When talking about dragons in the Vietnamese stock market, it is impossible to ignore Dragon Capital – the largest foreign fund in the market with assets under management of over $4 billion. The year of Mão is not an easy investment year for members of the “Dragon” fund. However, there are still stocks that bring remarkable success to Dragon Capital, particularly FPT Retail (FRT) stock.

This stock has recently experienced a remarkable surge, reaching a new all-time high of VND 125,000/share, doubling its value in just one year. Interestingly, VND 125,000/share was also the reference price for the first trading session of FRT on the stock exchange on April 26, 2018, valuing the company at around VND 5 trillion. After nearly 6 years of listing, the market capitalization of FPT Retail has more than tripled, reaching over VND 17 trillion.

The strong growth of FRT stock has brought Dragon Capital a huge profit from this long-term investment. It is known that the “Dragon” fund invested in FPT Retail in 2017, before its IPO. At that time, the member funds of Dragon Capital and VinaCapital received a transfer of a total of 30% of FPT Retail’s capital from FPT Corporation. Although the specific structure was not disclosed, it was revealed that Dragon Capital spent about $11 million (~VND 250 billion) on this deal.

After FRT went public, both Dragon Capital and VinaCapital have made moves to reduce their ownership. By the beginning of 2021, both foreign funds are no longer major shareholders in FPT Retail. VinaCapital subsequently “withdrew” while Dragon Capital quietly accumulated FRT shares to become a major shareholder of the retail company at the end of November 2022.

In mid-December last year, Dragon Capital increased its ownership stake in FPT Retail to over 11%, but quickly sold off the shares. To date, the fund holds a total of 14.89 million FRT shares (10.93% stake) and is the second largest shareholder in FPT Retail. Based on the current market price, this investment of the “Dragon” fund is valued at nearly VND 1.9 trillion.

Targeting Long Châu?

