“It’s not my fault, just bad luck!”

This is the phrase that new traders often say when they make mistakes in the trading process. I remember when I first entered the stock market in 2014 and 2015, I was just a fourth-year student with fragile knowledge learned in school, but I had many dreams and aspirations about the “3-letter code”, the trace of money flow, or the behavior of the big fish… I was quite excited about every buy and sell order when the market was up and disappointed when the electronic board was filled with red and blue colors. At that time, I decided to become a trader because I thought I had enough talent, passion, and enthusiasm for this profession.

However, after a period of trading, I gradually realized that most of my buying and selling decisions were influenced by emotions, following the noise of the crowd instead of accumulating knowledge, experience from mistakes, or self-discipline. Every time I had a successful trade, I thought I had an inherent talent. But when I had a losing trade, I would blame it on bad luck.

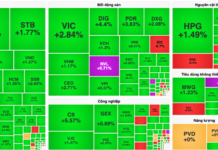

The turning point came when I witnessed, experienced the downturn of the VN-Index in the period of 2018-2020 and lost a lot of “tuition fees” for the market. Only then did I truly wake up. At that time, I realized that I was just lucky to participate in the market at the time of the upswing in 2016-2017. Since then, I have been emotionally manipulated and lost all my achievements in the following years. I didn’t understand the importance of the macro picture, the global economic context that affects my trading results to what extent.

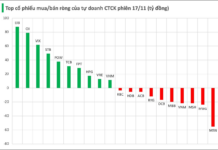

|

VN-Index performance from 2016-2020

Source: VietstockFinance

|

Learning to control emotions

After many failures, paying a high price to “enlighten” myself, I have been learning to control my emotions. I actively keep a “trading journal” that includes buying and selling decisions and the reasons for these decisions. Only then do I truly know what luck is and when to use the skills and knowledge accumulated over the years to execute trades. More importantly, I have learned what experiences I have gained from both my mistakes and successful trades. This I learned from the famous quote by great investor John Templeton, founder of the Templeton Growth Fund: “The time to look back at your investment method is when you are most successful, not when you make the most mistakes”.

I also understand that the nature of the market is the absolute convergence of financial events. The result is that financial disasters are quickly forgotten. The consequence is that in similar or nearly similar cases, sometimes just a few years later, they are hailed by the new investor class, also known as F0. Jeremy Grantham, co-founder and chief investment strategist of Grantham, Mayo & van Otterloo (GMO, an investment management firm), once said, “We will learn a lot in a short time, a little in the medium term, and nothing in the long term. This has been a precedent in history”.

In addition to the trading journal, I have learned to cultivate objectivity within myself, which means that every action must be based on the belief that anything can happen. Therefore, before every trade, I ask myself: Do I feel pressure, unease when doing this? If so, I immediately stop buying and selling stocks.

And now, after more than 10 years as a trader, I have realized that investing in stocks is a boring job, that’s when you learn to control your emotions!