According to FiinRatings, capital allocation for the real estate market should focus on the middle-low segment. Illustration: Int Source

“Warm” corporate real estate bonds return

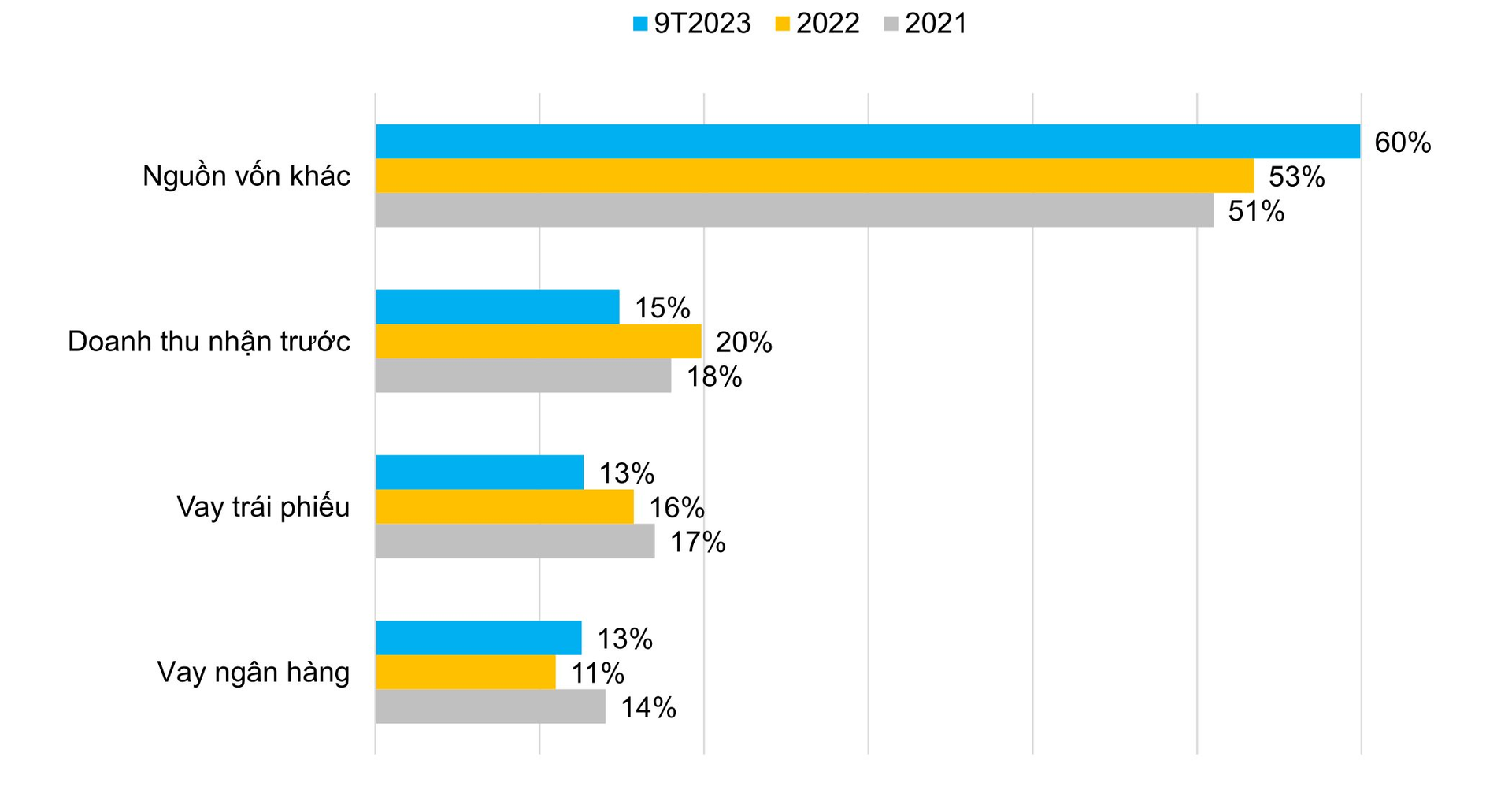

Data based on the financial reports of 50 residential real estate (RE) companies listed on stock exchange shows that these companies currently have a total debt of VND 180.3 trillion ($8 billion), and if including “other sources of capital”, the total debt rises to VND 492.4 trillion ($21.6 billion).

