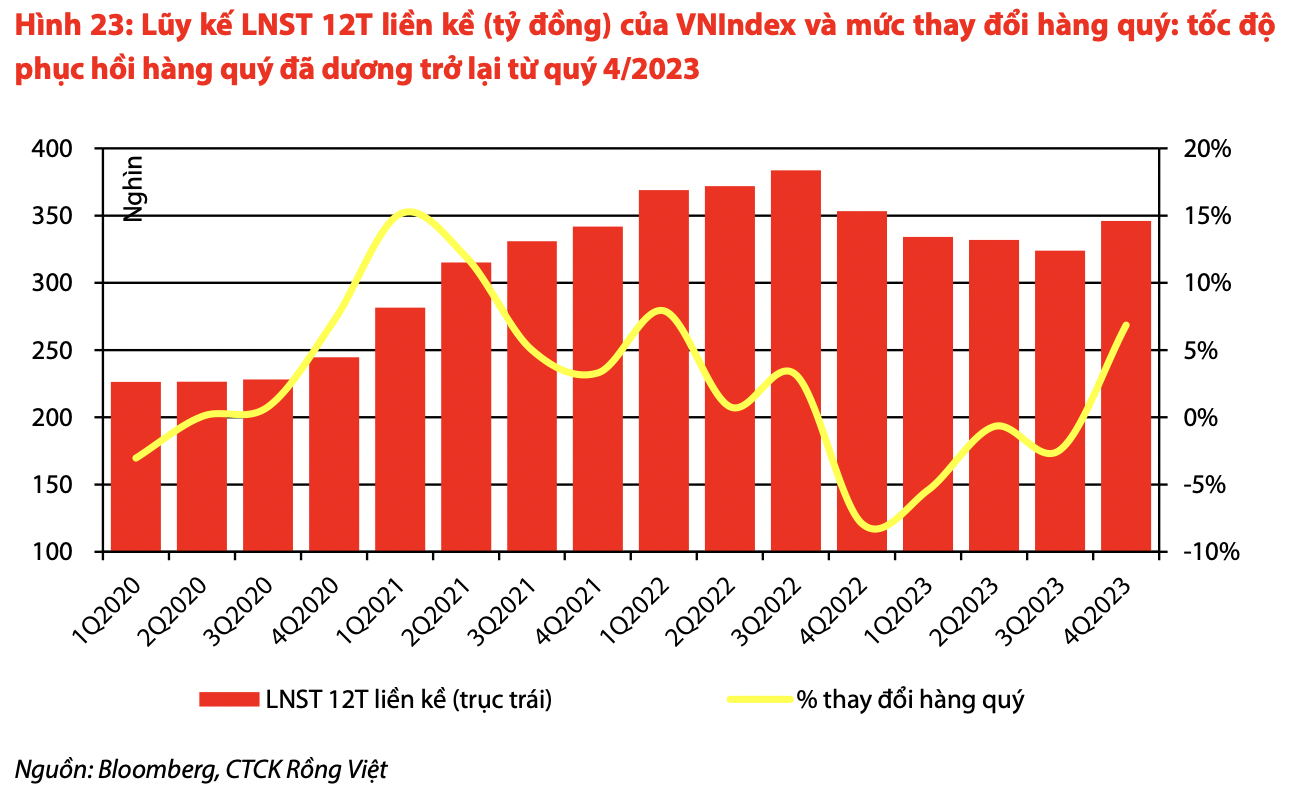

The VN-Index has had a positive start to 2024 with a 3% increase in January as money flows begin to concentrate in the banking sector, supported by the return of foreign investors and a 22% growth in Q4 2023 profit.

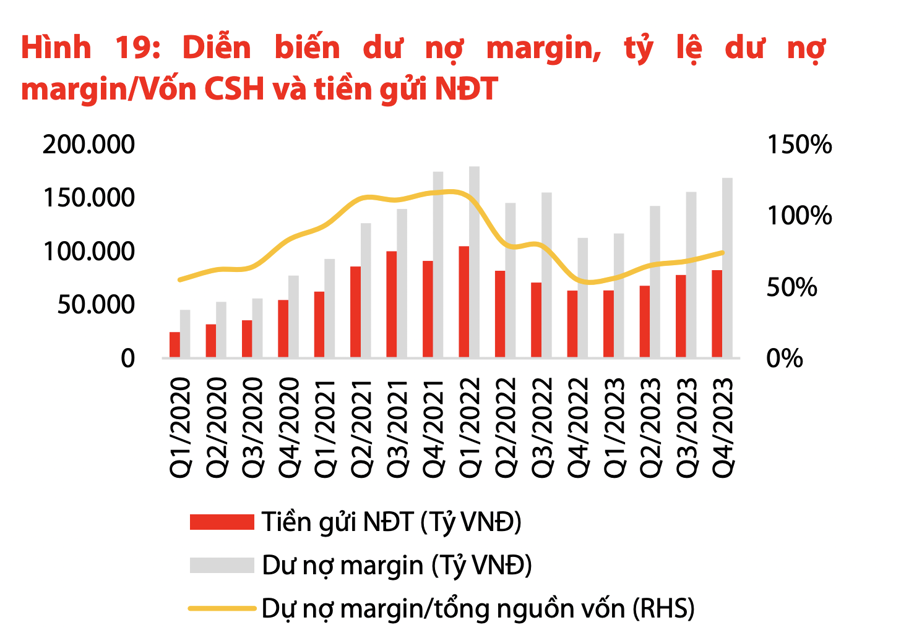

In its February stock market strategy report, Rong Viet Securities (VDSC) noted that the recent financial statements provide further data on the characteristics of the stock market in terms of margin lending and investor deposit levels at securities companies.

