Hoang Anh Gia Lai Joint Stock Company (code HAG-HOSE) announces the receipt of a letter from the State Securities Commission regarding the registration file for the private placement of shares.

Accordingly, the State Securities Commission has approved HAG’s private placement of 130 million shares. During the 10-day offering period, HAGL must submit a report accompanied by a confirmation from the bank where the account is opened, proving the amount of money raised from the offering to the State Securities Commission.

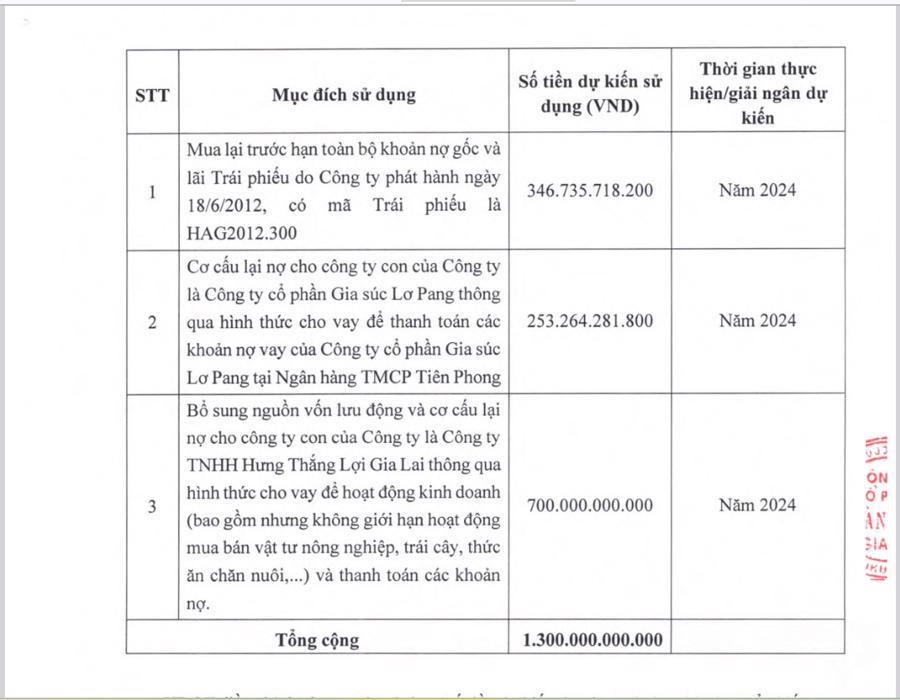

According to the issuance plan, the total amount of money raised, 1.3 trillion VND, will be used by the company for specific purposes as follows:

– 347 billion VND to partially or fully repay the principal and interest of the HAG2012.300 bond;

– Over 253 billion VND to restructure the debt for the subsidiary company Gia Suc Lo Pang, specifically to repay the loan from TPBank;

Finally, the remaining 700 billion VND will be used to supplement working capital and restructure the debt for another subsidiary company, Hung Thang Loi Gia Lai.

The disbursement is expected to be made in 2024.

There are 3 investors participating in this issuance of HAGL, including LPBank Securities (LPBS) planning to buy 50 million shares, accounting for 4.73%; Thaigroup Corporation planning to buy 52 million shares, accounting for 4.92%; and individual investor Nguyen Duc Quan Tung planning to buy 28 million HAG shares, accounting for 2.65%. If successful, the total ownership ratio of these 3 investors will be 12.3%.

Notably, these two organizations and one individual have no relation to HAG. On January 18, Nguyen Duc Quan Tung officially became the CEO of LPBS.

It is known that on February 7, the company received Resignation Letter from Vo Truong Son as CEO due to personal reasons. Accordingly, the company has appointed Nguyen Xuan Thang as CEO and Legal Representative of the Company, from February 7, 2024 to February 6, 2029.

Mr. Thang, born in 1977, holds a Bachelor’s degree in Finance. Since 2007, Mr. Thang has been working at Hoang Anh Gia Lai Joint Stock Company.

According to the consolidated financial statements for the fourth quarter of 2023, the business performance of the company has shown positive changes and has partly addressed the reasons for the stock being put on the alert list. Specifically, the after-tax profit of the parent company in 2023 reached 1,709 billion VND; the total after-tax profit of the parent company in 2023 reached 1,817 billion VND.

Regarding investment in projects, the company is still focusing on developing its key products: bananas, durians, and pigs.

Regarding financial restructuring, in 2023, the company liquidated some non-productive assets and financial investments to partially repay the BIDV bonds, thereby significantly reducing interest costs and partly generating cash flow, maintaining stable business operations in a challenging market.

With the positive signals and potential projects mentioned above, HAG believes that its future business activities will achieve positive results, reduce losses, and address the reasons for the stock being put on the alert list.

At the close of the trading session on February 15, the stock price rose by 2.28% to 13,450 VND per share.