Here, “other sources of capital” includes capital raised from investment cooperation contracts, which accounts for the majority. Circular 06 (postponed according to Circular 10) has a major impact on the capital source for RE as this “other source of capital” can come from bank loans.

Capital structure of listed residential RE companies. Source: FiinRatings

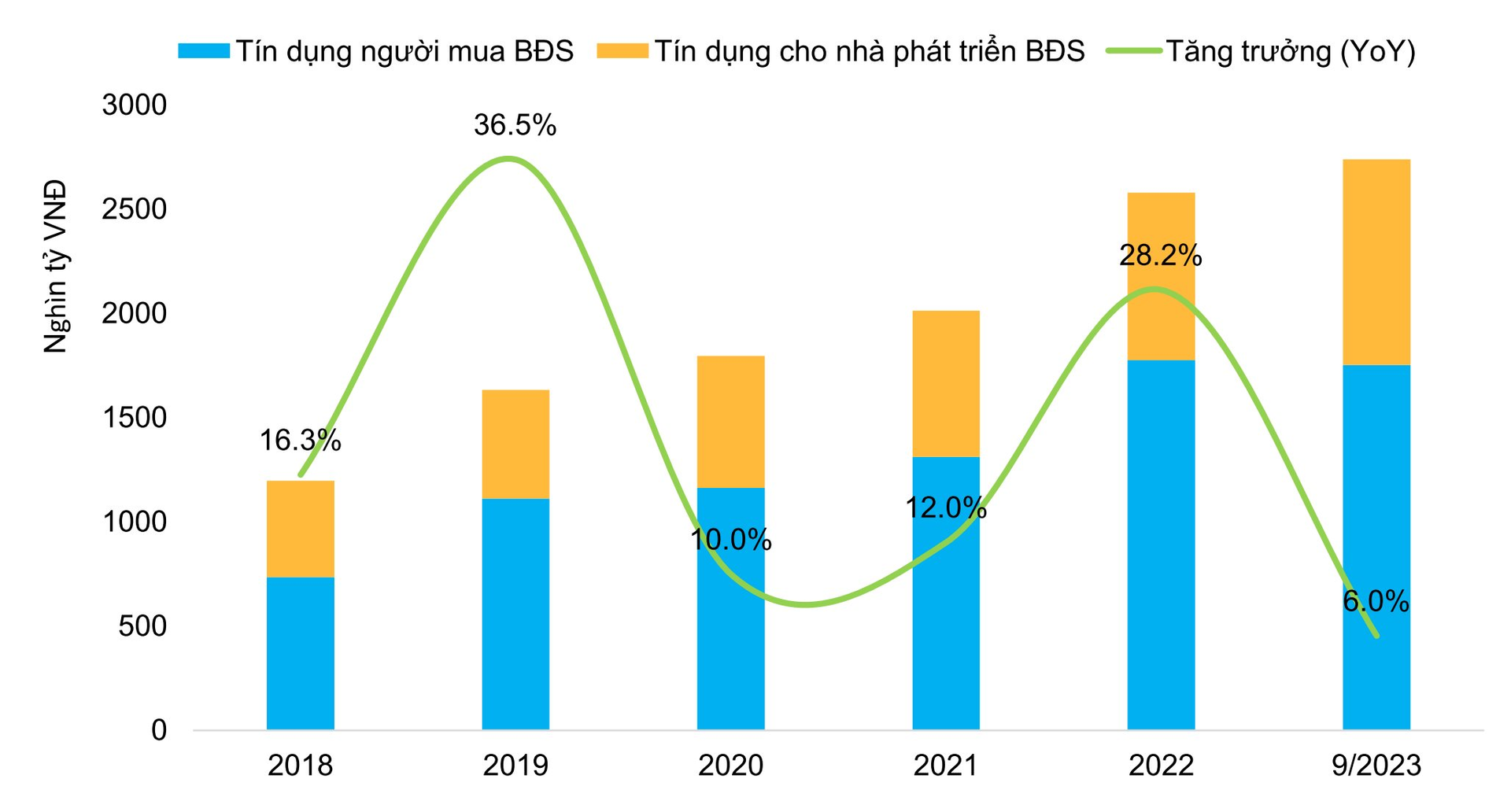

Regarding the credit capital of the banking system for RE lending, the trend during the period from 2018 to the end of Q3/2023 shows consistent growth over the years, with the peak in 2019 (36.5% YoY growth). Then, in the 2 years 2020-2021, the credit growth rate of banks for the real estate sector was at 10-12% per year.