Accordingly, the total margin debt across the market at the end of Q4 2023 reached 169 trillion VND, up 8% from the previous quarter and 50% from the beginning of 2023. Margin lending activities experienced strong growth at securities companies like TCBS, VPBS, MBS, VCI, with a total increase of over 10 trillion VND. Excluding these companies, margin debt at other securities companies increased by about 2.3% compared to the previous quarter. The margin debt-to-equity ratio is relatively healthy, reaching about 74% compared to the peak during the Covid period (~110%).

On the other hand, this trend is supported by a 6% increase in investor deposits at the end of Q4 2023, reaching 82 trillion VND. This figure has also increased by 30% since the beginning of 2023, surpassing the deposit growth of the banking system (+13.2%).

Interestingly, the increase in investor deposits and margin lending somewhat contradicts the turnover decline of the three stock exchanges in Q4 (down 25% QoQ). This indicates that although investors were more cautious in late 2023, most of them chose to stay in the market due to the ongoing low interest rates on savings and expectations of early recovery in other major investment channels.

External funds will return after the Lunar New Year holiday

VDSC believes that the temporarily “sideline” funds will return after the lunar new year holiday, especially when there is more active movement of large funds, which have a market-leading impact on blue-chip stocks in the upcoming period with the news flow of the 2024 shareholders’ meetings.

Moreover, the sharp unexpected decline in the more attractive investment opportunities in the market may also reactivate this waiting money.

After the Q4 2023 financial statements, the 12-month profit growth rate increased by 7% compared to the end of Q3 2023, further affirming that business activities have bottomed out in the mid-2023 period. VDSC expects the effectiveness of the central bank’s liquidity loosening policies and the acceleration of public investment in 2023 by policymakers will be more evident in 2024.

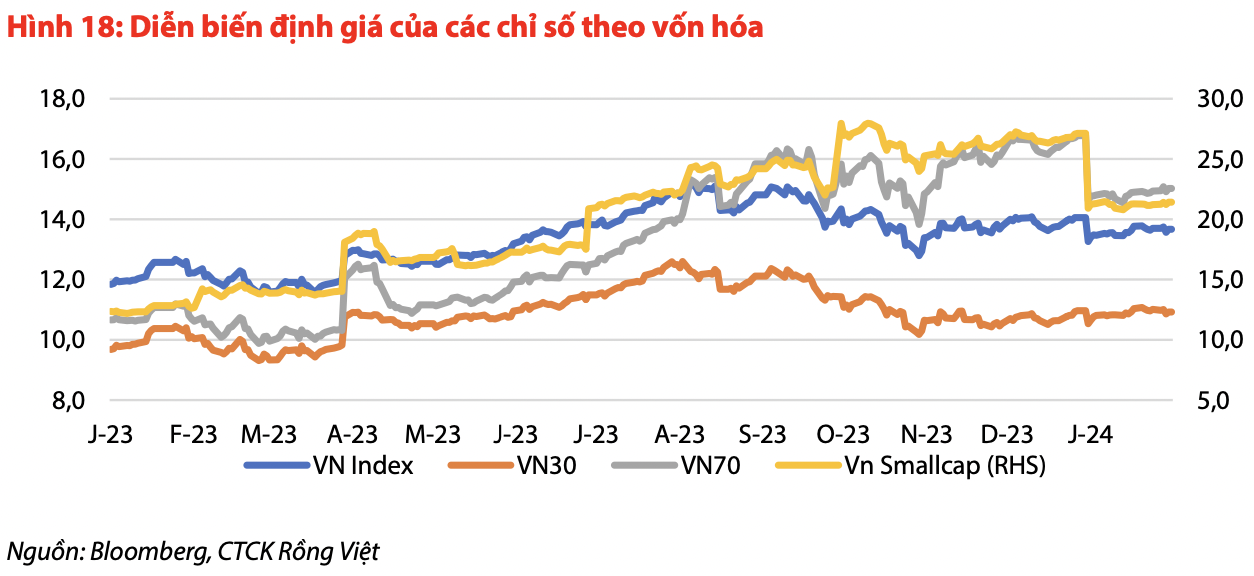

The overall P/E ratio is estimated at 13.6x, compared to the nearly 14x at the end of last year. VDSC’s observations indicate that at this P/E level, there will be no significant pressure from foreign investors. Therefore, market corrections are opportunities for astute investors to accumulate industry-leading stocks with the potential for a quick recovery after the economic recovery.

Furthermore, for Q1 2024, the analysts believe that the story of rising commodity prices may continue to attract attention. The ongoing decline in prices of dairy products or soybeans could significantly improve the profitability of food and beverage companies compared to the same period in 2023.