|

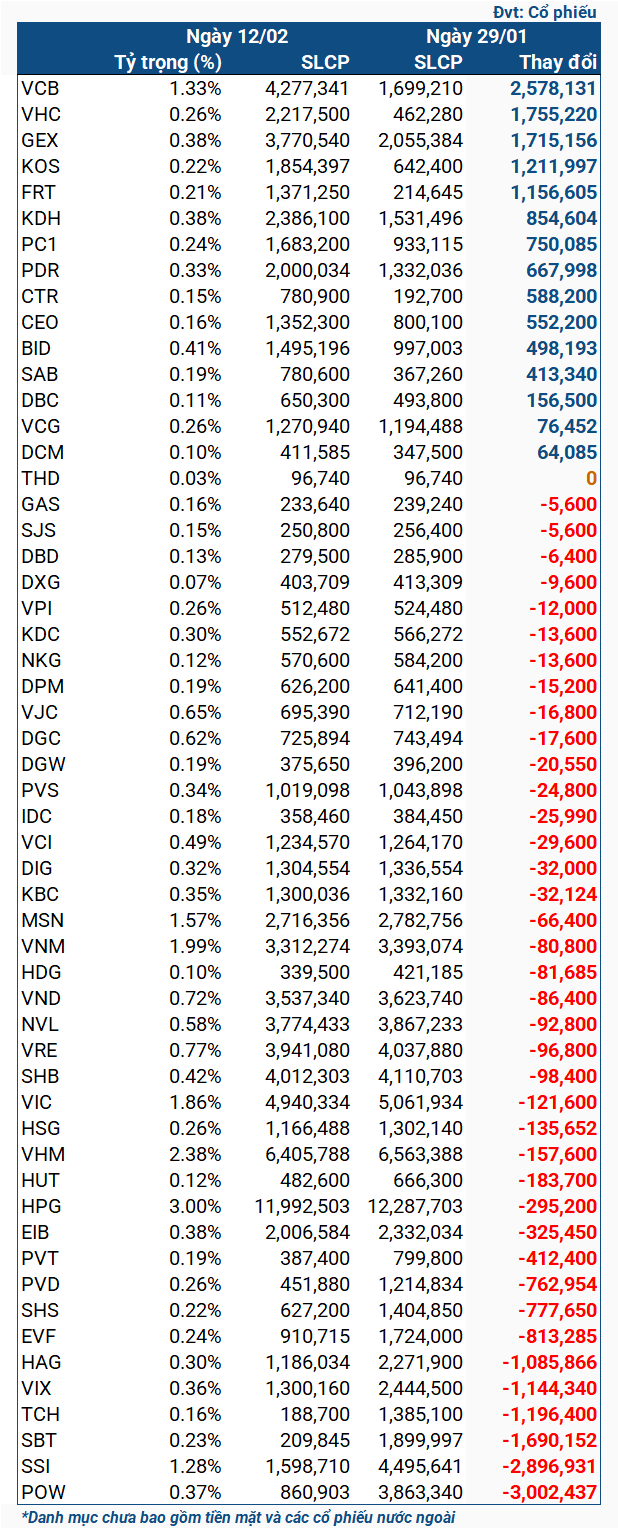

iShares ETF stock changes from 29/01 – 12/02

Source: VietstockFinance

|

During this period, iShares ETF underwent significant restructuring. The fund purchased a large amount of stocks, with a focus on VCB with nearly 2.6 million shares. VHC and GEX were also purchased with over 1.7 million shares. KOS and FRT followed, with each stock having over 1 million shares.

On the other hand, POW was sold over 3 million shares, being the most heavily sold stock during the period. SSI followed with nearly 2.9 million shares. SBT, TCH, VIX, and HAG were also sold with over 1 million shares for each stock.

The strong restructuring of iShares ETF took place just before MSCI announced the results of the Q1/2024 review (in the early morning of February 13, 2024). Despite becoming an active fund, it seems that iShares ETF is still using MSCI’s index baskets for reference.

In the Q1 review, MSCI Frontier Market Index added 3 Vietnamese stocks, namely FTS, NKG, and SJS, to its index basket. Meanwhile, the MSCI Frontier Markets Small Cap Index added 5 Vietnamese stocks, including PGC, DHA, NAF, VPH, and VTO; on the other hand, it removed NKG, SJS, and VPD. However, NKG and SJS were removed to be transferred to the MSCI Frontier Markets Index basket.

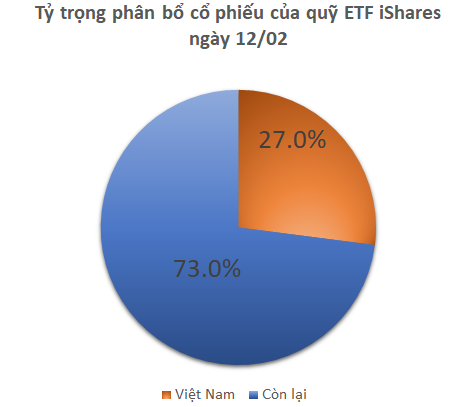

As of February 12, the total asset value of iShares ETF was nearly 461 million USD, a decrease compared to over 482 million USD on January 29. The allocation of Vietnamese stocks accounted for 27%, with the top allocations belonging to HPG (3%), VHM (2.38%), VNM (1.99%), VIC (1.86%), and MSN (1.57%).