The morning’s price momentum could not be continued this afternoon. From 1:55 onwards, the pressure from the pre-Tet buying volume being dumped into accounts caused a significant drop in prices. At the end of the continuous trading session, the VN-Index only increased by 0.53 points, before some pillars were pulled up in the ATC session, helping the index close above the reference point by 3.97 points.

The selling pressure increased from around 2 p.m. onwards, usually due to newly acquired shares being put up for sale. If investors bought before Tet, their profit margins were quite good until today. Taking profit is also normal.

However, it is still a short-term profit-taking, so the pressure is not too dramatic. Although the VN-Index fell close to the reference point at the end of the continuous session, the breadth was not bad. At its worst, the index recorded 285 stocks up and 188 stocks down, and closed with 321 stocks up and 153 stocks down. In other words, sellers are still looking out for good prices, and the demand for price drops is not enough to reverse the widespread upward trend.

However, it cannot be denied that stocks have had to drop significantly. According to statistics on HoSE, there were 160 stocks that fell by 1% or more from the intraday peak, accounting for about 43% of the total number of traded stocks. This ratio was about 30% in the morning session. Of course, not all of these stocks closed below the reference point, but returning such a large increase reflects the increased pressure.

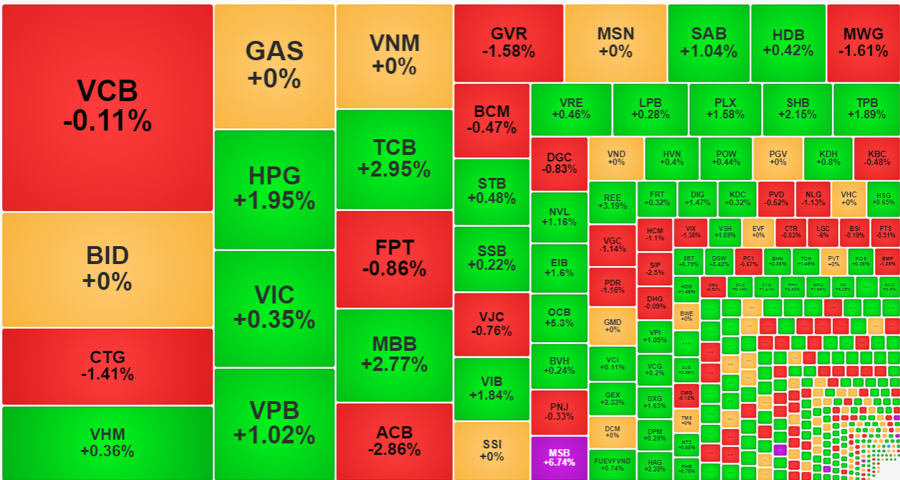

This pressure is very evident in the blue-chip stock group. In the morning session, only a few stocks like FPT, MWG, VCB, VJC were notably pressured, dropping more than 1% and closing with 15 stocks down. Many banking stocks collapsed, with ACB closing down 2.86%, which is a 4.22% difference from the morning’s peak. This stock also has one of the highest liquidity in the VN30 basket with a trading volume of about 22.58 billion VND. MWG also fell further compared to the morning session, dropping 2.5% from the peak. CTG closed the morning session at +0.14% but closed down 1.41% and dropped 2.24% from the peak. GVR, SHB, VPB, STB, TCB, TPB are also other stocks with notable drops.

However, the indices still closed with gains: the VN-Index increased by 0.33% and the VN30-Index increased by 0.36%. Today is the futures expiration session, and the closing of some pillar stocks was unexpectedly pushed up. VIC is an example, it was still in the red but was pushed up by 0.35% in the ATC session. BID was even down more than 1% a few minutes ago but closed back to the reference. VHM was also pushed up by 0.36%, HPG was pushed up by 1.95%… TCB, MBB, HPG, VPB, despite dropping significantly, still maintained good gains and played a supportive role in the index.

The stocks that faced strong selling pressure had fairly large liquidity and significant price drops. ACB had a trading volume of 3.983 trillion VND, with a 2.86% price drop; SZC matched 14.94 billion with a 2.24% price drop; MWG matched 43.11 billion with a 1.61% price drop; GVR matched 11.64 billion with a 1.58% price drop; VSC matched 11.88 billion with a 1.57% price drop; VIX matched 44.36 billion with a 1.38% price drop… There were several billion VND liquidity stock groups with significant drops like ST8, SIP, VOS, BMP…

Foreign investors actually did not sell a lot this afternoon, the total sold on HoSE was about 879.5 billion VND, down 20% compared to the morning session, and the net selling volume was only about 117 billion VND. In the morning session, this group net sold 210.9 billion VND. Meanwhile, the liquidity on this exchange in the afternoon session even decreased slightly compared to the morning session, reaching 9.296 trillion VND. Thus, the dominant selling force and the increasing force are from domestic investors.

Before Tet, the market had a quite strong increase, and investors taking profits at the beginning of the year is normal. The selling pressure is not too strong and does not have a big impact, as the breadth still shows an overwhelming number of increases. However, today is also a session with a significant increase in liquidity, with a total trading volume of 1.98 quadrillion VND for both exchanges.