.png)

According to YouNet ECI, a market data analytics company, the hair shampoo industry in Vietnam earned VND 1,997 billion in GMV revenue across the three TMĐT platforms Shopee, Lazada, and Tiki in 2023. With the overall growth of TMĐT, the hair shampoo industry has also consistently increased in consecutive quarters, ranging from 3.8% (Q2 2023 compared to Q1 2023) to as high as 18% (Q4 2023 compared to Q3 2023).

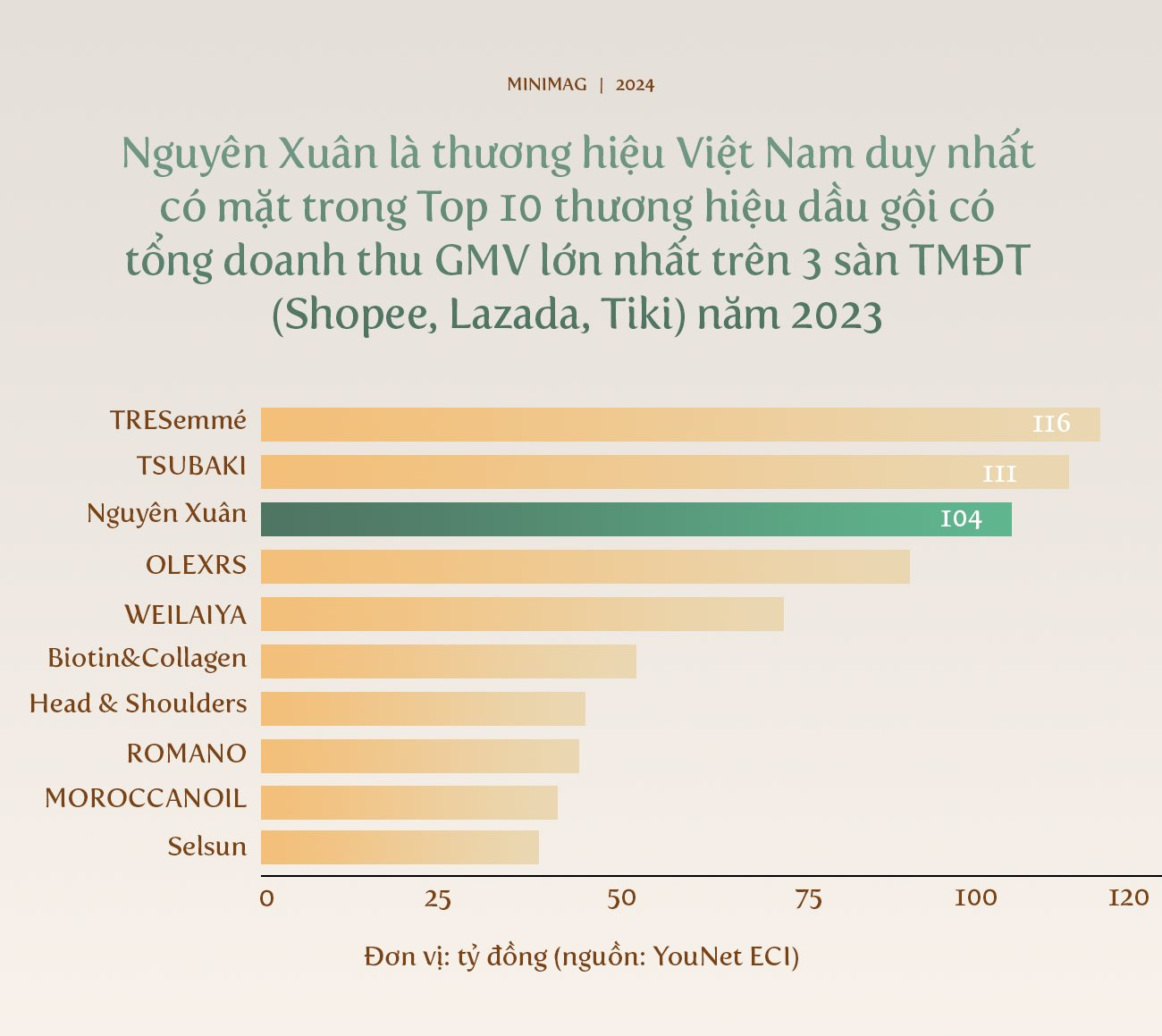

Among the

Top 10 brands with the highest GMV revenue in 2023

, nine are foreign brands. TRESemmé, a brand under Unilever, topped the list with VND 116 billion GMV revenue, equivalent to a 5.81% market share. It was followed closely by TSUBAKI (VND 111 billion), also under the large Japanese corporation Shiseido, accounting for approximately 5.56% market share. The only Vietnamese brand on the list is Nguyên Xuân hair shampoo, bringing in VND 104 billion GMV revenue, or 5.2% market share. This places Nguyên Xuân in the third position, approaching the top two brands and creating a significant gap with the remaining competitors such as OLEXRS, WEILAIYA, Biotin&Collagen, Head & Shoulders, etc. In a broader view, the Top 50 includes up to 17 local brands, all of which have shown good growth.

In the

Top 10 hair shampoo products with the highest revenue on TMĐT

(according to YouNet ECI), Nguyên Xuân is also the only brand with two product lines on the list. Other foreign brands like TRESemmé, TSUBAKI, OLEXRS, etc. only have one product each.

In addition to Nguyên Xuân, the

Top 10 hair shampoo products with the highest revenue on TMĐT

also include two other Vietnamese products from the brands Cocoon and Namnung. Although belonging to independent businesses, the “best-selling” products from these three local brands all share the common use of natural ingredients, herbs familiar to the Vietnamese people, such as grapefruit essential oil, aloe vera, and hà thủ ô (Polygonum multiflorum), etc.

Just by typing the phrase “herbal shampoo” in the search bar on Shopee, consumers can easily find other Vietnamese products with thousands, even tens of thousands, of units sold. Except for Nguyên Xuân, which has a strong foothold from Hoa Linh Pharmaceutical Company, most of the shampoo brands using herbal ingredients and traditional medicine are young startups that are booming on TMĐT.