In 2022, along with the heating up of the real estate market, the bank credit ratio for this sector continued to grow strongly, up 28.2% compared to the same period last year.

Notably, in the first 3 quarters of 2023, despite facing many negative developments, bank credit for the real estate sector still maintained a growth rate of 6% and is forecasted to be more positive for the whole year 2023.

As for the issuance of bonds by real estate companies, the market is starting to pick up again as in the first 10 months of 2023, a total of VND 82.9 trillion ($3.6 billion) was issued, including VND 74.8 trillion ($3.27 billion) of individual bond issuances with a relatively stable coupon interest rate averaging 11.92% and an average term of 3.65 years. However, the interest rates for real estate bonds have a large fluctuation range from 6% to 14.5% depending on the quality of the issuing organization or the structure of the business deal.

Currently, the supply and demand situation in the corporate real estate bond market has not truly met. While the supply side is more restricted due to tighter requirements of new regulations (Decree 65) and businesses focusing on debt structure (Decree 08), the demand side mainly consists of banks as well as non-banking organizations and individual investors who still have concerns related to legal issues because many projects are not yet legally clear or take a long time to complete procedures.

Banking system credit for RE lending. Source: FiinRatings

Challenges ahead

The reality shows that all capital channels for the real estate market are facing significant challenges. For bank credit, the credit risk control, high credit risk, and high project-related legal risks are the main concerns.

For corporate bond channel, recent bond default incidents have lowered investor trust in corporate bond products. In addition, the high project-related legal risks and the impact of high international interest rates still affect foreign capital inflows into the real estate market.

With the source of prepayment from home buyers, this source is also affected by the high real estate prices while the income of home buyers is being impacted. Along with that, although housing credit interest rates have tended to decrease recently, there are still legal risks on projects and floating mechanisms.

For the channel of capital from business cooperation, this source is also limited due to the State Bank’s credit risk control policy on the correct use of loans, limiting capital contribution and business cooperation (Circular 06 amending Circular 39 although it has been postponed according to Circular 10). In addition, the bond channel is also limited in terms of bond issuance purposes (Decree 65).

It can be said that the quality of corporate RE credit is decreasing amid the weakening credit quality of investors. As a result, the real estate market is facing many difficulties, and the execution and sales capabilities of real estate developers are significantly affected, as evidenced by the sharp decline in the prepayment/receivables ratio.

