After the transaction, the ownership rate of VIX in HJS decreased from 19.12% (over 4 million shares) to 12.64% (nearly 2.66 million shares).

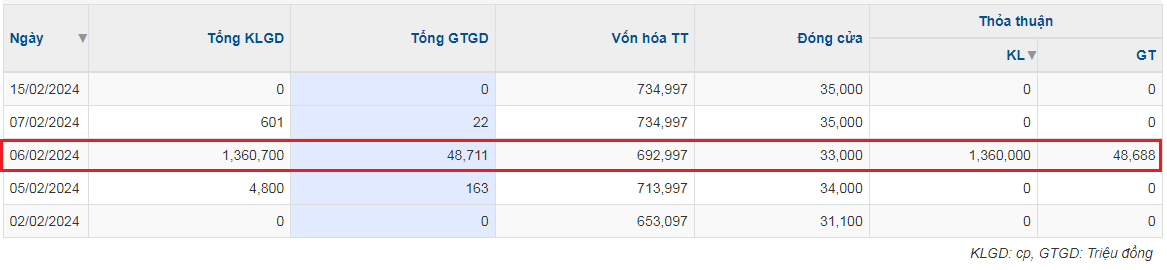

On February 6, 2024, there were 1.36 million shares traded by agreement with a total value of nearly 49 billion VND. Therefore, it is likely that VIX has sold the agreed number of shares and received nearly 49 billion VND.

|

Stock Trading Statistics of HJS

Source: VietstockFinance

|

VIX became a major shareholder of HJS on November 21, 2022, after buying nearly 3 million shares by agreement, increasing the ownership ratio from 4.86% to 19.12% as mentioned above, with a total value of nearly 111 billion VND.

In other developments, HJS has just paid 24% cash dividends for 2022, divided into 3 installments. With a quantity of over 4 million shares (before selling 1.36 million shares), it is estimated that VIX could receive about 10 billion VND in dividends from HJS.

|

Dividend Payment History of HJS since 2021

Source: VietstockFinance

|

In 2023, HJS recorded net revenue of 159 billion VND and after-tax profit of 54 billion VND, representing a decrease of 11% and 6% respectively compared to the previous year, exceeding the 2023 after-tax profit target of 53 billion VND. Net profit was nearly 54 billion VND, a decrease of 6%.

| Business Results of HJS in the period 2019-2023 |

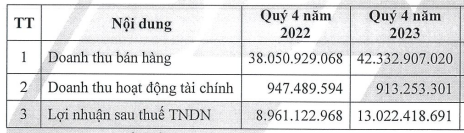

In the fourth quarter of 2023, consolidated financial statements recorded sales revenue and after-tax profit of over 42 billion VND and 13 billion VND, an increase of 11% and 45% respectively compared to the same period last year.

Source: HJS

|

In the explanatory text, HJS stated that the parent company specializes in trading and producing commercial electricity, with mainly sales revenue from electricity production, and the main raw material source is entirely dependent on natural water sources. In the fourth quarter, with more rainfall, the water volume for electricity production increased, resulting in both revenue and after-tax profit increasing compared to the same period last year.

The business results of the subsidiary company in the fourth quarter of 2023, Sông Đà Tây Đô Joint Stock Company, specializing in real estate business, had little impact or changes on the consolidated financial statements of the parent company.