.png)

In the past, the main distribution channels for FMCG products in general and shampoo in particular were traditional channels such as supermarket chains, grocery stores, pharmacies, etc. The boom of TMĐT in the past decade has opened up new ways of selling. With the DTC – Direct to Consumer approach, instead of using distributors, manufacturers now sell directly to consumers on TMĐT platforms. This allows businesses to have comprehensive control over the entire process, from production to marketing and sales. According to a report by Metric, if the B2B2C (Business to Business to Customer) model is applied, they would have to spend around 35% – 40% of the product cost on distributors. In the case of direct sales on TMĐT platforms, manufacturers only incur much lower fees, around 10%.

However, TMĐT alone is not enough to become the launching pad for Vietnamese shampoo brands to break through. Vietnam has had many domestic brands participating in this industry. Previously, there were prominent names on the market, but they are now only mentioned with the phrase “once famous.” Similar to a caterpillar needing to accumulate and undergo the most powerful transformations inside before becoming a butterfly, the current progress of Vietnamese shampoo brands is also the fusion of internal and external environmental conditions.

Nguyễn Thanh Sơn – Chairman of MVV Group, a communication consulting expert, pointed out some conditions that are contributing to the success of Vietnamese brands in the shampoo industry today.

Firstly, there is a change in consumer perception. Previously, the trend of globalization and the preference for foreign goods in Vietnam made it easy for multinational brands and companies to enter the local communities. Some brands that originally belonged to the mass market segment in foreign countries were positioned as high-end when entering Vietnam. However, the tide has turned, and the current generation of Gen Z consumers is leading a reverse trend, showing a certain rejection of foreign brands. They not only recognize the concept of fair trade but also support domestic brands that are environmentally friendly and advocate sustainability.

