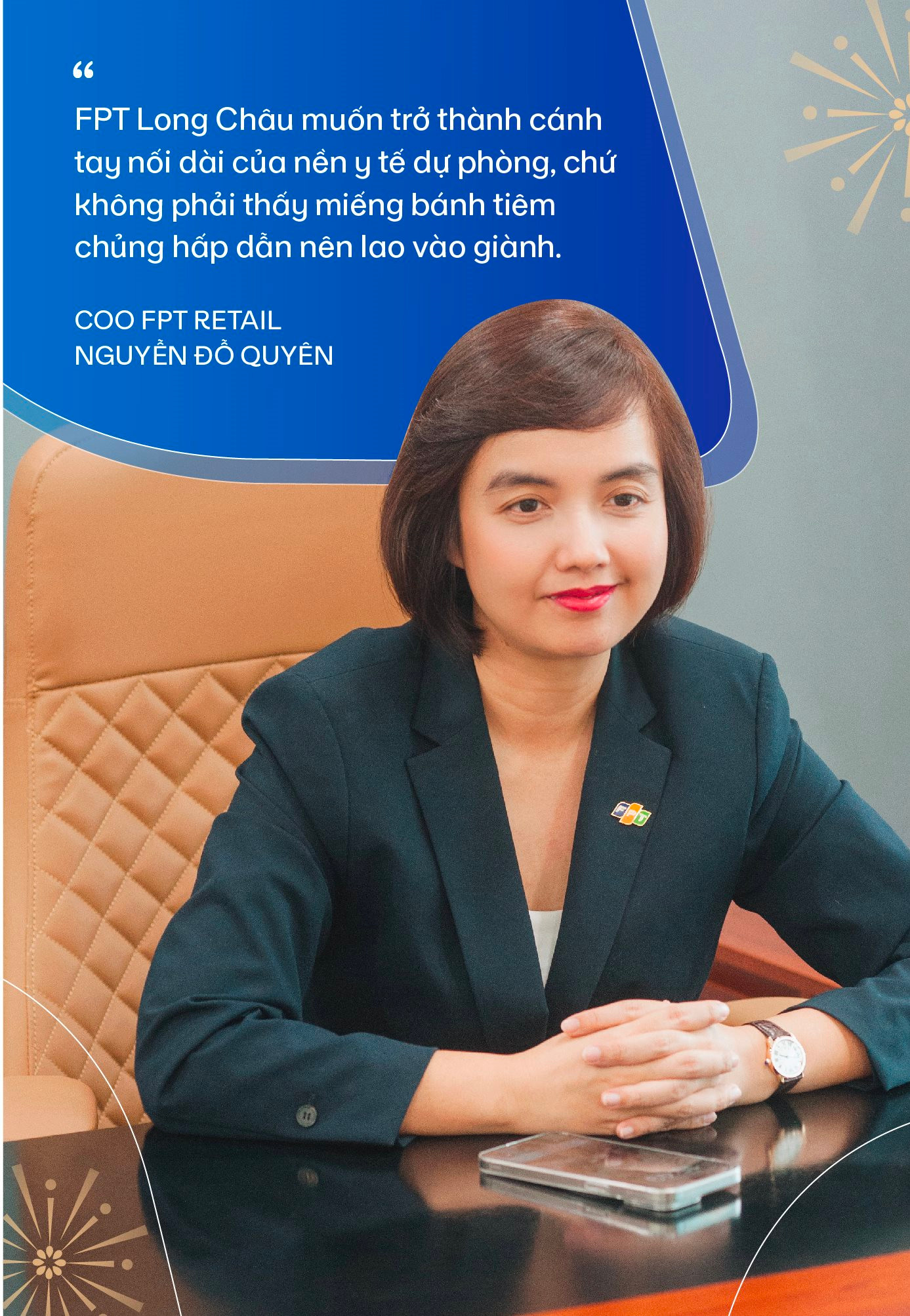

Many people have asked us about the competitive landscape in this field. The truth is that vaccination coverage in Vietnam is still very low. Our goal is not to compete, but to collaborate with other businesses in the industry to become an extended arm of Vietnam’s preventive healthcare system. That is the true purpose of Long Chau’s foray into vaccination, rather than pursuing attractive business opportunities.

