The amount of capital lent by US financial institutions to shadow banks in the country has surpassed the $1 trillion mark. This figure comes as US officials warn that the increasing relationship between traditional lenders and alternative lenders could pose systemic risks.

A report from the Federal Reserve on February 9 showed that the balance of loans provided by commercial banks in the country to shadow banks at the end of January had exceeded 13 digits. Shadow banks – including financial technology companies, private credit organizations, hedge funds, private equity investment firms, direct lenders, etc. – use borrowed money from commercial banks as leverage for investment and lending to high-risk customers that regulatory agencies require commercial banks to limit lending to.

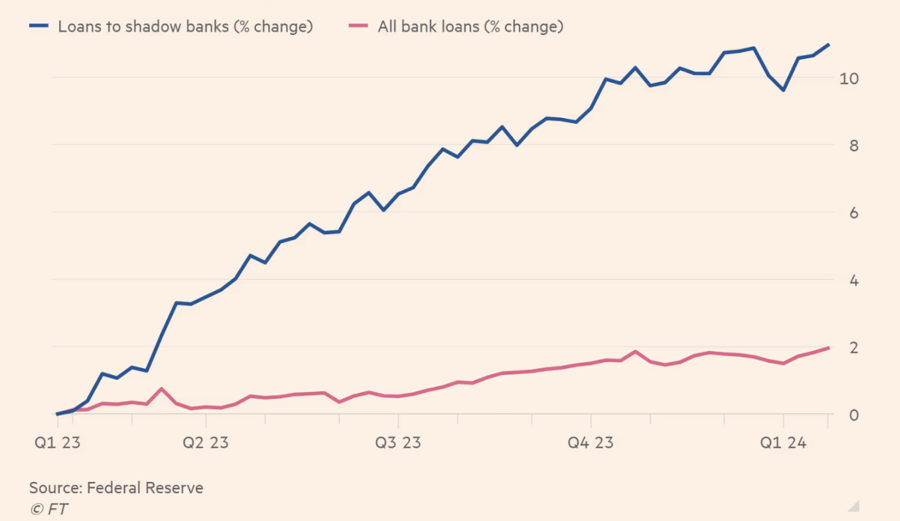

Compared to the same period last year, the amount of loans provided by commercial banks to shadow banks in the US increased by 12%, making this lending segment the fastest-growing within the banking system. The total amount of loans in the US banking system increased by only 2% during the same period.

The strong growth of banking lending activities to shadow banks has raised concerns among US officials, as they have very little information and not enough regulations to monitor the risks of shadow banks. Last month, European Union authorities stated that they will further investigate the relationship between traditional banks and shadow banks.

Michael Hsu, Acting Comptroller of the Currency, one of the highest-level banking regulatory agencies in the US, recently told the Financial Times that shadow banks – with loose control – are pushing commercial banks to shoulder a large amount of low-quality and high-risk debt.

“We need to address the root of this problem. I believe one of the measures that needs to be implemented is to closely monitor shadow bank organizations,” Hsu said.

Recently, some US commercial banks have sought to tighten relations with shadow banks. Last month, Citigroup announced that it will collaborate with an asset management company named LuminArx to provide an “innovative leverage solution” for a $2 billion loan fund of this company. Citigroup also led a lending group that provided a $310 million loan for Sunbit, a “buy now pay later” company specializing in providing services to auto repair shops and dental clinics.

Wells Fargo, last year, signed an agreement to provide billions of dollars in loans to a new credit fund operated by Centerbridge – a private equity investment company with a scale of $40 billion.

In 2010, commercial banks in the US had to disclose specific loan amounts provided to shadow banks. At that time, the amount of loans that the US banking system provided to shadow banks was just over $50 billion. Currently, JPMorgan Chase alone has a loan balance with shadow banks that is more than twice that figure.

In the overall US banking system, the balance of lending capital provided to shadow banks at the end of January accounted for more than 6% of total loan balances, higher than the 5% level for auto loans and lower than the credit card loan balance – a loan segment that exceeded $1 trillion for the first time last year and accounted for 7%.

By the end of 2023, the Federal Deposit Insurance Corporation (FDIC) proposed regulations requiring commercial banks to disclose additional data on their lending to specific types of shadow banks. Instead of reporting a general category of lending to financial institutions not allowed to receive deposits, banks may have to itemize the amount of loans provided to each type such as private equity investment firms, credit funds, and other consumer lending organizations.

“We need more specific numbers. A lot of leveraged loans have flowed into the financial market, and this could be a risky area that investors need to pay attention to,” said Gerard Cassidy, an analyst at RBC Capital Markets.