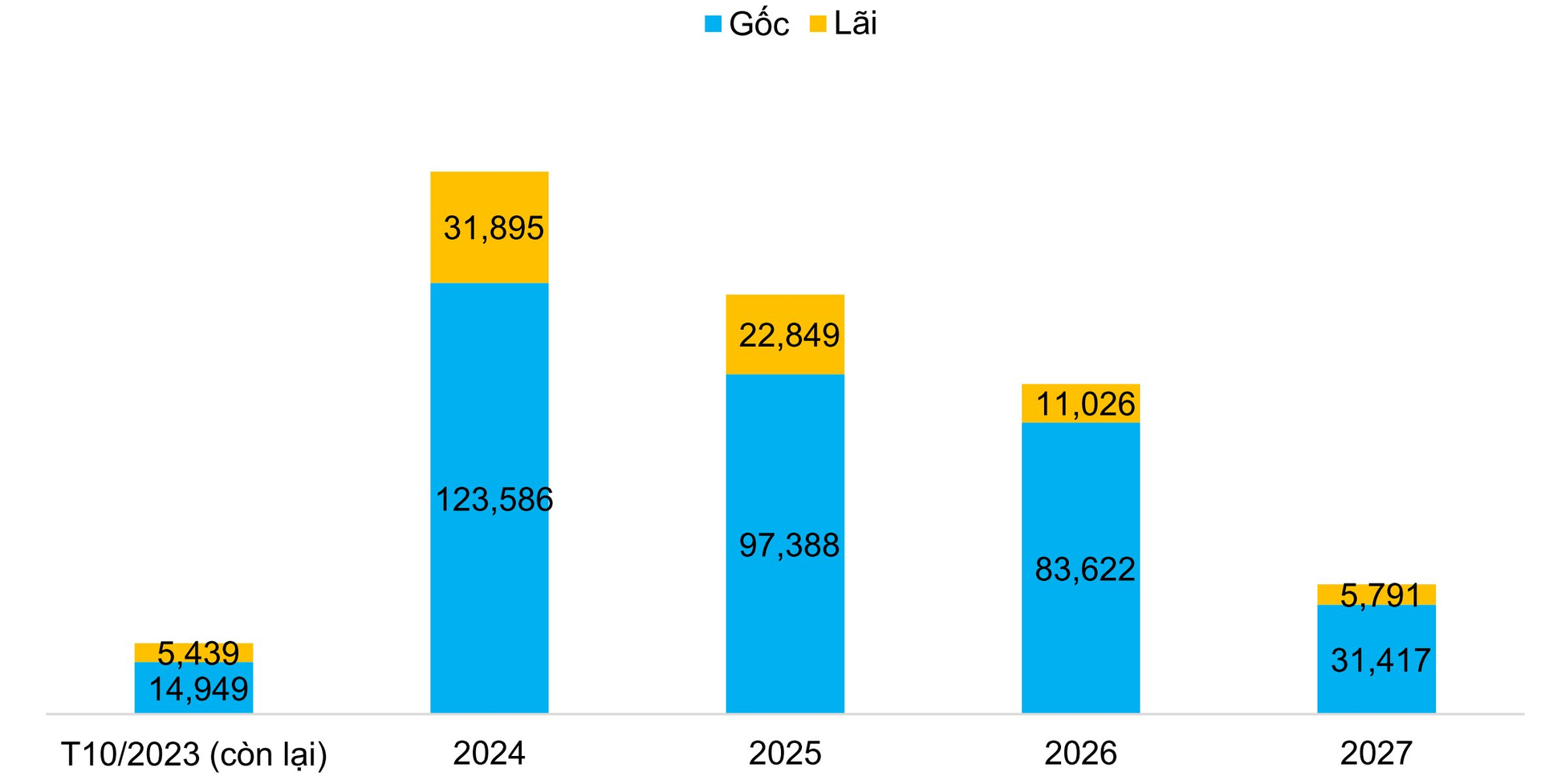

In addition, the financial health and liquidity of RE companies are also weakened when there is pressure to repay large debts and pay interests, while the cash flow from business operations is insufficient to meet these obligations.

It should be noted that while the demand for real estate is high, the supply/legal issues affect the completion of projects and the bankability of banks, which is still a major challenge.

The prospects for 2024 are still unclear and depend largely on the focus on resolving bad corporate bond debts and RE borrowing debts, although business credit for RE has returned to growth (+ 21.86% for the first 9 months of 2023), the scale is still too small compared to the capital needs of this sector. Meanwhile, the pressure to repay both principal and interest from corporate bonds of RE companies in the next 12-24 months is quite high with a total amount of up to VND 275.7 trillion ($12 billion).

Expected cash flow from corporate bonds of RE companies (VND Billion). Source: FiinRatings

Unlocking credit capital solutions

Unlocking credit capital solutions for RE market need resolute implementation from all parties involved, and bondholders may have to accept a reduction in bond value (hair-cut), the amount of value reduced according to a certain ratio to help reduce debt, and could be converted into shares of issuing entities/banks.

Besides “technical” measures, the most important thing is to effectively implement solutions to remove legal barriers in projects, projects that have completed land clearance and only require tax obligations and construction permits. Other projects need to be reviewed and considered their ability to pay to have their pink books issued. In addition, there should also be a closed housing credit stimulus program, promoting credit for home buyers with specific conditions for the parties, focusing on the middle-low segment.

Particularly, improving information transparency and boosting bond issuance should come early. The reality shows that the bond issuance activity is gradually recovering. Projects with legal clarity and appropriate proactive transparency still have opportunities for capital mobilization.

Currently, the market expects the revision of Circular 02 (providing conditions for credit restructuring) and the revision of Decree 08 (postponement of corporate bonds) to have a positive impact on the corporate bond market, but the cross-impact on bank credit is currently a major risk, especially for banks with low capital buffers or low bad debt coverage.

With the identification of 147 violating organizations for interest/principal repayment, helping the market identify a group of healthy financial bondholders, that is a basis and premise for restoring corporate bond issuance activities of this group of bondholders, banks and businesses in general.