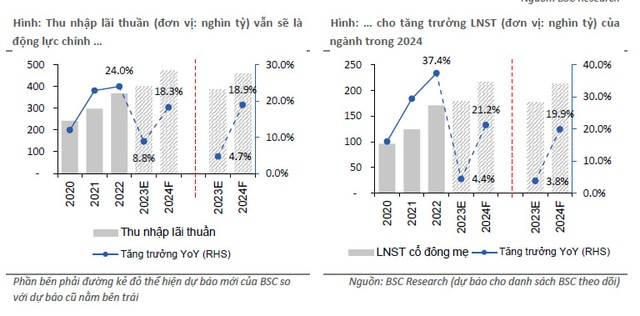

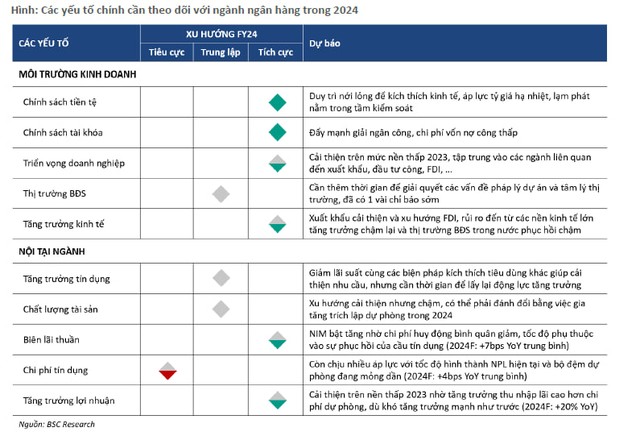

In a recent report, BIDV Securities (BSC) expects the overall profit growth of the banking industry to recover (forecasting a 20% profit growth after tax for the watchlist in 2024 compared to 4% in 2023) with the main driver being the expansion of the net interest margin (NIM), however, the speed of this recovery will depend on the development of credit demand and asset quality.

Credit growth expected to improve as real estate market shows signs of bottoming out

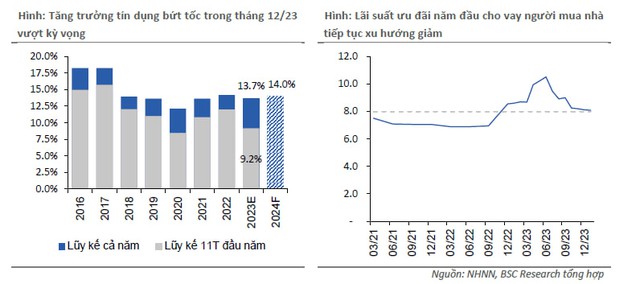

According to recent data from the SBV, the estimated credit growth for the entire economy in 2023 is 13.7%. Based on the SBV’s actions of providing the full credit limit for banks at the beginning of the year (unlike previous years when it was provided in stages) and the target credit growth for the entire system of 14-15% in 2024, BSC expects credit growth in 2024 to reach around 14% in the baseline scenario. The driving force will come from areas related to exports, public investment, real estate business, etc. However, the analysis team acknowledges the risk of slower-than-expected economic recovery, which could lead to compressed credit demand (especially from consumers) in the second half of the year.

The main factor to monitor will be the recovery of liquidity in the real estate market as real estate loans currently account for over 21% of the total economy’s outstanding loans (of which 64% are for consumer purposes and 36% are for business purposes), which will determine the speed of credit demand recovery.

BSC has observed that real estate consumer loans showed signs of bottoming out in September 2023 and rebounded in October 2023, while preferential interest rates for home loans continue to decline (the current average first-year interest rate is around 8%) and gradually return to normal levels. For example, Vietcombank currently has a personal loan program with fixed medium to long-term interest rates of 11% per year for a 10-year term or 9.5% per year for a 5-year term, and BSC believes that these interest rates are relatively attractive.

The analysis team also expects that the legal issues will be gradually resolved through amendments to the Land Law, which will take effect from January 01, 2025, and will help the real estate market become more active again from the second half of 2024. This will contribute to a significant improvement in credit growth this year.