* Some technology leaders have mentioned the story of AI taking over human jobs. At Long Chau, does AI replace any positions?

As a leader, I am rarely certain about anything, so I will share a personal viewpoint. After spending a long time observing our stores, I discovered that many elderly people come to Long Chau just to buy a small eye drop, for example, but when they meet our pharmacists, they would share, “My eyes have been itchy and I can’t sleep well these days.”

They may come just for a small eye drop, but they see our pharmacists as family and a healthcare companion, so they have the need to visit in person to discuss their health issues. Sometimes, all they need is a listening ear and a companion to go through their health journey. I believe in the role of pharmacists for customers and patients.

.jpg)

* At the beginning of this year, Nguyen Bach Diep, Chairman of FPT Retail, mentioned that Long Chau will not only focus on opening new pharmacies, but also on developing new services and products to increase revenue from the pharmacy chain. Can you provide more details?

I would like to rephrase Diep’s statement a bit: Long Chau will not just keep opening pharmacies, but will also expand into healthcare services beyond pharmacies.

Many shareholders ask, “Is Long Chau just going to keep opening more stores?” In fact, there were still about 62,000 private pharmacies in the retail market, but the number has reduced to around 45,000 with the development of chains. Compared to Long Chau’s 1,600 pharmacies, there is still plenty of room for opening more stores.

However, in order to achieve sustainable growth, we need to consider new business areas while Long Chau still has room to grow. We also want to motivate young leaders to see and engage in new battles. We have chosen to transform into a healthcare company rather than just a retailer. We will provide superior services beyond simple “buying and selling”.

* Does this include vaccination services?

We hope to raise Vietnamese people’s awareness of the meaning and importance of vaccination. We hope that with the participation of Long Chau and many other businesses, Vietnam’s vaccination coverage will be on par with other Southeast Asian countries within 5 years, and then catch up with developed countries. By then, the burden on the healthcare system, especially in terms of disease treatment, will be reduced. At that time, Long Chau’s expertise in rapid expansion will truly fulfill its purpose of helping people prevent diseases.

* How does FPT Retail retain its employees? How does the company deal with the difficult situation at FPT Shop this year?

In the FPT Group, and specifically in FPT Retail, people are our top priority.

For Long Chau, we have built a team of pharmacists who possess the “4T” qualities: Heart, Talent, Money, and continued Learning. We truly want them to earn a living from their profession and be able to grow professionally. We are constantly balancing two factors with our pharmacists: competitive income and continuous learning opportunities. We strive to establish a suitable ratio to retain our pharmacists.

With FPT Shop, this year has been challenging for the mobile phone retail sector. Truong Gia Binh, Chairman of FPT, has provided clear guidance: “No matter how difficult the situation, people must be the last element to retain.” Binh has entrusted us, the management team, with the key performance indicator (KPI) of job retention for our employees, while we optimize other costs and avoid jeopardizing their job security.

* How does FPT Retail handle the situation of employees leaving after receiving Tet bonuses?

We organize leader-talk sessions to share the macro and micro situations with our employees every quarter. Alongside that, it is essential to assert the crucial role of immediate supervisors in employee retention. In reality, when interviewing a departing employee, it is often related to their immediate supervisor.

Therefore, we continuously improve the management skills of our supervisors. They must be nurturing leaders who focus on employee development, rather than simply pursuing sales figures. In some years, we had to link the resignation rate to the mid-level management’s income formula. Before Tet, each manager had to submit their estimated post-Tet resignation rate, and we compared it with the actual post-Tet situation to assess the quality of their management.

Some say, “Take care of your family first, govern the nation second, and pacify the world third.” If you consider your team as a family, you must learn to take care of your family first. If you say, “No one is allowed to take time off,” but people end up taking several days off, it means you are not aligned with your family or not competent enough to lead the family.

After two years of implementation, the middle management of FPT Retail has shown great awareness regarding employee turnover. We are proud that our accumulated resignation rate is only 10% out of the total 11,000 employees. We continue to aim for a post-Tet resignation rate of 10% or below, which means less than 1% of employees leave each month.

* Thank you!