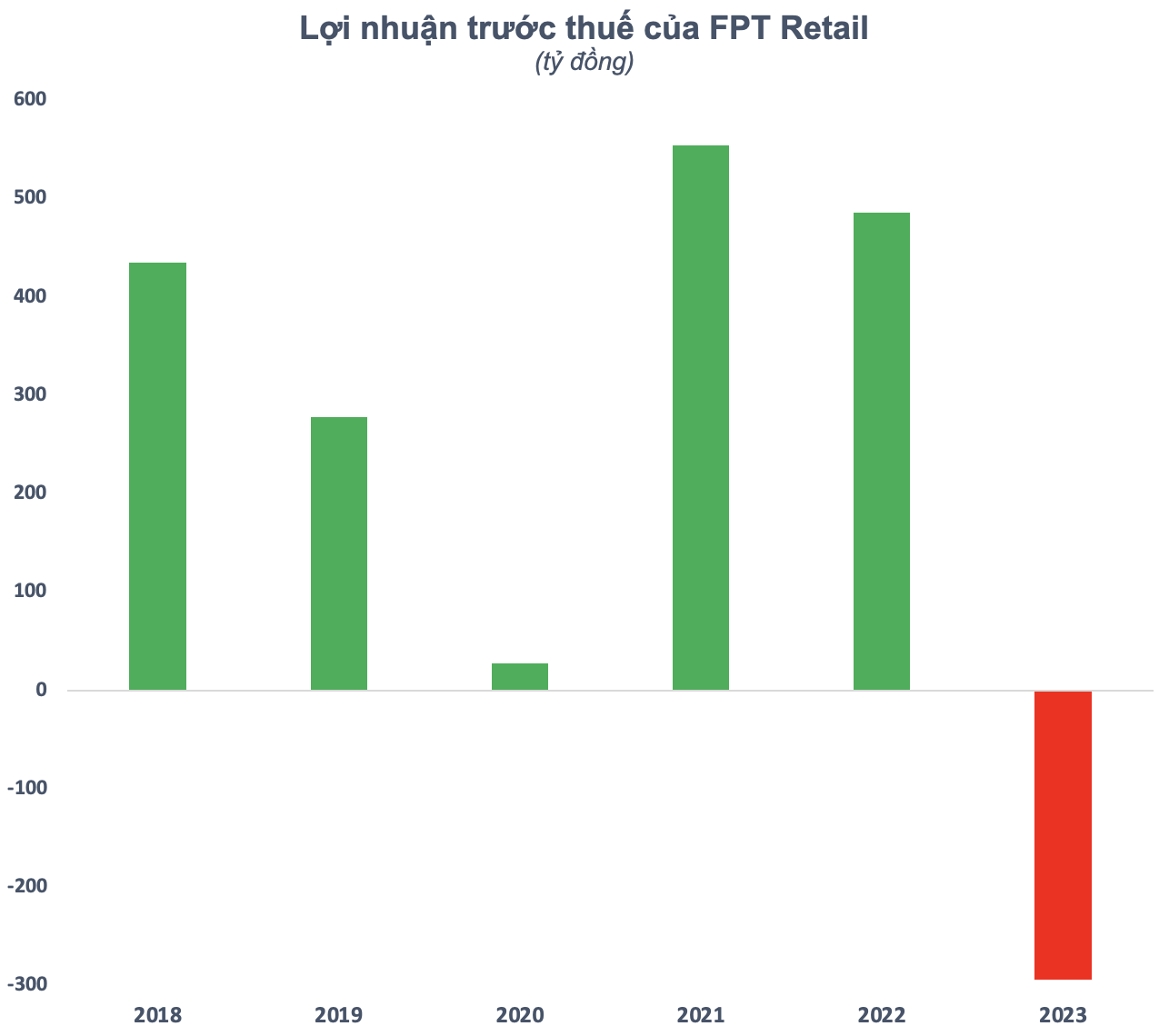

Dragon Capital’s aggressive buying spree took place during a period when the ICT retail sector faced many challenges due to weak buying power. In 2023, FPT Retail suffered losses in 3 out of 4 quarters, with a pre-tax loss of VND 294 billion for the whole year. This is the first year that the retail company has reported a loss since its IPO.

According to the explanation, the main reason for the loss in the fourth quarter was the incurrence of certain expenses such as business efficiency bonuses, close-to-“date” product disposal costs, and the closure of 36 inefficient FPT Shop stores… The report from FPT Retail also revealed that compared to the beginning of 2023, FPT Shop has decreased the number of stores by 31. By the end of 2023, the FPT Shop chain had a total of 755 stores.

It is very likely that Dragon Capital is targeting Long Châu, the main growth driver of FPT Retail. In the fourth quarter of 2023 alone, the revenue of this pharmacy chain increased by about 60% to nearly VND 5 trillion, while the revenue of FPT Shop decreased by 27% compared to the same period in 2022. This is the first quarter that the revenue of FPT Retail’s pharmacy chain has surpassed the ICT retail chain.