Private banks will face more pressure on credit costs

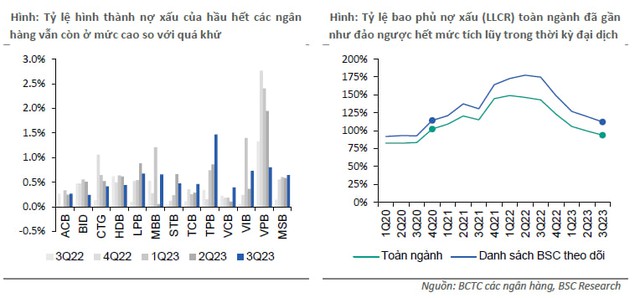

With the high level of non-performing loans (NPL ratio plus the amount of write-offs in the period) in the short term, BSC maintains a cautious view on the asset quality of the industry in 2024. In the baseline scenario, the analysis team expects banks to maintain a stable NPL ratio in 2024 compared to 2023 after significant write-offs in the past year.

The possibility of extending the regulations on debt restructuring (according to Circular 02/2023 currently in effect until June 30, 2024) is also being kept open in the case of continued increase in potential bad debts. However, even if there is no extension, BSC believes that the impact on the system’s safety will not be significant because (1) the current debt restructuring accounts for only about 1.09% of the total system’s outstanding loans (according to the SBV’s data released at the end of Q3/2023) and (2) banks still need to complete the full provision in 2024 (after having made a minimum provision of 50% in 2023).

Therefore, BSC expects that banks will incur slightly higher credit costs in 2024, providing an opportunity to strengthen the bad debt coverage buffer as the cumulative provision during the pandemic period has almost been reversed in 2023.

This pressure is most evident for private banks, as the bad debt coverage ratio (LLCR) of this group in BSC’s watchlist has decreased to 63.4% in Q3/2023, while the specific provisions/bad debts ratio has also decreased to an equivalent level before the pandemic at about 35%.

In contrast, state-owned banks continue to affirm their leading position in terms of asset quality and provisioning level, with LLCR and specific provisions/bad debts ratios still at 189.8% and 137.2% in Q3/2023 (much higher than pre-pandemic levels), so the pressure on credit costs will not be significant.

In the baseline scenario, BSC forecasts that the average credit cost for the watchlist will increase by more than 0.04% in 2024, corresponding to an expected 16% increase in specific provisions compared to 2023.

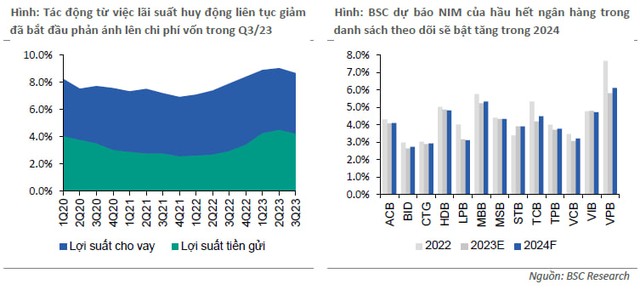

NIM expected to rebound in 2024

BSC believes that there will be differentiation in the recovery of the industry’s NIM in 2024. Banks most affected in 2023 when funding costs increased significantly at the beginning of the year are expected to experience the most significant recovery (Techcombank, VPBank), while banks with stable CASA advantages (MB) or loan portfolios that focus on retail segments (ACB, Sacombank, VIB, VietinBank, BIDV) are expected to maintain stable NIM and show a slight improvement.

In the baseline scenario, with low deposit interest rates and gradually improving credit growth, BSC forecasts that the average NIM for the watchlist will increase by about 0.07% in 2024, thereby contributing to an expected 19% increase in net interest income compared to 2023 and being the main driver for the expected 20% growth in after-tax profit.

According to BSC, the unexpected factor for the above forecast will come from the pace of credit demand recovery, especially positive developments in the real estate market, which will help banks improve their lending rates. An early indicator of the return of credit demand may come from the time when banks collectively raise deposit interest rates again, indicating increased mobilization pressure to support lending.