Cocoon is a typical example as it has made an impression with specific messages and actions such as not conducting tests on animals, participating in the protection of endangered species, promoting gender diversity, etc. Similarly, Cỏ Cây Hoa Lá focuses on fulfilling its social responsibility by deducting VND 10,000 from the revenue of each order to sponsor thousands of meals for students in difficult circumstances. Due to winning the favor of the new generation of customers, domestic brands have gained a relative advantage in the personal care industry.

Secondly, Vietnamese brands now have the ability to control manufacturing, packaging, modern production lines, etc.

“Manufacturing technologies are no longer an absolute strength of multinational brands,”

said Nguyen Thanh Sơn.

Thirdly, there are no longer limitations in terms of investment capital for Vietnamese businesses, and the startup trend is on the rise. Venture capitalists and entrepreneurs are willing to invest in startups to compete with foreign giants. Most recently, despite being limited to the realm of television, the organic herb shampoo brand Cỏ Cây Hoa Lá attracted four “sharks” with a $1 million investment proposal, although it was considered overvalued. At the same time, these young brands are encouraged and gain more confidence through the successes of pioneers in the FMCG industry, such as Masan, Trung Nguyên, etc.

The important task now is to focus on building a brand image, starting with a few SKU (Stock Keeping Unit), a customer group, and dominate the segment. Concentrating resources also helps businesses save on advertising costs, instead of spreading out numerous SKUs like large corporations.

“Multinational brands are not afraid of large Vietnamese companies. What they really fear is the many small businesses. It’s like the story of small biting ants that can kill an elephant. Or imagine a paper cut on the skin. A paper cut is not significant, but 100 paper cuts can become a fatal blow. If there are hundreds of Vietnamese businesses and each business chooses one SKU, the competitive pressure on multinational brands will be enormous.”

emphasized Nguyen Thanh Sơn.

Nguyễn Thanh Sơn also reiterated that a small scale can be an advantage for domestic businesses compared to international giants. With a cumbersome system, every decision regarding products or communication content or marketing undergoes multiple levels of approval. On the other hand, flexibility and concentration would help young businesses make quick decisions and seize immediate opportunities.

Another urgent task is diversifying distribution channels and seeking new sales methods. Relying too much on TMĐT or direct competition with foreign rivals in the MT (Modern Trade) and GT (General Trade) channels is not a wise strategy if businesses want to build a sustainable brand. Currently, in addition to the TMĐT channel, Nguyên Xuân also has an advantage in the pharmacy network. Meanwhile, Cỏ Cây Hoa Lá and Namnung are developing a network of tens of thousands of individual agents in many provinces across the country. These agents are trained for free to understand the products and learn sales skills, etc. The personal agent channel currently contributes a higher proportion to Cỏ Cây Hoa Lá’s revenue compared to the TMĐT channel.

However, the challenge for businesses is to strike a balance between the interests of various sales channels. Nguyên Xuân learned a valuable lesson when collaborating with female YouTuber and TikToker Hà Linh to carry out a promotion campaign on the TMĐT platform in April 2023. At that time, the sale price announced by TikToker Hà Linh was “unprecedented” as the Nguyên Xuân green Hoa Linh hair shampoo label would be sold during a livestream for VND 18,000, and the Nguyên Xuân brown hair shampoo would be sold for VND 11,000. At that time, the Nguyên Xuân shampoo products were already being sold in pharmacies for VND 76,000 and VND 71,000, respectively. Just a few hours later, the campaign faced protests from pharmacy partners, as they believed that Hoa Linh Pharmaceutical Company was selling at a discounted price, causing difficulties for traditional retail channels. The manufacturer had to apologize to the pharmacy partners, admitting that the company’s implementation was not well-coordinated and had many shortcomings, leading to misleading information that affected traditional distribution channels.

“Reducing prices too deeply on TMĐT reduces the revenue of traditional retail partners and affects long-term cooperation relationships between manufacturers and partners. What’s even more serious is that it leads to a price war between channels and damages the brand’s image,”

said Phuong Lam, Director of the Market Insights Department at YouNet ECI, in a previous interview.