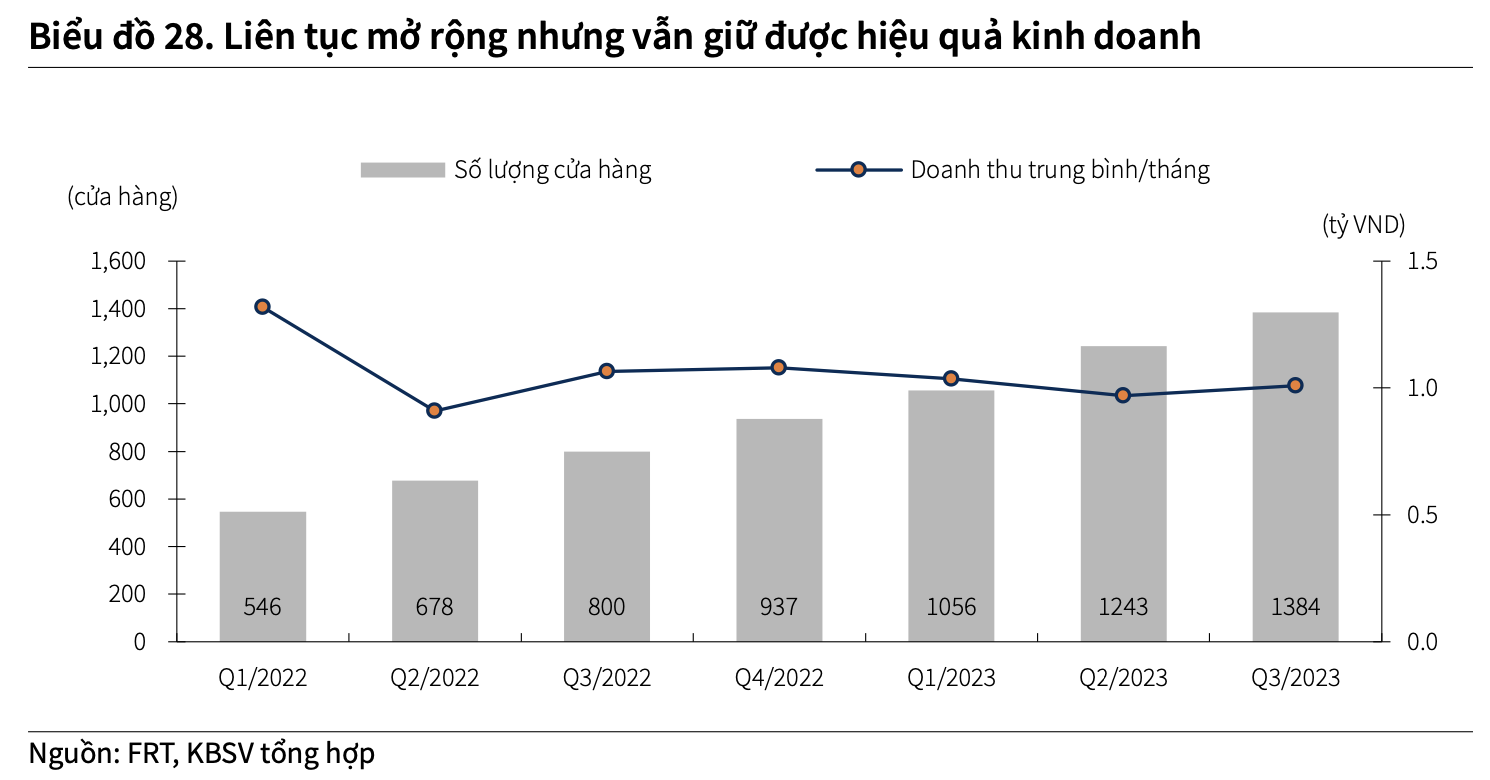

In 2023, FPT Retail continued to expand the Long Châu chain with 560 new stores, bringing the total number of pharmacies contributing to revenue to 1,497. These figures make Long Châu the largest pharmacy chain in Vietnam. The average monthly revenue per pharmacy remains VND 1.1 billion in 2023, and new stores only need about 6 months to break even.

Although still in the expansion phase and not yet contributing much in terms of profitability, the prospects of Long Châu and the healthcare sector are highly appreciated by analysts. According to KBSV, with a potential market, it is not surprising that there will be many new entrants, but the inevitable trend of the industry is that market share will increasingly concentrate on large chains.

KBSV’s report evaluates that Long Châu has a very bright growth potential as the entire chain has been profitable and continuously expanding its growth, while competitors are facing their own issues. In the long run, Long Châu aims to delve deeper into the healthcare ecosystem on a much larger scale.

Similarly, SSI Research also believes that a larger scale will help increase profitability for Long Châu in the long term. With lower borrowing costs, FPT Retail can accelerate the pace of new store openings for the Long Châu chain to gain market share in the context of An Khang and Pharmacity struggling with their business models.

According to SSI Research’s projections, the pre-tax profit of the Long Châu pharmacy chain is estimated at VND 271 billion (a 454% increase YoY) and VND 385 billion (a 42% increase YoY) in 2023-2024, corresponding to pre-tax profit margins of 1.7% and 2% for 2023-2024. The research department also emphasized that the profit margin of the pharmacy chain is much more sustainable than that of FPT Shop, thanks to the essential nature of drugs and the competitive advantage of Long Châu.

The Long Châu pharmacy chain has certain competitive advantages compared to other companies in the same industry (An Khang and Pharmacity), such as (1) a wider product range reflecting a larger SKU quantity, (2) a larger scale allowing for more direct sourcing, and (3) higher revenue from prescriptions, helping the chain gain market share from hospital channels.